Reebok 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

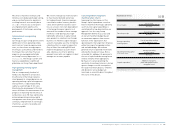

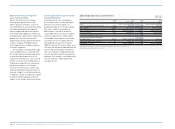

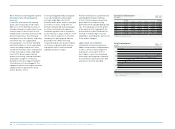

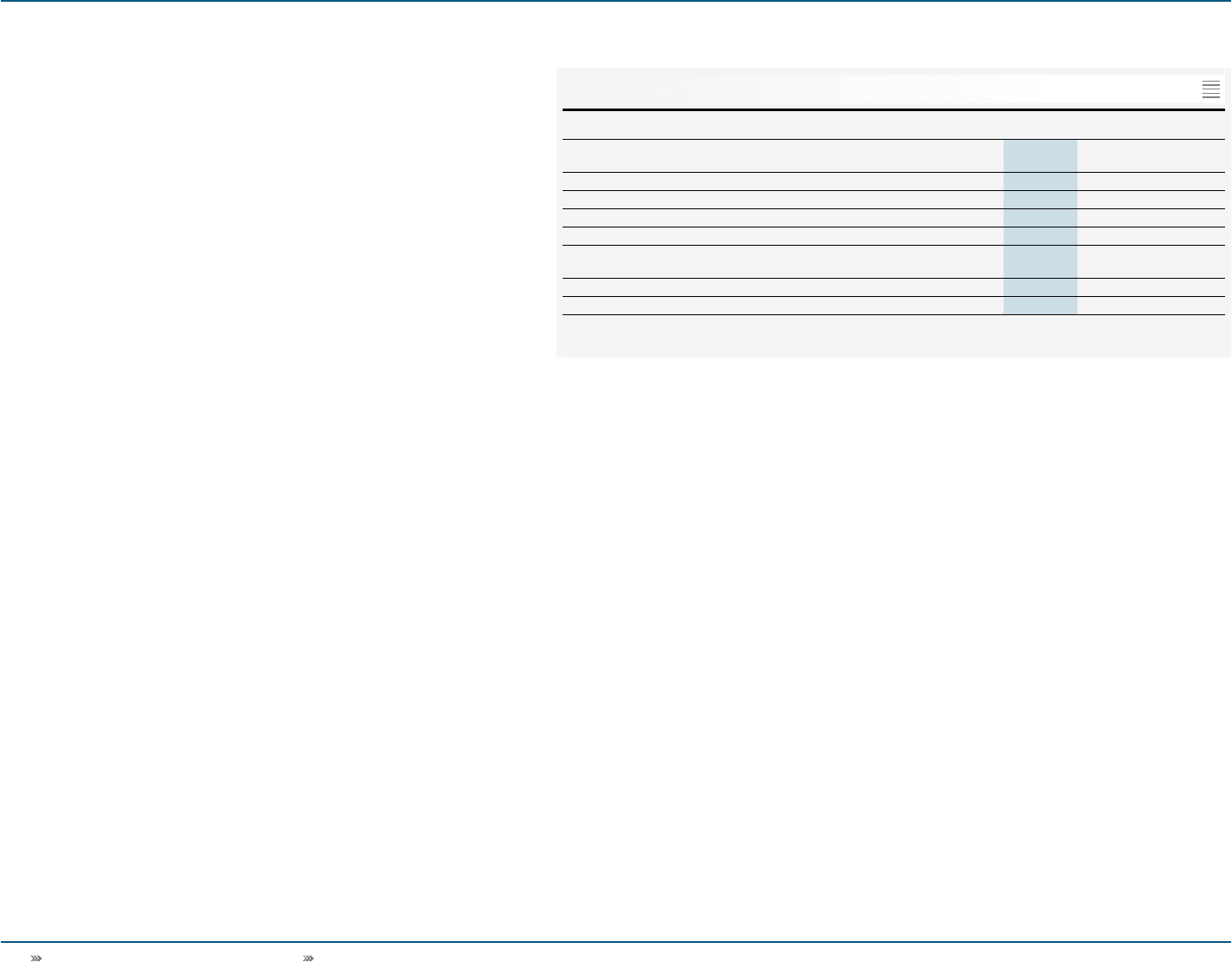

128 Group Management Report – Financial Review Internal Group Management System

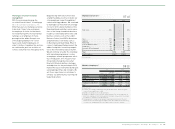

adidas Group targets versus actual key metrics

2009

Actual 2010

Initial outlook 1 )

2010

Actual 2011

Targets

Sales

(year-over-year change, currency-neutral) (6%) low- to mid-single-digit

increase 9% mid- to high-single-digit

increase

Gross margin 45.4% 46% to 47% 47.8% 47.5% to 48.0%

Other operating expenses (in % of sales) 42.3% moderate decline 42.1% moderate decline

Operating margin 4.9% around 6.5% 7.5% 7.5% to 8.0%

(Diluted) earnings per share (in €) 1.22 1.90 to 2.15 2.71 2.98 to 3.12

Average operating working capital

(in % of net sales) 24.3% further reduction 20.8% increase

Capital expenditure (€ in millions) 2 ) 240 300 to 400 269 350 to 400

Net debt (€ in millions) 917 further reduction 221 further reduction

1) As published on March 3, 2010. The outlook was updated over the course of the year.

2) Excluding acquisitions and finance leases.

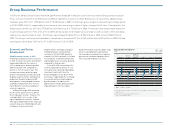

03

M&A activities focus on long-term

value creation potential

We see the majority of our Group’s

future growth opportunities in our

organic business. However, as part of

our commitment to ensuring sustainable

profitable development we regularly

review merger and acquisition options

that may provide additional commercial

and operational opportunities. Acquisitive

growth focus is primarily related to

improving our Group’s positioning within

a sports category, strengthening our

technology portfolio or addressing new

consumer segments.

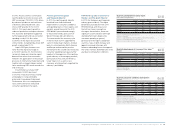

The strategies of any potential acqui-

sition candidate must correspond with

the Group’s direction. Maximising return

on invested capital above the cost of

capital in the long term is a core consid-

eration in our decision-making process.

Of particular importance is evaluating

the potential impact on our Group’s

free cash flow. We assess current and

future projected key financial metrics to

evaluate a target’s contribution potential.

In addition, careful consideration is given

to potential financing needs and their

impact on the Group’s financial leverage.

Cost of capital metric used to measure

investment potential

Creating value for our shareholders

by earning a return on invested capital

above the cost of that capital is a

guiding principle of our Group strategy.

We source capital from equity and

debt markets. Therefore, we have a

responsibility that our return on capital

meets the expectations of both equity

shareholders and creditors. Our Group

calculates the cost of capital utilising

the weighted average cost of capital

(WACC) formula. This metric allows us to

calculate the minimum required financial

returns of planned capital investments.

The cost of equity is computed utilising

the risk-free rate, market risk premium

and beta. Cost of debt is calculated using

the risk-free rate, credit spread and

average tax rate.