Reebok 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

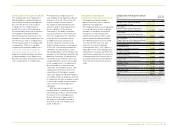

32 To Our Shareholders Compensation Report

Commitments to Executive Board

members upon premature end of tenure

In the service contracts of the Executive

Board members Glenn Bennett, Robin

J. Stalker and Erich Stamminger, a

severance payment cap in the case of

premature termination of tenure which

is not due to good cause is not provided

for due to the relatively short contractual

terms of up to three years. The service

contract of Herbert Hainer, on the other

hand, which has a contractual term of

more than three years, does provide for a

severance payment relating to payment

claims for the remaining period of his

service contract. However, the severance

payment has been limited to a maximum

of twice the overall annual compensation

(Severance Payment Cap). In this

respect, the overall annual compensation

means the overall compensation for

the last full financial year prior to his

resignation from the Executive Board

while considering the expected total

compensation for the current financial

year. If the service contract is terminated

due to a change of control, a possible

severance payment is limited to 150% of

the Severance Payment Cap.

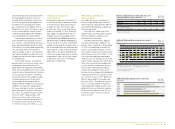

Commitments to Executive Board

members upon regular end of tenure

In case of regular termination of

the service contract, i.e. in case of

non-renewal of the service contract

or termination due to reaching the

retirement age, the respective Executive

Board member is entitled to a follow-up

bonus as individually agreed. This bonus

amounts to 75% for Glenn Bennett, 100%

for Robin J. Stalker and 125% for Herbert

Hainer and is based on the Performance

Bonus granted to the respective

Executive Board member for the last

full financial year. The follow-up bonus

is payable in two tranches, 12 and 24

months following the end of the contract.

Instead of the follow-up bonus, the

service contract with Erich Stamminger

contains a severance payment of 100% of

the last annual fixed salary in the event

that adidas AG decides not to renew his

contract although he would be willing to

continue his function as Executive Board

member under the existing conditions.

In this case, the amount is based on the

annual fixed salary of the financial year

at the time of retirement from office. The

severance payment is granted instead

of the follow-up bonus. The Supervisory

Board has aligned this contractual

provision to the system valid for the other

Executive Board members as of the 2011

financial year and set a follow-up bonus

in the amount of 125%.

Other benefits and additional Other benefits and additional

commitments to the Executive Boardcommitments to the Executive Board

– Except for the other benefits listed in

the table, the Executive Board members

did not receive any additional payments.

– The Executive Board members did not

receive any additional compensation for

mandates within the adidas Group.

– The Executive Board members did not

receive any loans or advance payments

from adidas AG.

– The company maintains a

consequential loss and liability

insurance for Board members of the

adidas Group (D&O Insurance). It

covers the personal liability in the event

of claims raised against Executive

Board members for indemnification

of losses incurred in connection with

their acts and omissions. For cases of

damage occurring after July 1, 2010,

there is a deductible in accordance

with the statutory provisions and

recommendations of the German

Corporate Governance Code. This

deductible amounts to 10% of the

damage up to a maximum of one and

a half times the fixed annual salary for

all cases of damage within one financial

year.

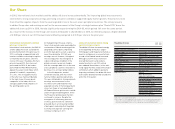

Payments to former members of the Payments to former members of the

Executive Board and their surviving Executive Board and their surviving

dependantsdependants

In the 2010 financial year, pension

payments to former Executive

Board members or to their surviving

dependants amounted to € 3.235 million

(2009: € 2.607 million). As at December

31, 2010, the provisions for pension

entitlements of this group of persons

totalled € 45.884 million (2009:

€ 45.658 million). The dynamisation

of the pension payments is made in

accordance with statutory regulations or

regulations under collective agreements

unless a surplus from the pension fund

is used after the commencement of

retirement for an increase in retirement

benefits.