Reebok 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

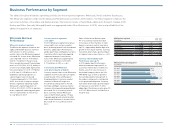

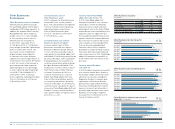

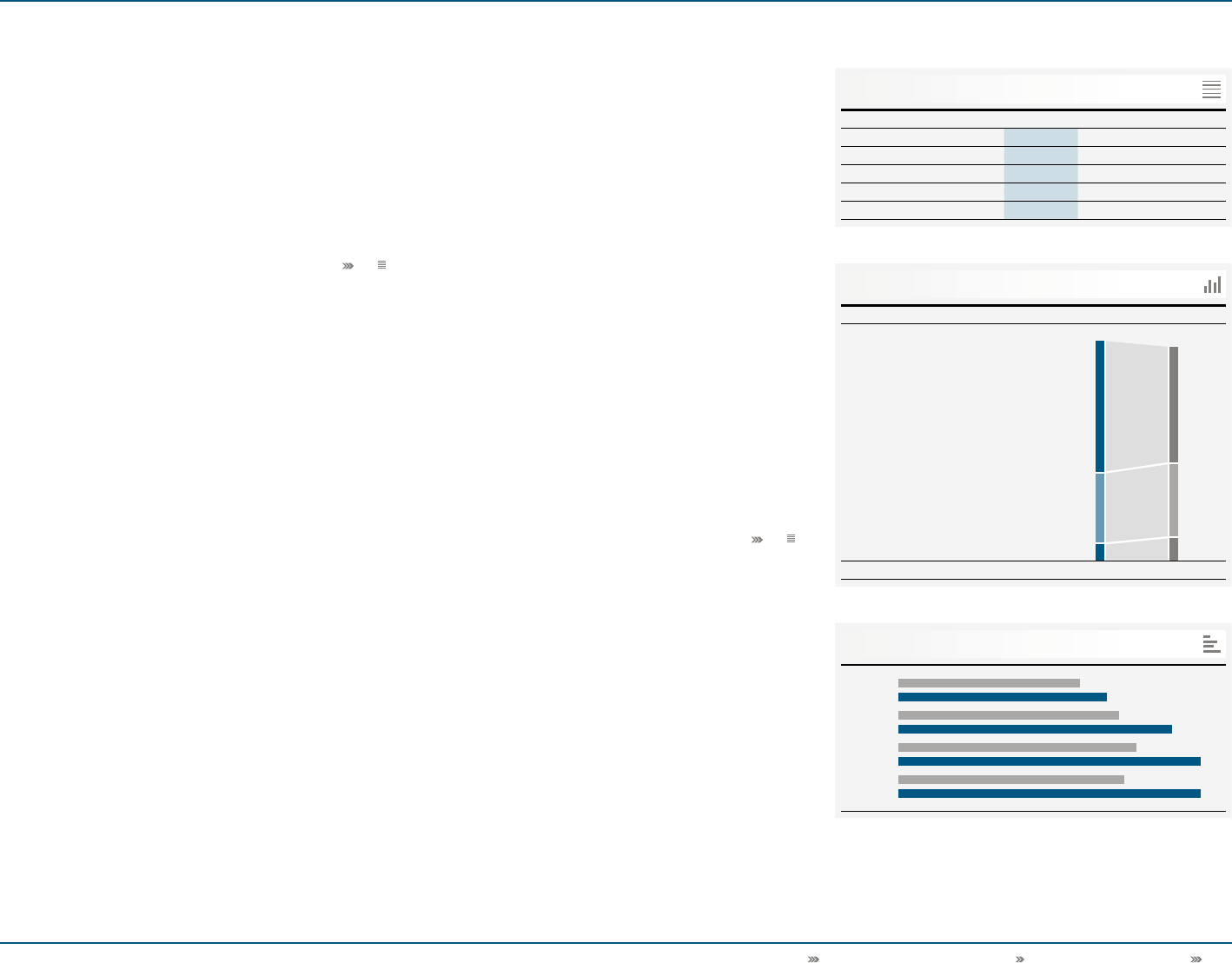

Group Management Report – Financial Review Business Performance by Segment Retail Business Performance 153

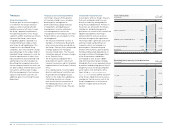

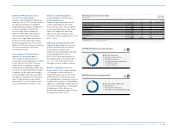

Retail at a glance

€ in millions

2010 2009 Change

Net sales 2,389 1,906 25%

Gross profit 1,476 1,116 32%

Gross margin 61.8% 58.6% 3.2pp

Segmental operating profit 452 259 74%

Segmental operating margin 18.9% 13.6% 5.3pp

08

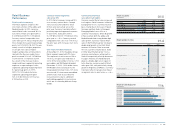

Retail net sales by quarter

€ in millions 10

Q1 2009

Q1 2010

Q2 2009

Q2 2010

Q3 2009

Q3 2010

Q4 2009

Q4 2010

400 459

486 602

524 665

497 664

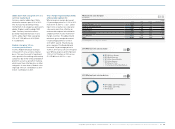

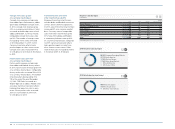

Retail number of stores

2010 2009

Total 2,270 2,212

09

Concept stores ...................1,352

Factory outlets ....................725

Other formats .....................193

1,203

755

254

Retail Business

Performance

Retail results in summary

The Retail segment comprises the

own-retail activities of the adidas and

Reebok brands. In 2010, currency-

neutral Retail sales increased 18%. In

euro terms, Retail sales grew 25% to

€ 2.389 billion (2009: € 1.906 billion).

Currency-neutral comparable store

sales were up 11% versus the prior year.

Gross margin increased 3.2 percentage

points to 61.8% (2009: 58.6%). This was

mainly a result of a higher proportion

of concept store sales at higher

margins and positive currency effects

related to the Russian rouble. Gross

profit increased 32% to € 1.476 billion

in 2010 from € 1.116 billion in 2009.

As a result of the increase in gross

margin and lower segmental operating

expenses as a percentage of sales,

segmental operating margin improved

5.3 percentage points to 18.9%

(2009: 13.6%). In absolute terms,

segmental operating profit grew

74% to € 452 million in 2010 versus

€ 259 million in 2009.

Currency-neutral segmental

sales grow 18%

In 2010, Retail revenues increased 18%

on a currency-neutral basis. Concept

store, factory outlet and other retail

format sales were all up versus the

prior year. Currency translation effects

positively impacted segmental revenues

in euro terms. Sales grew 25% to

€ 2.389 billion from € 1.906 billion in the

prior year see 08. Currency-neutral

comparable store sales rose 11% versus

the prior year, with increases in all store

formats.

Own-retail store base increases

At December 31, 2010, the adidas Group

Retail segment operated 2,270 stores.

This represents a net increase of 58 or

3% versus the prior year-end level of

2,212. Of the total number of stores, 1,712

were adidas and 558 Reebok branded

(December 31, 2009: 1,626 adidas stores,

586 Reebok stores). During 2010, the

Group opened 234 new stores, 127 stores

were closed, 51 stores were remodelled

and 49 stores were reclassified. The

reclassification is due to a different

methodology applied to store locations

which are co-shared by different Group

brands.

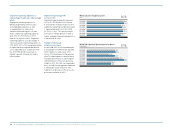

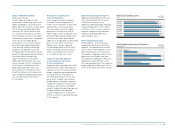

Currency-neutral Retail

sales grow in all regions

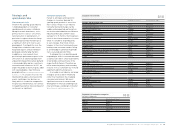

Currency-neutral Retail sales increased

in all regions. Retail revenues in Western

Europe grew 4% on a currency-neutral

basis, mainly due to increases in Spain,

Germany and Italy. Sales in European

Emerging Markets rose 30% on a

currency-neutral basis, driven by growth

in Russia where both the adidas and

Reebok brands had strong double-digit

sales growth. Currency-neutral Retail

sales in North America grew 14% due to

double-digit growth in the USA. Retail

revenues in Greater China increased

41% on a currency-neutral basis. Sales

in Other Asian Markets grew 1% on a

currency-neutral basis, with growth in

South Korea partially offset by decreases

in Japan. However, the Reebok brand

grew at a double-digit rate in Japan. In

Latin America, currency-neutral Retail

sales grew 34%, with particularly strong

growth in Argentina and Mexico. Currency

translation effects had a positive impact

on regional sales in euro terms see 11.