Reebok 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

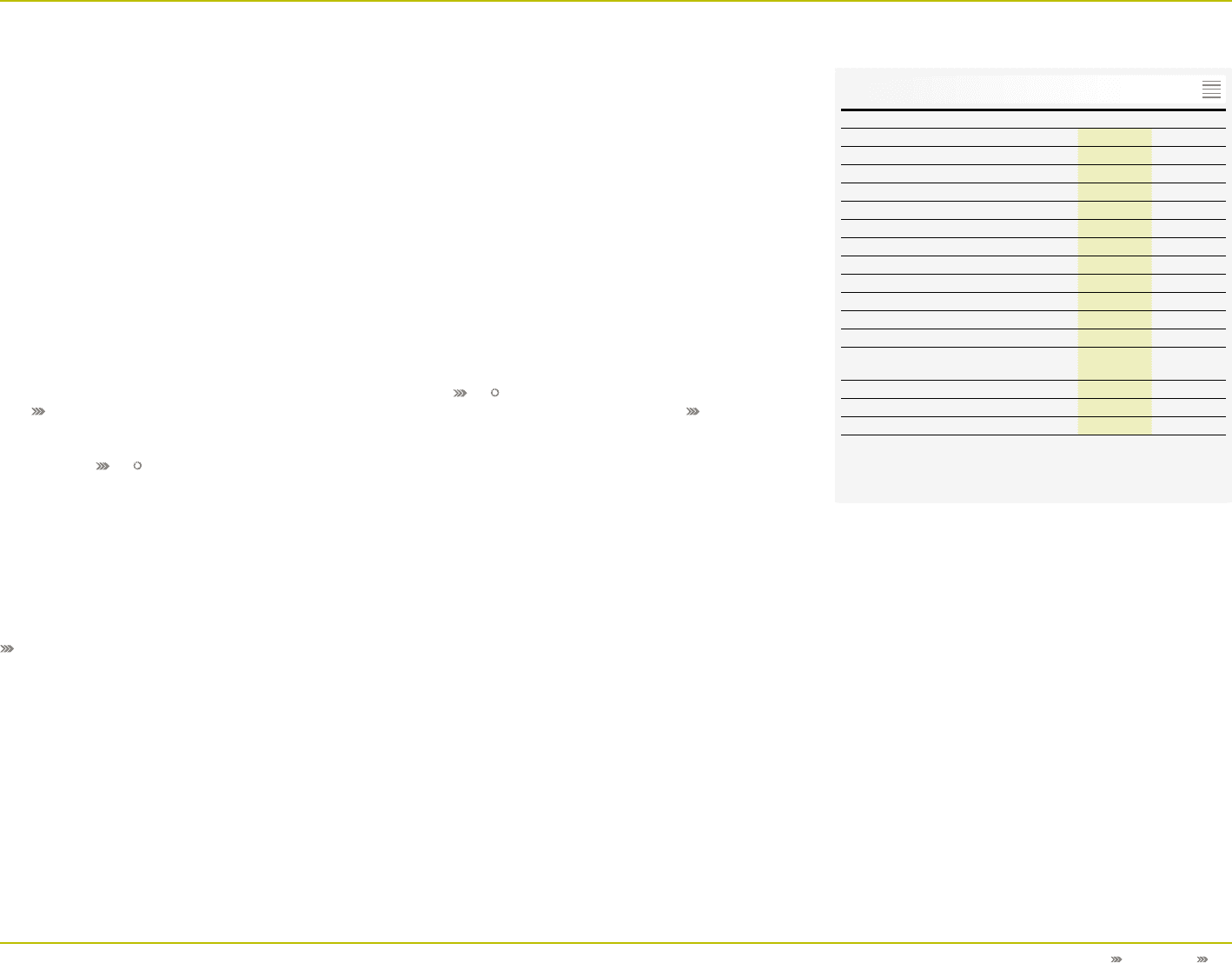

To Our Shareholders Our Share 37

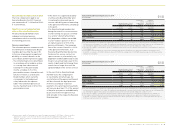

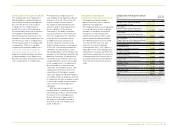

Share ratios at a glance

2010 2009

Basic earnings per share €2.71 1.25

Diluted earnings per share €2.71 1.22

Operating cash flow per share €4.28 6.11

Year-end price €48.89 37.77

Year-high €51.48 38.76

Year-low €35.01 22.73

Dividend per share €0.801) 0.35

Dividend payout € in millions 1672) 73

Dividend payout ratio %29.5 29.8

Dividend yield %1.6 0.9

Shareholders’ equity per share €22.06 18.02

Price-earnings ratio at year-end 18.0 31.0

Average trading volume

per trading day 3) shares 1,170,523 1,392,613

DAX-30 ranking 4 ) at year-end

by market capitalisation 16 17

by turnover 23 22

1) Subject to Annual General Meeting approval.

2) Based on number of shares outstanding at year-end.

3) Based on number of shares traded on all German stock exchanges.

4) As reported by Deutsche Börse AG.

08

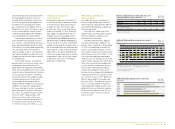

Strong international investor baseStrong international investor base

Based on our share register, we

estimate that adidas AG currently has

around 60,000 shareholders. In our

latest ownership analysis conducted in

February 2011, we identified 88% of our

shares outstanding. Shareholdings in the

North American market account for 28%

of our total shares outstanding. Identi-

fied German institutional investors hold

10% of shares outstanding. The share-

holdings in the rest of Europe excluding

Germany amount to 44%, while 4% of

institutional shareholders were identi-

fied in other regions of the world. adidas

Group Management, which comprises

current members of the Executive

and Supervisory Boards, holds 2% in

total see Corporate Governance Report,

p. 25. Undisclosed holdings, which also

include private investors, account for the

remaining 12% see 06.

Voting rights notifications receivedVoting rights notifications received

In 2010, adidas AG received twelve voting

rights notifications in accordance with

§ 21 section 1 of the German Securities

Trading Act ( Wertpapierhandelsgesetz

– WpHG). All voting rights notifications

received in 2010 and thereafter can

be viewed on our corporate website

www.adidas-Group.com/voting_rights_

notifications. Information on investments

that have exceeded or fallen below a

certain threshold can also be found in

the Notes section of this Annual Report

see Note 25, p. 204.

Our efforts to deliver best-in-class

services to our investors and analysts

were again highly acknowledged in an

investor relations survey conducted

by Thomson Reuters. In the sector

Consumer/Luxury Goods, the adidas

Group was ranked number two by

buy-side analysts in this survey.

The print version of our 2009 Annual

Report also achieved high recognition,

taking fifth place in the DAX-30 ranking

by Manager Magazin.

Extensive financial information Extensive financial information

available onlineavailable online

We offer extensive information around

our share as well as the Group’s

strategy and financial results on our

corporate website at www.adidas-

Group.com/investors. Our event calendar

lists all conferences and roadshows

we attend and provides all presenta-

tions for download. In addition to live

webcasts of all major events such as our

Analyst Conferences, the Annual General

Meeting and Investor Days, we also offer

podcasts of our quarterly conference

calls. Furthermore, in order to give a

regular update about the latest develop-

ments of the adidas Group and the adidas

AG share, we also offer our shareholders

and the financial market community the

opportunity to subscribe to our quarterly

Investor Relations Newsletter.

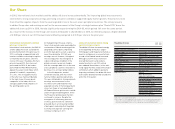

adidas Group again receives adidas Group again receives

strong analyst supportstrong analyst support

The adidas Group continued to receive

strong analyst support in 2010. Around

35 analysts from investment banks and

brokerage firms regularly published

research reports on our Group. The

majority of analysts are confident about

the medium- and long-term potential

of our Group. This is reflected in the

recommendation split for our share as

at December 31, 2010. 55% of analysts

recommended investors to “buy” our

share in their last publication during

the 12-month period (2009: 54%). 28%

advised to “hold” our share (2009: 22%).

17% of the analysts recommended to

“sell” our share (2009: 24%) see 07.

Award-winning Investor Relations Award-winning Investor Relations

activitiesactivities

adidas AG strives to maintain close

contact to institutional and private share-

holders as well as analysts. In 2010,

Management and the Investor Relations

team spent more than 35 days on

roadshows and presented at 19 national

and international conferences. In

addition, in order to present the adidas

Group’s new strategic business plan

“Route 2015”, we hosted an Investor

Day in Herzogenaurach on November 8,

which was attended by more than 70

investors and other representatives of the

financial markets.