Reebok 2010 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

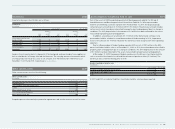

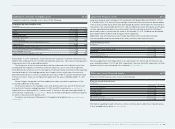

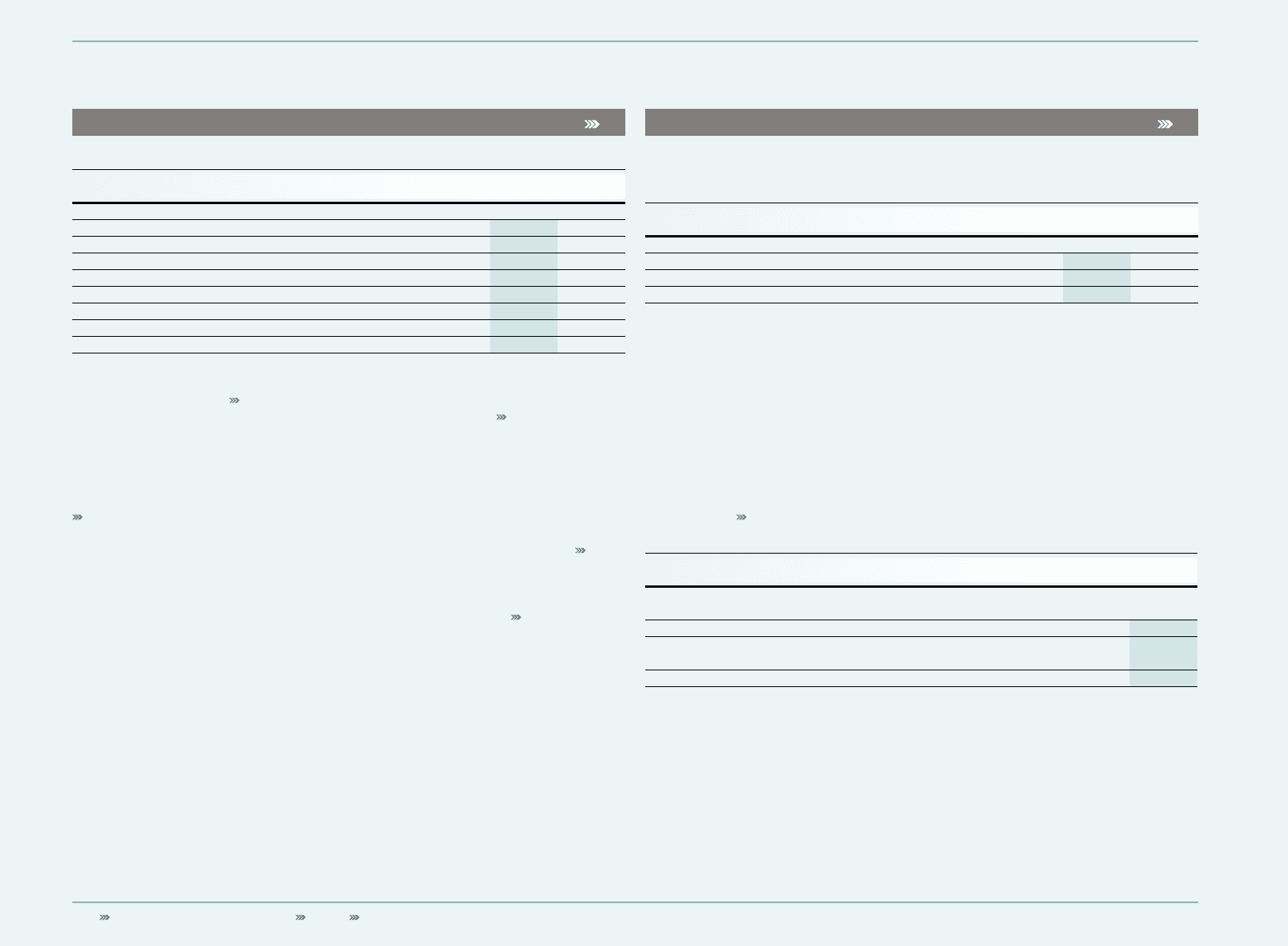

198 Consolidated Financial Statements Notes Notes to the Consolidated Statement of Financial Position

Property, plant and equipment 11

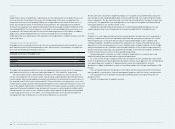

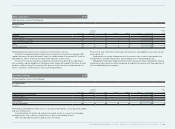

Property, plant and equipment consist of the following:

Property, plant and equipment

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Land and buildings/Leasehold improvements 510 380

Technical equipment and machinery 161 156

Other equipment, furniture and fittings 987 876

1,658 1,412

Less: accumulated depreciation and impairment losses 943 757

715 655

Construction in progress, net 140 68

Property, plant and equipment, net 855 723

Depreciation expenses were € 194 million and € 198 million for the years ending December 31,

2010 and 2009, respectively see Note 30. Impairment losses amounted to € 10 million and

€ 16 million for the years ending December 31, 2010 and 2009, respectively see Note 30. These

are related to assets within other equipment, furniture and fittings, mainly in the Group’s

own-retail activities, for which contrary to expectations there will be an insufficient flow of future

economic benefits. In 2010, reversals of impairment losses were recorded in an amount of

€ 7 million.

In 2010, assets amounting to € 80 million in connection with the unrealised sale of assets

see Note 10 were transferred from “assets classified as held for sale” to “land and buildings”

within property, plant and equipment.

The reclassified depreciation expenses consist of depreciation subsequently reflected see

also Note 10 and the formerly reclassified depreciation which has now been taken back.

Contractual commitments for the acquisition of property, plant and equipment mainly relate

to building projects in Herzogenaurach amounting to € 33 million.

For details see Statement of Movements of Intangible and Tangible Assets see Attachment I

to these Notes.

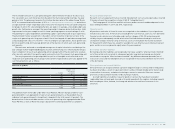

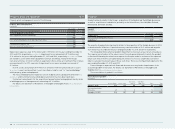

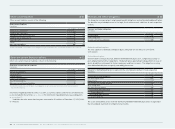

Goodwill 12

Goodwill primarily relates to the Group’s acquisitions of the Reebok and TaylorMade businesses

as well as acquisitions of subsidiaries, primarily in the United States, Australia/New Zealand,

Netherlands, Denmark and Italy.

Goodwill

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Goodwill, gross 1,539 1,478

Less: accumulated impairment losses — —

Goodwill, net 1,539 1,478

The majority of goodwill which primarily relates to the acquisition of the Reebok business in 2006

is denominated in US dollars. A positive currency translation effect of € 61 million and negative

€ 27 million was recorded for the years ending December 31, 2010 and 2009, respectively.

The Group determines whether goodwill impairment is necessary at least on an annual basis.

This requires an estimation of the value in use of the cash-generating units to which the goodwill

is allocated. Estimating the value in use requires the Group to make an estimate of the expected

future cash flows from the cash-generating unit and also to choose a suitable discount rate in

order to calculate the present value of those cash flows. There was no impairment expense for the

years ending December 31, 2010 and 2009.

Future changes in expected cash flows and discount rates may lead to impairments of the

accounted goodwill in the future. For details see Statement of Movements of Intangible and

Tangible Assets see Attachment I to these Notes.

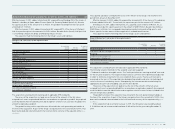

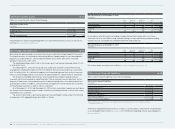

The reconciliation of goodwill is as follows:

Reconciliation of goodwill

€ in millions

Western Europe Greater China Other Asian

Markets TaylorMade-

adidas Golf Other Total

January 1, 2010 513 210 159 283 313 1,478

Currency translation

differences 25 11 8 1 16 61

December 31, 2010 538 221 167 284 329 1,539