Reebok 2010 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

214 Consolidated Financial Statements Notes Notes to the Consolidated Statement of Financial Position / Notes to the Consolidated Income Statement

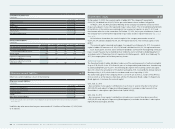

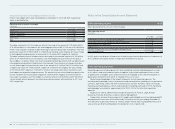

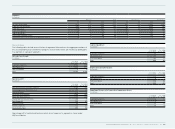

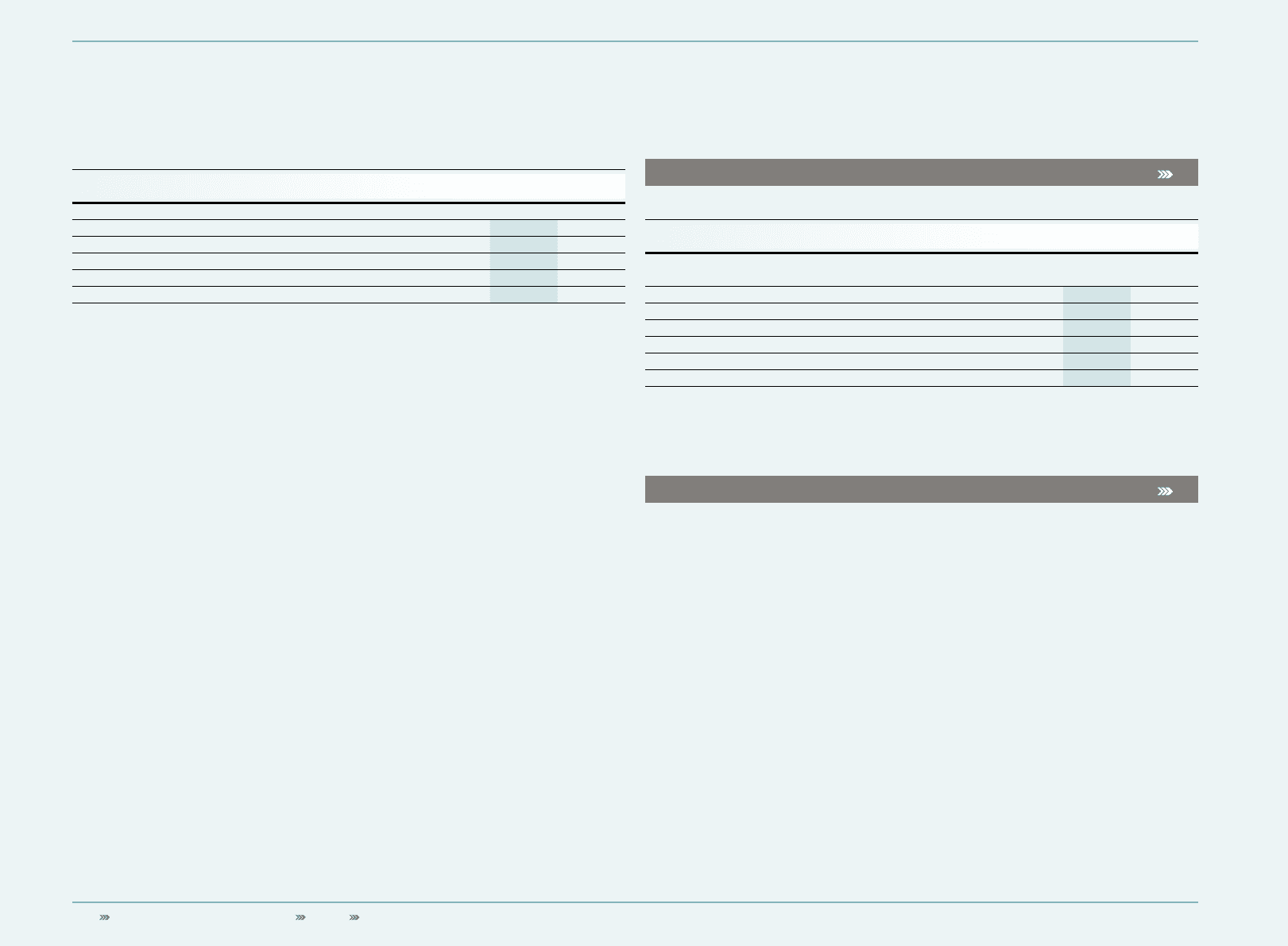

Financial instruments for the hedging of interest rate riskFinancial instruments for the hedging of interest rate risk

Interest rate hedges which were outstanding as at December 31, 2010 and 2009, respectively

expire as detailed below:

Expiration dates of interest rate hedges

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Within 1 year 60 139

Between 1 and 3 years 105 150

Between 3 and 5 years 75 —

After 5 years — 81

Total 240 370

The above summary for 2010 includes an interest rate swap in the amount of € 75 million (2009:

€ 79 million) which is classified as a fair value hedge pursuant to IAS 39. The aim of this US dollar

interest rate swap was to obtain variable financing for a private placement in US dollars. The total

positive fair value of € 8 million (2009: € 4 million) was offset by a total negative fair value change

in the hedged private placements in the amount of € 8 million (2009: negative € 4 million).

The above summary further includes interest rate swaps in the nominal amount of € 150 million

(2009: € 279 million), which are classified as cash flow hedges pursuant to IAS 39. The goal of

these hedges is to protect future cash flows arising from private placements with variable interest

rates by generating synthetic fixed interest rate financing. These interest rate swaps classified

as cash flow hedges had a positive fair value in the amount of € 0 million (2009: € 0 million) and

a negative fair value of € 6 million (2009: negative € 10 million). The negative fair value change

of € 2 million (2009: negative € 7 million) for interest rate swaps which were classified as cash

flow hedges was booked in hedging reserves. The amount that was reclassified from equity to the

income statement for the period was negative € 4 million (2009: negative € 4 million). Interest

rate swaps classified as cash flow hedges in a nominal amount of € 45 million and € 105 million

secure variable interest payments arising from private placements with maturities in 2011 and

2012, respectively.

Notes to the Consolidated Income StatementNotes to the Consolidated Income Statement

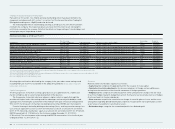

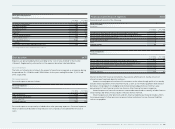

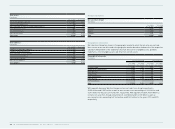

Other operating income 29

Other operating income consists of the following:

Other operating income

€ in millions

Year ending

Dec. 31, 2010 Year ending

Dec. 31, 2009

Income from accounts receivable previously written off 2 2

Income from release of accrued liabilities and other provisions 19 31

Gains from disposal of fixed assets 16 3

Sundry income 66 64

Reversals of impairment losses for intangible and tangible assets 7 0

Other operating income 110 100

In 2010, gains from disposal of fixed assets include income from the divestiture of a trademark. In

2010, sundry income partly relates to the positive settlement of a lawsuit.

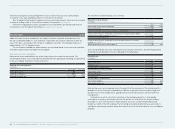

Other operating expenses 30

Operating expenses include expenses for sales, marketing, research and development, as well

as for logistics and central administration. In addition, they include impairment losses as well

as depreciation on tangible assets and amortisation on intangible assets, with the exception of

depreciation and amortisation which is included in the cost of sales.

Marketing working budget is the largest component of other operating expenses. The

marketing working budget consists of promotion and communication spending such as promotion

contracts, advertising, events and other communication activities. However, it does not include

marketing overhead expenses, which are presented in marketing overheads. In 2010, marketing

working budget accounted for approximately 26% (2009: 23%) of the total other operating

expenses.

Expenses for central administration include the functions IT, Finance, Legal, Human

Resources, Facilities & Services as well as General Management.

Depreciation and amortisation expense for tangible and intangible assets (excluding goodwill)

and impairment losses were € 263 million and € 299 million for the years ending December 31,

2010 and 2009, respectively. Thereof, € 3 million and € 5 million were recorded within the cost of

sales as they are directly attributable to the production costs of goods sold.