Reebok 2010 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

170 Group Management Report – Financial Review Risk and Opportunity Report

We believe the IFRS 7 interest rate

analysis represents a realistic if rough

estimate of our current interest rate risk.

To moderate interest rate risks and

maintain financial flexibility, a core tenet

of our Group’s financial strategy is to

continue to use surplus cash flow from

operations to reduce net borrowings

see Treasury, p.146. Beyond that, the

adidas Group is constantly looking for

adequate hedging strategies through

interest rate derivatives in order to

mitigate interest rate risks.

In 2010, interest rate levels in

North America and Europe reached

new all-time lows. In the light of the

low interest rate levels, the easing of

government fiscal action to stimulate

economic growth and rising inflation, the

risk of upward interest rate adjustments

compared to the prior year has increased.

Therefore, we now believe that the

likelihood of a Group-wide interest rate

increase is highly probable. Nevertheless,

given the increase in our Group’s portion

of longer-term fixed rate financing in

2010, we project any potential interest

rate increases as having a moderate

financial effect.

Strategic and operational

opportunities

Favourable macroeconomic

developments

Since we are a consumer goods company,

consumer confidence and spending

can impact our sales development.

Therefore, better than initially forecasted

macroeconomic developments which

support increased discretionary private

consumption can have a positive impact

on our sales and profitability. In addition,

legislative changes, e.g. with regard to

the taxation of corporate profits, can

positively impact Group profitability.

Growing importance of sports

to fight obesity

Governments are increasingly promoting

living an active lifestyle to fight obesity

and cardiovascular disease. According

to the International Obesity Task Force

(IOTF), more than 600 million adults

were considered obese in 2010. An

additional 1.0 billion were estimated

to be overweight. Furthermore, up to

200 million school-age children were

either obese or overweight. Once

considered a problem only in affluent

nations, obesity is also becoming an

issue in countries with low per capita

income. This development has serious

health consequences and a dramatic

effect on health care expenditures.

As a result, governments and

non-governmental organisations are

increasing their efforts to promote

a healthy lifestyle and encourage

sports participation. For example,

the US Department of Education

awarded US $ 80 million to schools

and community-based organisations

for use in innovative physical education

classes through the Carol M. White

Physical Education Program. Given our

strong market position, in particular

in categories considered suitable for

weight loss such as training, running and

swimming, we expect to benefit from this

trend.

Ongoing fusion of sport and lifestyle

The border between pure athletics

and lifestyle continues to blur as sport

becomes a more integral part in the lives

of more and more consumers. People

want to be fashionable when engaging in

sporting activities without compromising

on quality or the latest technological

advances. At the same time, performance

features and styles are finding their way

into products meant for more leisure-

oriented use. We estimate the global

sports lifestyle market to be at least

three times larger than the performance

market. This development opens up

additional opportunities for our Group

and our brands – which already enjoy

strong positions in this market. One

example of this is our plan to expand the

adidas NEO label as part of our Route

2015 strategic business plan see Global

Brands Strategy, p. 87.

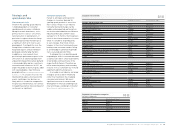

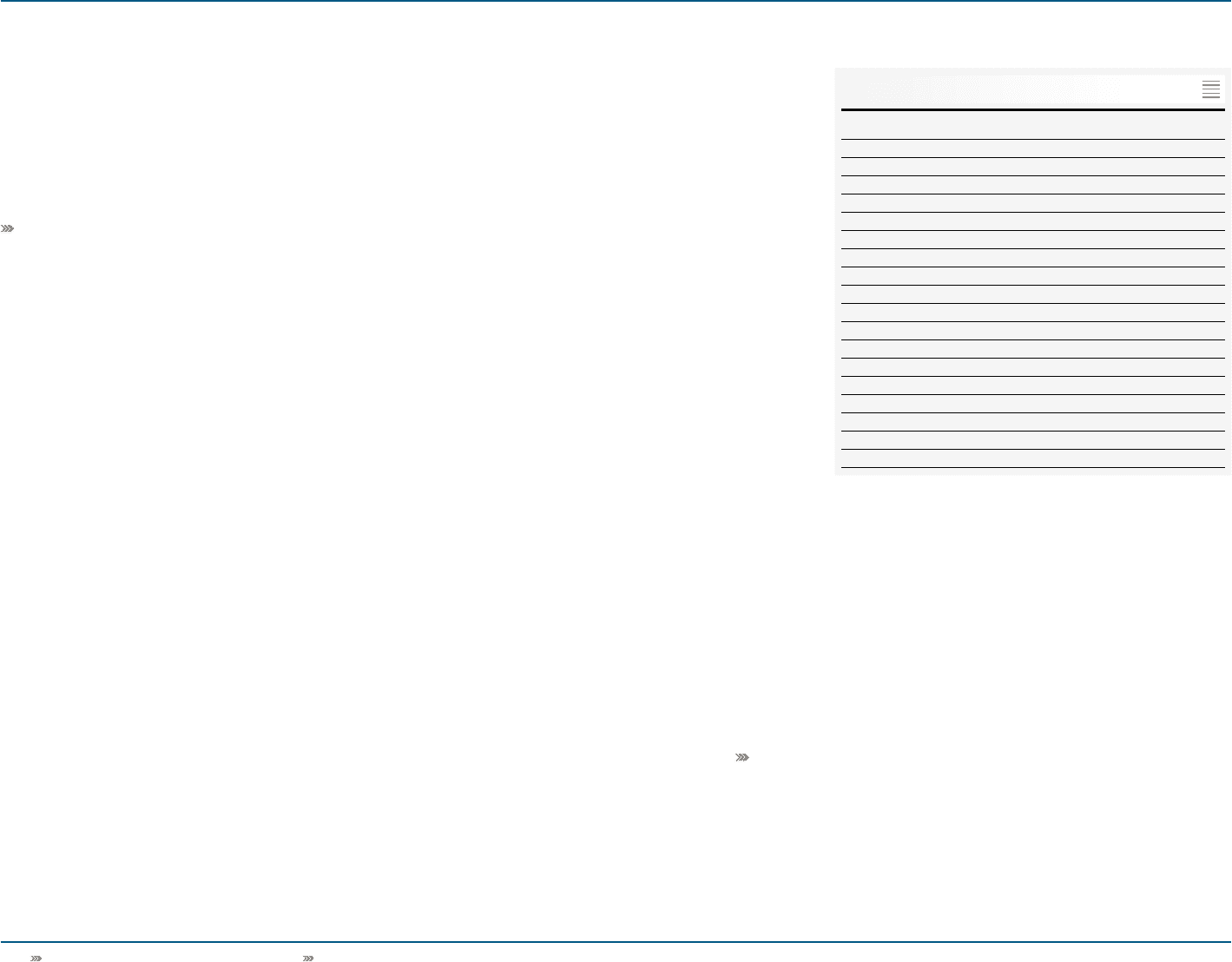

Corporate opportunities overview

Strategic and operational opportunities

Favourable macroeconomic developments

Growing importance of sports to fight obesity

Ongoing fusion of sport and lifestyle

Emerging markets as long-term growth drivers

Women’s segment offers long-term potential

Increasing consumer demand for functional apparel

Growing popularity of "green" products

Social media offering new ways of consumer engagement

Strong market positions worldwide

Multi-brand approach

Personalisation and customisation replacing mass wear

Exploiting potential of new and fast-growing sports categories

Expanding distribution scope

Cost optimisation drives profitability improvements

Financial opportunities

Favourable financial market changes

07