Reebok 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 To Our Shareholders Our Share

Our ShareOur Share

In 2010, international stock markets and the adidas AG share increased markedly. The improving global macroeconomic

environment, strong corporate earnings and rising consumer confidence supported equity market growth. These factors more

than offset the negative impacts from the sovereign debt crisis in the euro area’s peripheral countries. The strong recovery

in adidas Group sales and earnings as well as the announcement of the Group’s strategic business plan “Route 2015” drove the

adidas AG share up 29% in 2010, thereby significantly outperforming the DAX-30, which gained 16% over the same period.

As a result of the increase in the Group’s net income attributable to shareholders in 2010, we intend to propose a higher dividend

of € 0.80 per share at our 2011 Annual General Meeting compared to € 0.35 per share in the prior year.

International stock markets continue International stock markets continue

prior year momentumprior year momentum

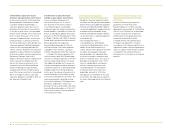

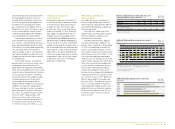

International stock markets, the DAX-30

and the adidas AG share sustained the

positive momentum of the prior year in

2010, continuing an upward trend with

investor confidence returning to equities

on relatively low valuations. Over the

course of the year, the adidas AG share

price increased 29%. Our share out -

performed the DAX-30, but under-

performed the MSCI World Textiles,

Apparel & Luxury Goods Index, which

gained 16% and 44%, respectively

see 02. The strong performance

of the latter was mainly attributable

to the high share of luxury goods

companies in the index, which on

average out performed companies in

the sporting goods sector.

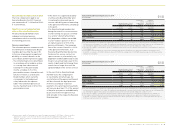

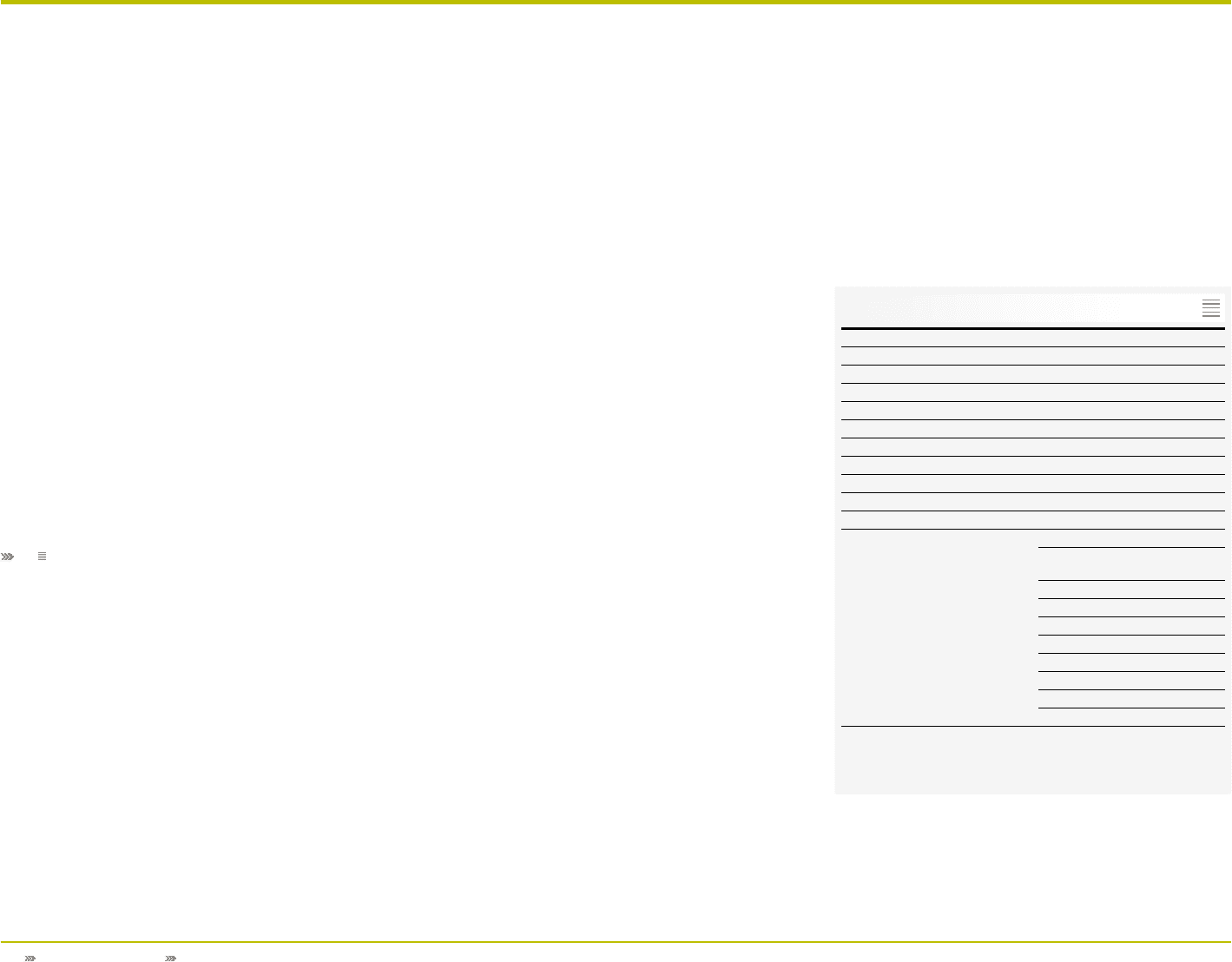

The adidas AG share

Number of shares outstanding

2010 average 209,216,186

At year-end 2010 1 ) 209,216,186

Type of share Registered no-par-value share

Free float 100%

Initial Public Offering November 17, 1995

Share split June 6, 2006 (in a ratio of 1: 4)

Stock exchange All German stock exchanges

Stock registration number (ISIN) 2 ) DE000A1EWWW0

Stock symbol ADS, ADSG.DE

Important indices DAX-30

MSCI World Textiles,

Apparel & Luxury Goods

Deutsche Börse Prime Consumer

Dow Jones STOXX

Dow Jones EURO STOXX

Dow Jones Sustainability

FTSE4Good Europe

Ethibel Index Excellence Europe

ASPI Eurozone Index

ECPI Ethical Index EMU

1) All shares carry full dividend rights.

2) On October 11, 2010, adidas AG converted its shares to registered no-par-value

shares. As a result, adidas AG registered shares are now traded under a new

ISIN DE000A1EWWW0 on the stock exchange (previously: DE0005003404).

01

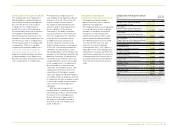

At the beginning of the year, interna-

tional stock markets were spurred by the

continuation of liberal monetary policies

adopted by central banks, improving

economic data points as well as positive

news flow during the 2009 full year

earnings season. However, throughout

the second quarter, the emergence of

signals indicating a slowdown of the

global economic recovery in tandem

with the sovereign debt crisis in the euro

area’s peripheral countries resulted in a

decline across all major global indices.

In the third quarter, market

sentiment reversed, with most inter-

national indices gaining substantially.

This was attributable to strong corporate

earnings announcements for the

first half of 2010 and the better than

expected outcome of the European bank

stress test. Signs of sustained liberal

US Federal Reserve policies also contrib-

uted to the positive development. In the

fourth quarter, global equity markets

continued to increase. Despite the

emergence of inflationary pressure

in China, positive investor sentiment

prevailed due to an increasing number

of data points indicating that the global

economy and corporate earnings will

continue to improve in 2011.

adidas AG share price reflects strong adidas AG share price reflects strong

operational improvementsoperational improvements

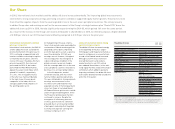

The adidas AG share increased strongly

at the beginning of the year, outper-

forming peers and the general market as

investor confidence in a successful turn-

around of the Reebok brand increased.

Although our 2009 results were well

received by investors and analysts,

market reaction to our 2010 outlook

was subdued. Nevertheless, in line with

rising equity markets and positive analyst

commentary which added to generally

improving sentiment, the adidas AG share

reversed the downward trend towards the

end of the first quarter.