Reebok 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

Group Management Report – Financial Review Business Performance by Segment Wholesale Business Performance 151

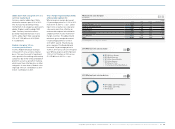

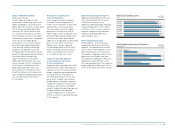

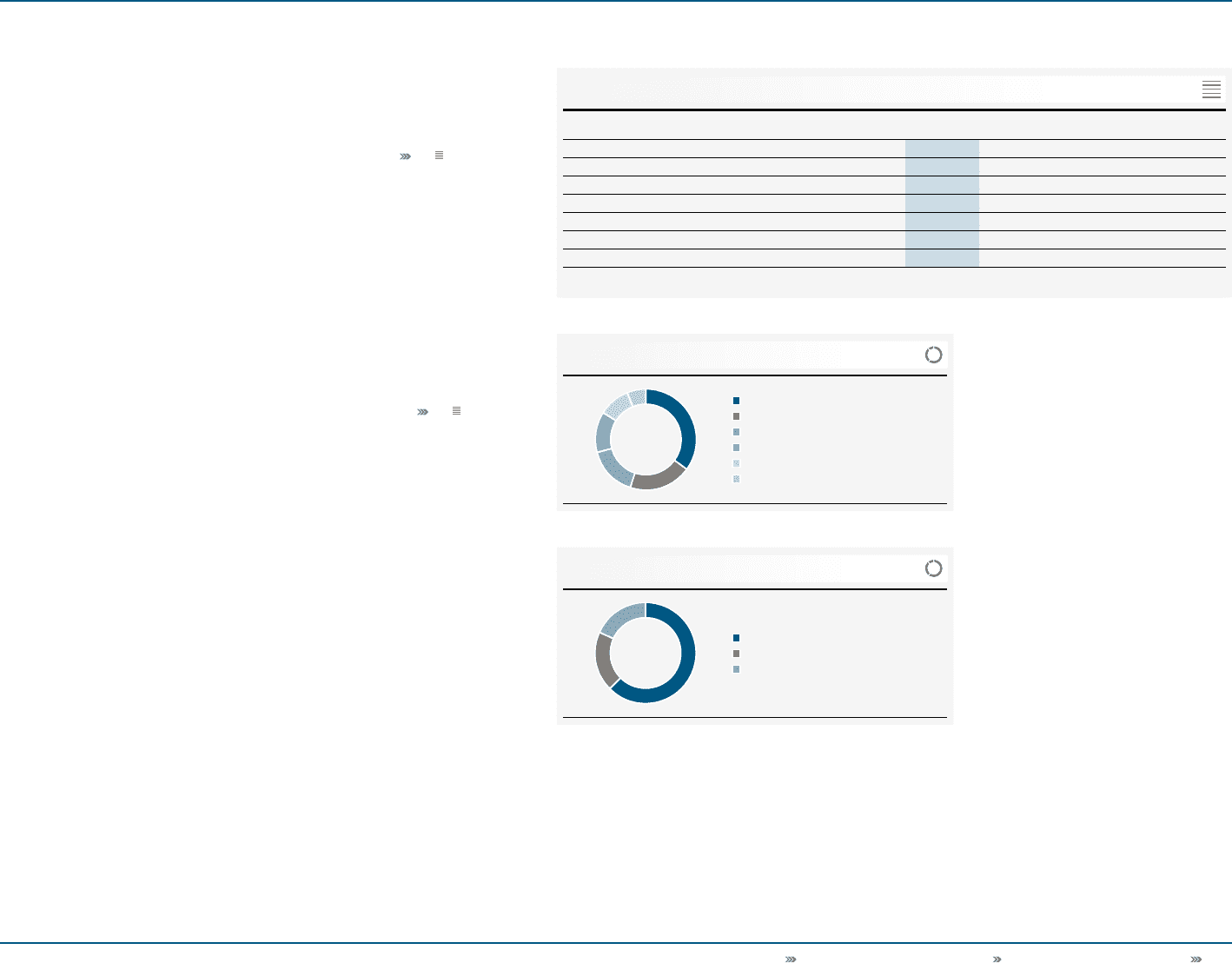

2010 Wholesale net sales by region

2010 Wholesale net sales by division

04

05

35% Western Europe

20% North America

16% Other Asian Markets

13% Latin America

10% Greater China

6% European Emerging Markets

63% adidas Sport Performance

19% adidas Sport Style

18% Reebok

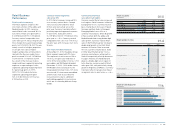

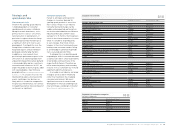

Wholesale net sales by region

€ in millions

2010 2009 Change Change

currency-neutral

Western Europe 2,882 2,633 9% 8%

European Emerging Markets 503 475 6% (2%)

North America 1,609 1,295 24% 17%

Greater China 840 855 (2%) (7%)

Other Asian Markets 1,270 1,041 22% 8%

Latin America 1,077 865 24% 11%

Total 1 ) 8,181 7,164 14% 8%

1) Rounding differences may arise in totals.

03

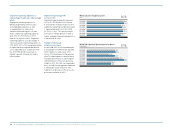

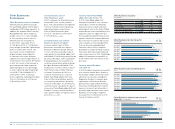

adidas Sport Style sales grow 21% on a

currency-neutral basis

Currency-neutral adidas Sport Style

wholesale revenues grew 21% in 2010.

This increase was driven by strong

momentum in all categories, particularly

adidas Originals and the adidas NEO

label. Currency translation effects

positively impacted revenues in euro

terms. adidas Sport Style sales grew

27% to € 1.559 billion in 2010 (2009:

€ 1.225 billion).

Reebok sales grow 12% on

a currency-neutral basis

In 2010, Reebok wholesale revenues

increased 12% on a currency-neutral

basis. This was the result of significant

sales growth in the walking and running

categories due to the toning and ZigTech

platforms as well as growth in training,

which more than offset declines in other

categories. In euro terms, Reebok sales

improved 19% to € 1.505 billion in 2010

from € 1.265 billion in 2009.

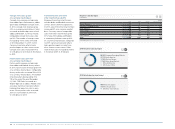

Gross margin negatively impacted by

unfavourable regional mix

Wholesale gross margin decreased

0.3 percentage points to 41.3% in 2010

from 41.6% in 2009 see 01. Lower

input costs as well as less clearance

sales were more than offset by an

unfavourable regional mix related to

a higher portion of sales from lower-

margin countries. The adidas brand

wholesale gross margin decreased

0.7 percentage points to 43.7% in

2010 (2009: 44.4%). The wholesale

gross margin of the Reebok brand

increased 2.4 percentage points to

30.8% in 2010 versus 28.4% in the prior

year. Wholesale gross profit improved

13% to € 3.379 billion in 2010 versus

€ 2.978 billion in 2009 see 01.