Reebok 2010 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review Business Performance by Segment Retail Business Performance 155

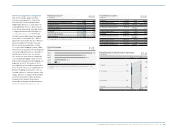

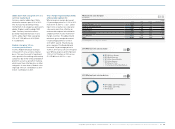

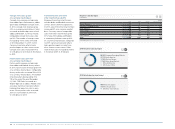

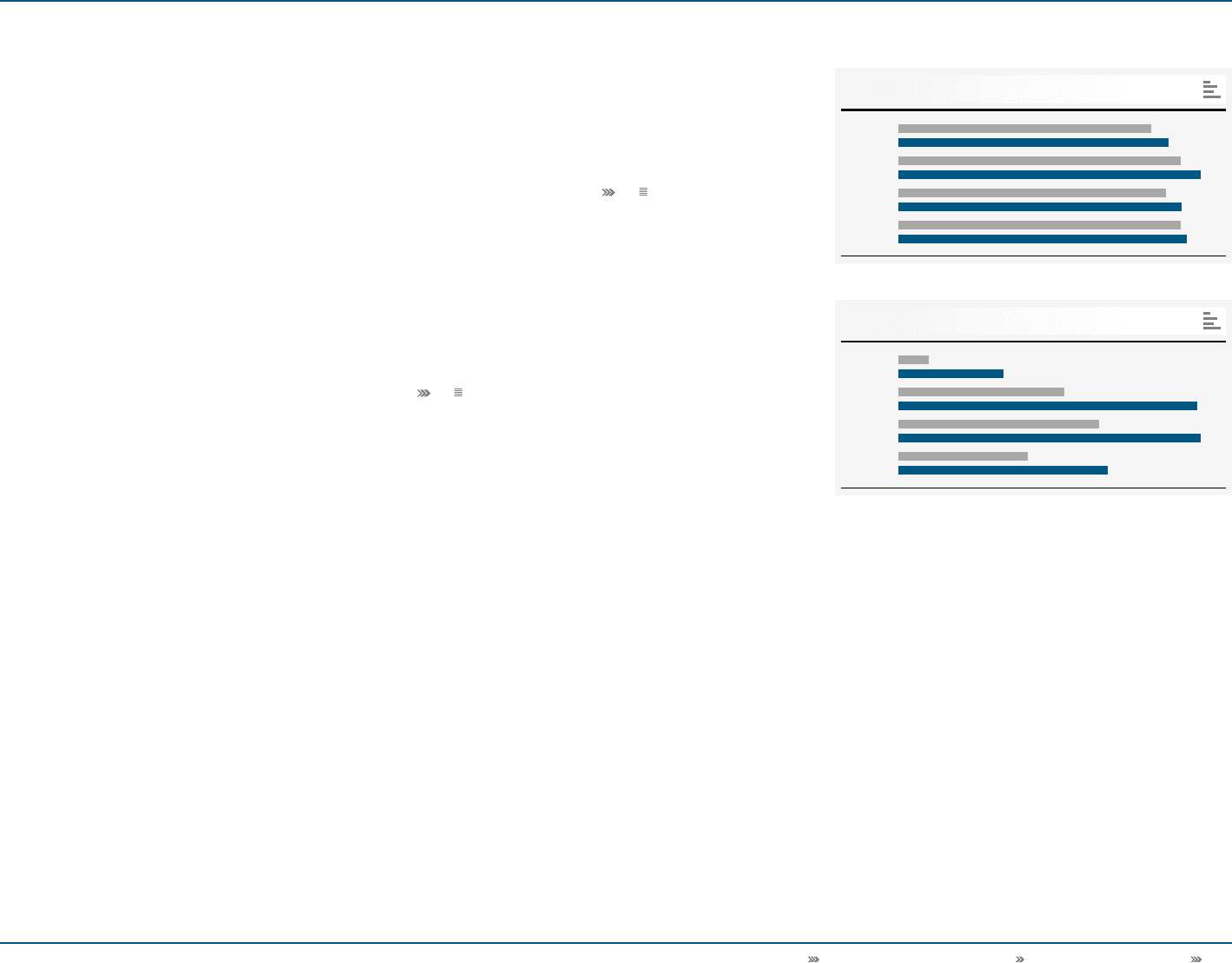

Retail gross margin by quarter

in %

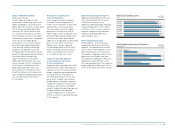

Retail segmental operating profit by quarter

€ in millions

14

15

Q1 2009

Q1 2010

Q2 2009

Q2 2010

Q3 2009

Q3 2010

Q4 2009

Q4 2010

Q1 2009

Q1 2010

Q2 2009

Q2 2010

Q3 2009

Q3 2010

Q4 2009

Q4 2010

54.5

58.2

60.8

65.1

57.6

60.9

60.7

62.1

15 52

82 147

99 149

64 103

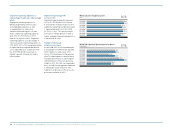

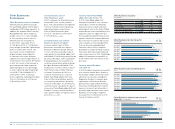

adidas and Reebok branded

Retail sales increase

In 2010, adidas Group Retail sales

increased at a double-digit rate at both

adidas and Reebok. Currency-neutral

adidas Sport Performance revenues grew

15% in the period. adidas Sport Style

sales rose 29% versus the prior year

on a currency-neutral basis. Currency-

neutral Reebok sales were 14% higher

compared to the prior year. Comparable

store sales for the adidas brand

increased 11% on a currency-neutral

basis, driven by double-digit growth

in the training, football and running

categories. Comparable store sales

for Reebok grew 11%, driven by strong

growth in training and running. Currency

translation effects had a positive

impact on revenues in euro terms.

adidas Sport Performance own-retail

sales increased 23% to € 1.404 billion

in 2010 from € 1.142 billion in 2009.

adidas Sport Style own-retail sales

were up 37% to € 575 million in 2010

from € 420 million in 2009. Own-retail

sales of Reebok branded products grew

20% to € 408 million in 2010 (2009:

€ 339 million).

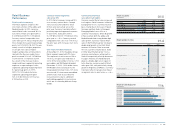

Retail gross margin improves

3.2 percentage points

Gross margin in the Retail segment

increased 3.2 percentage points to

61.8% in 2010 from 58.6% in 2009, with

improvements in all store formats.

This was mainly a result of a higher

proportion of concept store sales at

higher margins. Gross margin was also

positively impacted by the appreciation

of the Russian rouble. By brand, the

adidas gross margin grew 2.4 percentage

points to 63.2% (2009: 60.9%) and

Reebok’s gross margin improved

6.7 percentage points to 54.8% (2009:

48.1%). Retail gross profit increased

32% to € 1.476 billion in 2010 from

€ 1.116 billion in 2009 see 08.

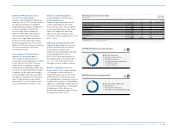

Segmental operating expenses

as a percentage of sales down

2.1 percentage points

Segmental operating expenses in Retail

primarily relate to personnel and rent

expenses as well as the sales working

budget. Segmental operating expenses

increased 19% to € 1.024 billion in

2010 from € 857 million in 2009. This

was a result of higher sales working

budget expenses and higher expenses

related to the expansion of the Group’s

store base, particularly in emerging

markets. Segmental operating expenses

as a percentage of sales declined

2.1 percentage points to 42.9% (2009:

45.0%), as a result of operating leverage

in the segment.

Segmental operating profit up 74%

Segmental operating profit increased

74% to € 452 million in 2010 versus

€ 259 million in the prior year.

Segmental operating margin improved

5.3 percentage points to 18.9% (2009:

13.6%) see 08. This was a result of

the gross margin increase and lower

segmental operating expenses as

a percentage of sales.

Retail employee base grows

On December 31, 2010, the Group

employed 22,286 people in the Retail

segment. This represents an increase

of 14% versus 19,576 employees at the

end of the prior year. The increase in

the number of employees relates to the

expansion of the Group’s store base.

The majority of employees in Retail are

employed on a part-time basis. On a

full-time equivalent basis, the number of

people employed in Retail grew 12% to

17,017 at the end of 2010 (2009: 15,229).