Reebok 2010 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

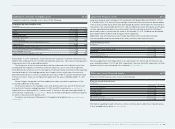

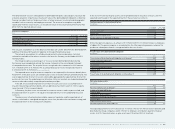

204 Consolidated Financial Statements Notes Notes to the Consolidated Statement of Financial Position

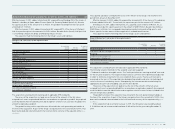

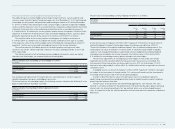

Constitution of plan assets

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Equity instruments 21 19

Bonds 14 13

Real estate 1 1

Pension plan reinsurance 21 19

Other assets 10 9

Fair value of plan assets 67 61

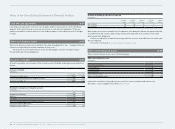

Historical development

€ in millions

Dec. 31, 2010 Dec. 31, 2009 Dec. 31, 2008 Dec. 31, 2007 Dec. 31, 2006

Present value of defined benefit obligation 237 207 172 171 170

Fair value of plan assets 67 61 53 60 46

Thereof: defined benefit assets (1) (2) (5) (4) (2)

Deficit in plan 171 148 124 115 126

Experience adjustments arising

on the plan liabilities (1) (3) 2 (1) 4

Experience adjustments arising

on the plan assets 1 3 (8) 4 —

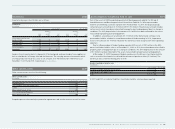

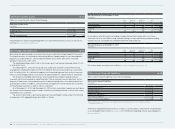

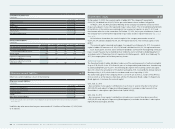

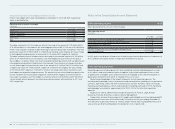

Other non-current liabilities 24

Other non-current liabilities consist of the following:

Other non-current liabilities

€ in millions

Dec. 31, 2010 Dec. 31, 2009

Finance lease obligations 1 ) — 2

Liabilities due to personnel 16 7

Deferred income 19 17

Sundry 1 2

Other non-current liabilities 36 28

1) From 2010 onwards, non-current finance lease obligations are presented under other non-current financial liabilities

see Note 22.

Liabilities due after more than five years amounted to € 12 million at December 31, 2010 (2009:

€ 10 million).

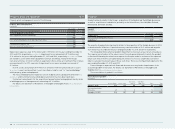

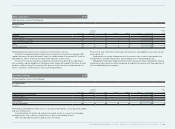

Shareholders’ equity 25

On December 31, 2009, the nominal capital of adidas AG (“the company”) amounted to

€ 209,216,186 divided into 209,216,186 no-par-value bearer shares and was fully paid in.

On May 6, 2010, the Annual General Meeting of the company resolved the conversion from

no-par-value bearer shares into registered no-par-value shares. The corresponding amendments

to the Articles of Association were entered into the commercial register on July 13, 2010 and

thus became effective on the same date. On October 11, 2010, the no-par-value bearer shares of

the company were converted into registered no-par-value shares (“registered shares”) see Our

Share, p. 34.

At the balance sheet date, the nominal capital of the company amounted to a total of

€ 209,216,186 and was divided into 209,216,186 registered shares. The nominal capital is fully

paid in.

The nominal capital remained unchanged. Consequently, on February 15, 2011, the nominal

capital of adidas AG amounts to € 209,216,186 and is divided into 209,216,186 registered shares.

Each share grants one vote and is entitled to dividends starting from the beginning of the year

it was issued. Treasury shares held directly or indirectly are not entitled to dividend payment in

accordance with § 71b German Stock Corporation Act (Aktiengesetz – AktG). As at February 15,

2011, the company does not hold any treasury shares.

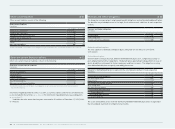

Authorised Capital Authorised Capital

The Executive Board of adidas AG did not make use of the existing amounts of authorised capital

of up to € 95,000,000 in the 2010 financial year or in the period beyond the balance sheet date up

to and including February 15, 2011. The following description of the existing authorised capital

does not contain the cancellation of the Authorised Capital 2006, resolved by the Annual General

Meeting on May 6, 2010, which had also not been made use of up to May 6, 2010.

The authorised capital of the company, which is set out in § 4 sections 2, 3 and 4 of the Articles

of Association as at the balance sheet date, entitles the Executive Board, subject to Supervisory

Board approval, to increase the nominal capital

until June 21, 2014

– by issuing new shares against contributions in cash once or several times by no more than

€ 50,000,000 and, subject to Supervisory Board approval, to exclude residual amounts from

shareholders’ subscription rights (Authorised Capital 2009/I);

until June 21, 2012

– by issuing new shares against contributions in kind once or several times by no more than

€ 25,000,000 and, subject to Supervisory Board approval, to exclude shareholders’ subscription

rights (Authorised Capital 2009/II);