Reebok 2010 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

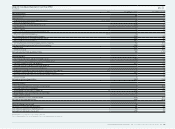

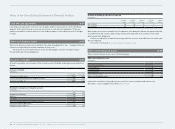

190 Consolidated Financial Statements Notes

Principles of measurementPrinciples of measurement

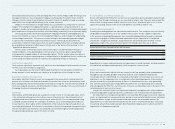

The following table includes an overview of selected measurement principles used in the

preparation of the consolidated financial statements.

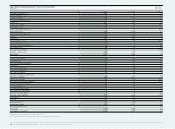

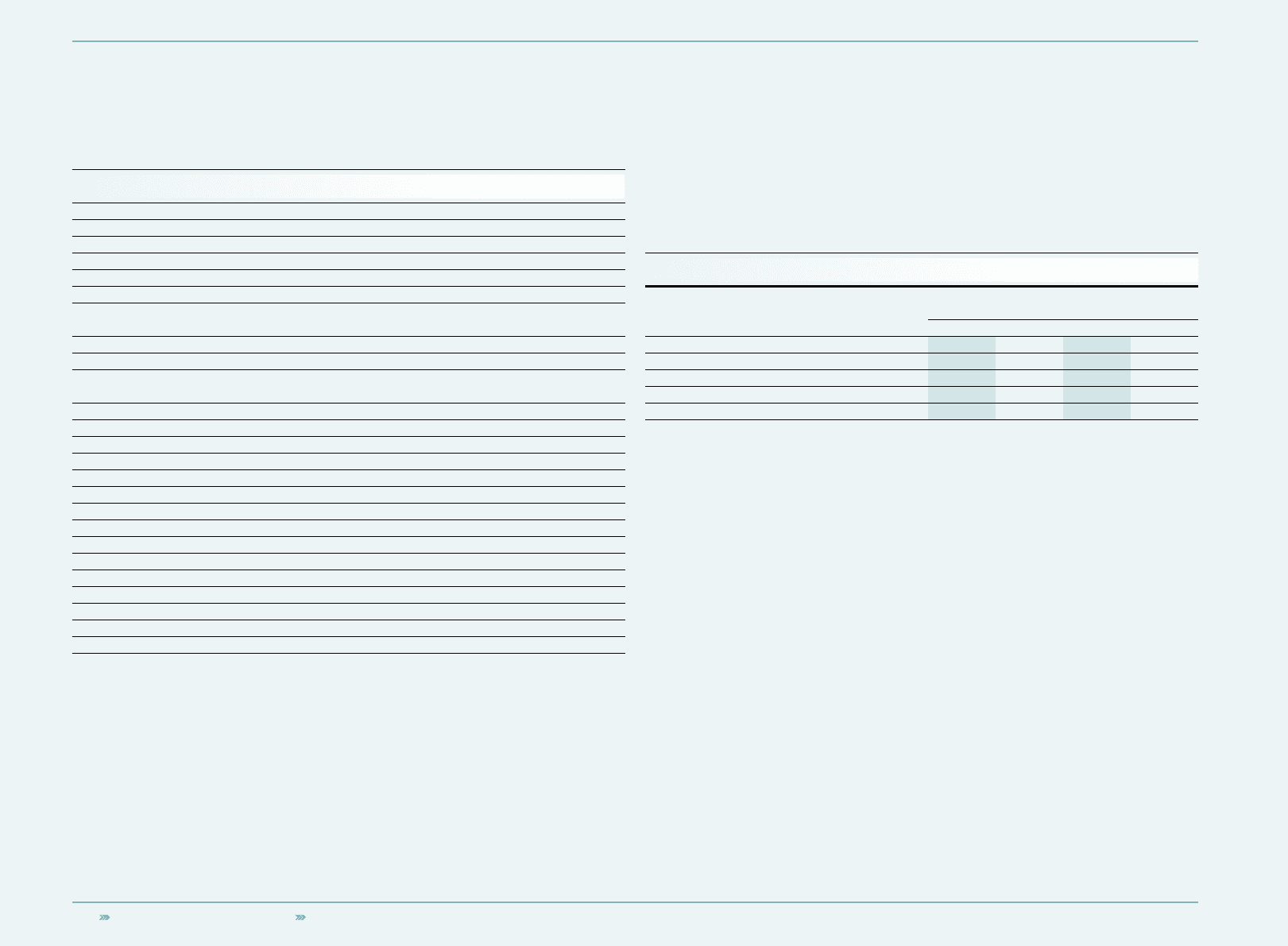

Overview of selected measurement principles

Item Measurement principle

Assets

Cash and cash equivalents Nominal amount

Short-term financial assets At fair value through profit or loss

Accounts receivable Amortised cost

Inventories Lower of cost or net realisable value

Assets classified as held for sale Lower of carrying amount and fair value

less costs to sell

Property, plant and equipment Amortised cost

Goodwill Impairment-only approach

Intangible assets (except goodwill)

With definite useful life Amortised cost

With indefinite useful life Impairment-only approach

Other financial assets (categories according to IAS 39):

At fair value through profit or loss At fair value through profit or loss

Held to maturity Amortised cost

Loans and receivables Amortised cost

Available-for-sale At fair value in other comprehensive income

Liabilities

Accounts payable Amortised cost

Financial liabilities Amortised cost

Provisions

Pensions Projected unit credit method

Other provisions Settlement amount

Accrued liabilities Amortised cost

Currency translation Currency translation

Transactions of assets and liabilities in foreign currencies are translated into the respective

functional currency at spot rates on the transaction date.

In the individual financial statements of subsidiaries, monetary items denominated in non-

functional currencies of the subsidiaries are generally measured at closing exchange rates at the

balance sheet date. The resulting currency gains and losses are recorded directly in the income

statement.

Assets and liabilities of the Group’s non-euro functional currency subsidiaries are translated into

the reporting currency, the “euro”, which is also the functional currency of adidas AG, at closing

exchange rates at the balance sheet date. Revenues and expenses are translated at exchange

rates on the transaction dates. All cumulative differences from the translation of equity of foreign

subsidiaries resulting from changes in exchange rates, are included in a separate item within

shareholders’ equity without affecting the income statement.

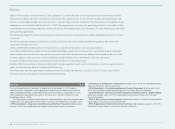

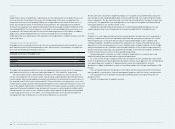

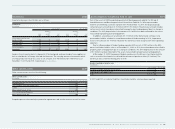

A summary of exchange rates to the euro for major currencies in which the Group operates is

as follows:

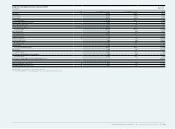

Exchange rates

€ 1 equals

Average rates for the year

ending Dec. 31, Spot rates at

Dec. 31,

2010 2009 2010 2009

USD 1.3279 1.3932 1.3362 1.4406

GBP 0.8584 0.8912 0.8608 0.8881

JPY 116.56 130.23 108.65 133.16

CNY 8.9885 9.5148 8.8493 9.8350

RUB 40.303 44.144 40.820 43.154

Derivative financial instruments Derivative financial instruments

The Group uses derivative financial instruments, such as currency options, forward contracts

as well as interest rate swaps and cross-currency interest rate swaps, to hedge its exposure to

foreign exchange and interest rate risks. In accordance with its Treasury Policy, the Group does

not enter into derivative financial instruments with banks for trading purposes.

Derivative financial instruments are initially recognised in the statement of financial position

at fair value, and subsequently also measured at their fair value. The method of recognising the

resulting gains or losses is dependent on the nature of the item being hedged. On the date a

derivative contract is entered into, the Group designates certain derivatives as either a hedge of a

forecasted transaction (cash flow hedge), a hedge of the fair value of a recognised asset or liability

(fair value hedge) or a hedge of a net investment in a foreign entity.

Changes in the fair value of derivatives that are designated and qualify as cash flow hedges,

and that are effective, as defined in IAS 39 “Financial instruments: recognition and measurement”,

are recognised in equity. When the effectiveness is not 100%, the ineffective portion of the

fair value is recognised in the income statement. Accumulated gains and losses in equity are

transferred to the income statement in the same periods during which the hedged forecasted

transaction affects the income statement.

For derivative instruments designated as fair value hedges, the gains or losses on the

derivatives and the offsetting gains or losses on the hedged items are recognised immediately in

the income statement.