Reebok 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130 Group Management Report – Financial Review Group Business Performance Economic and Sector Development

Group Business Performance

In 2010, the adidas Group results improved significantly compared to the prior year. Currency-neutral Group sales increased

9% as a result of growth in the Wholesale and Retail segments as well as in Other Businesses. In euro terms, adidas Group

revenues grew 15% to € 11.990 billion from € 10.381 billion in 2009. The Group’s gross margin increased 2.4 percentage points

to 47.8% (2009: 45.4%), supported by less clearance sales and a larger share of higher-margin Retail sales. Consequently, the

Group’s gross profit rose 22% to € 5.730 billion in 2010 versus € 4.712 billion in 2009. The Group’s operating margin improved

2.6 percentage points to 7.5% from 4.9% in 2009, primarily due to the higher gross margin as well as lower other operating

expenses as a percentage of sales. The Group’s operating profit grew 76% to € 894 million in 2010 versus € 508 million in

2009. The Group’s net income attributable to shareholders increased 131% to € 567 million from € 245 million in 2009. Diluted

earnings per share grew 122% to € 2.71 in 2010 versus € 1.22 in 2009.

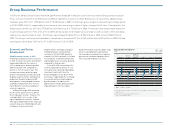

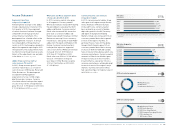

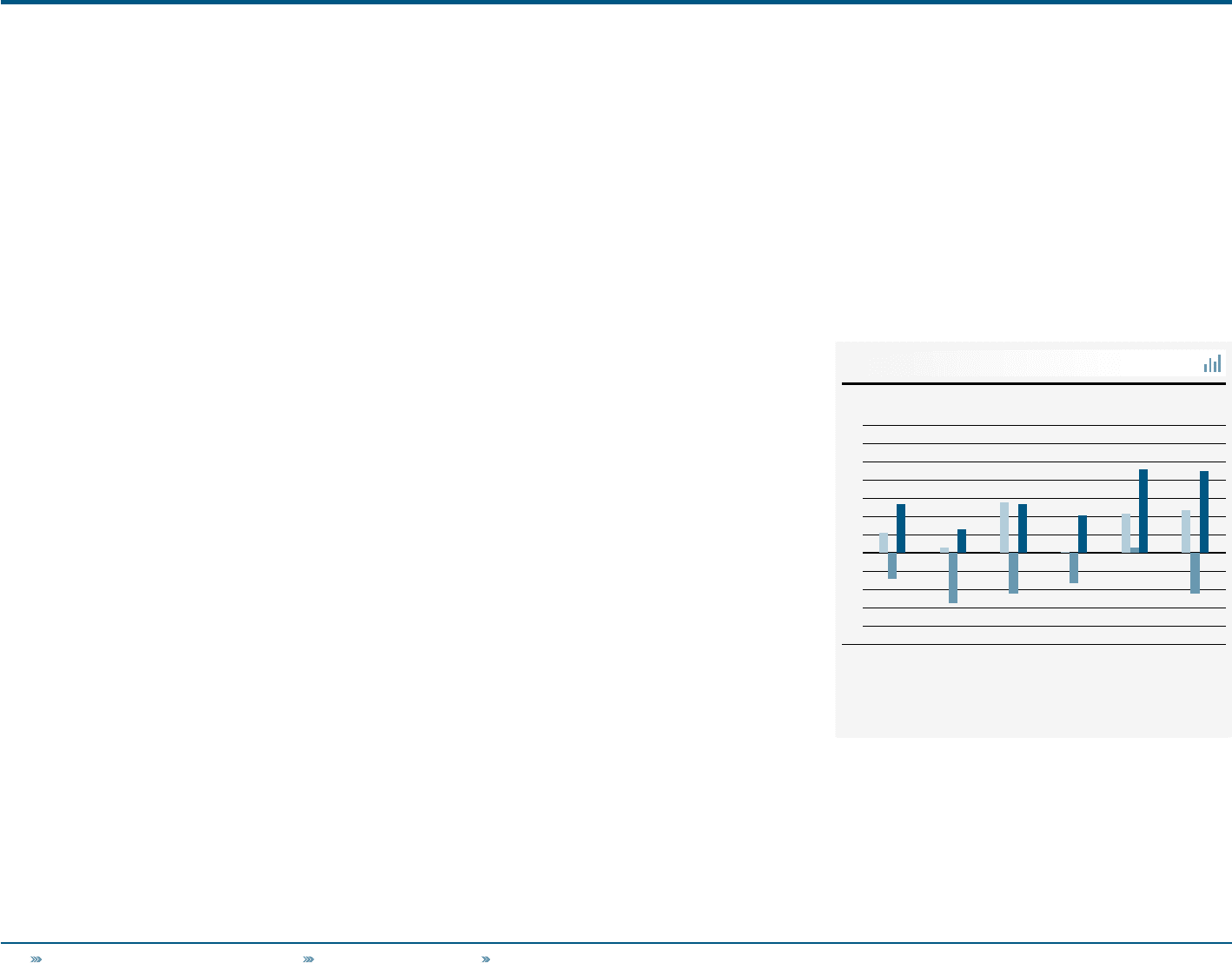

Regional GDP development 1 )

in %

Global Western

Europe

European

Emerging

Markets USA Asia 2 ) Latin America

9

6

3

0

(3)

(6)

—

2008

—

2009

—

2010

1) Real, percentage change versus prior year; 2009 figures restated compared

to prior year.

2) Asia also includes Japan and Area Pacific.

Source: World Bank, HSBC.

01

Economic and Sector

Development

Global economy recovers in 2010

Following the global economic recession

in 2009, the macroeconomic environment

improved notably over the course of

2010 as global gross domestic product

(GDP) increased 3.9% compared to a

decline of 2.2% in the prior year. This

recovery was mainly driven by rapid

growth in emerging economies, boosted

by global export activities and industrial

production. Despite the positive GDP

developments, sovereign debt concerns

and high unemployment rates in most

major Western economies weighed on

economic expansion.

In Western Europe, GDP increased

by 1.8% (2009: decline of 4.1%), driven

by strong export volumes. However, the

sovereign debt crisis, in some of the

region’s peripheral countries, coupled

with high unemployment levels and acute

austerity measures inhibited growth and

confidence in many economies.

Despite similar challenges, European

emerging markets continued their

recovery in 2010 with GDP growth of

around 3.9% (2009: decline of 3.4%), due

to rising levels of fixed investment and

improving domestic consumer demand

compared to the prior year.

In the USA, GDP increased by 2.9%

in 2010 compared to a decline of 2.6%

in the prior year, driven by rebounding

investment levels, both from the

private and public sector. Much of this

activity was supported by the continued

fiscal and monetary stimuli adopted

by policymakers. In addition, the

depreciation of the US dollar positively

impacted exports from the region.

Despite the overall economic upturn, high

levels of unemployment and relatively

low house prices remained as a negative

pressure on consumer spending, which

only increased modestly in the year.