Reebok 2010 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

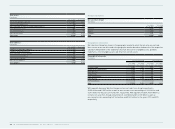

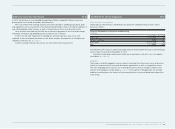

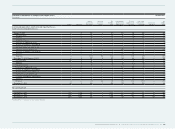

Consolidated Financial Statements Notes Notes to the Consolidated Income Statement 217

The Group does not recognise deferred tax liabilities for unremitted earnings of non-German

subsidiaries to the extent that they are expected to be permanently invested in international

operations. These earnings, the amount of which cannot be practicably computed, could become

subject to additional tax if they were remitted as dividends or if the Group were to sell its

shareholdings in the subsidiaries.

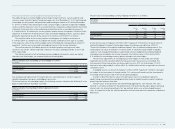

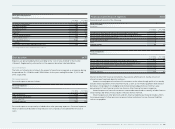

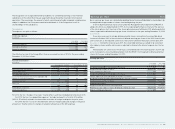

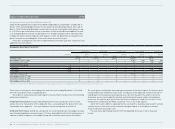

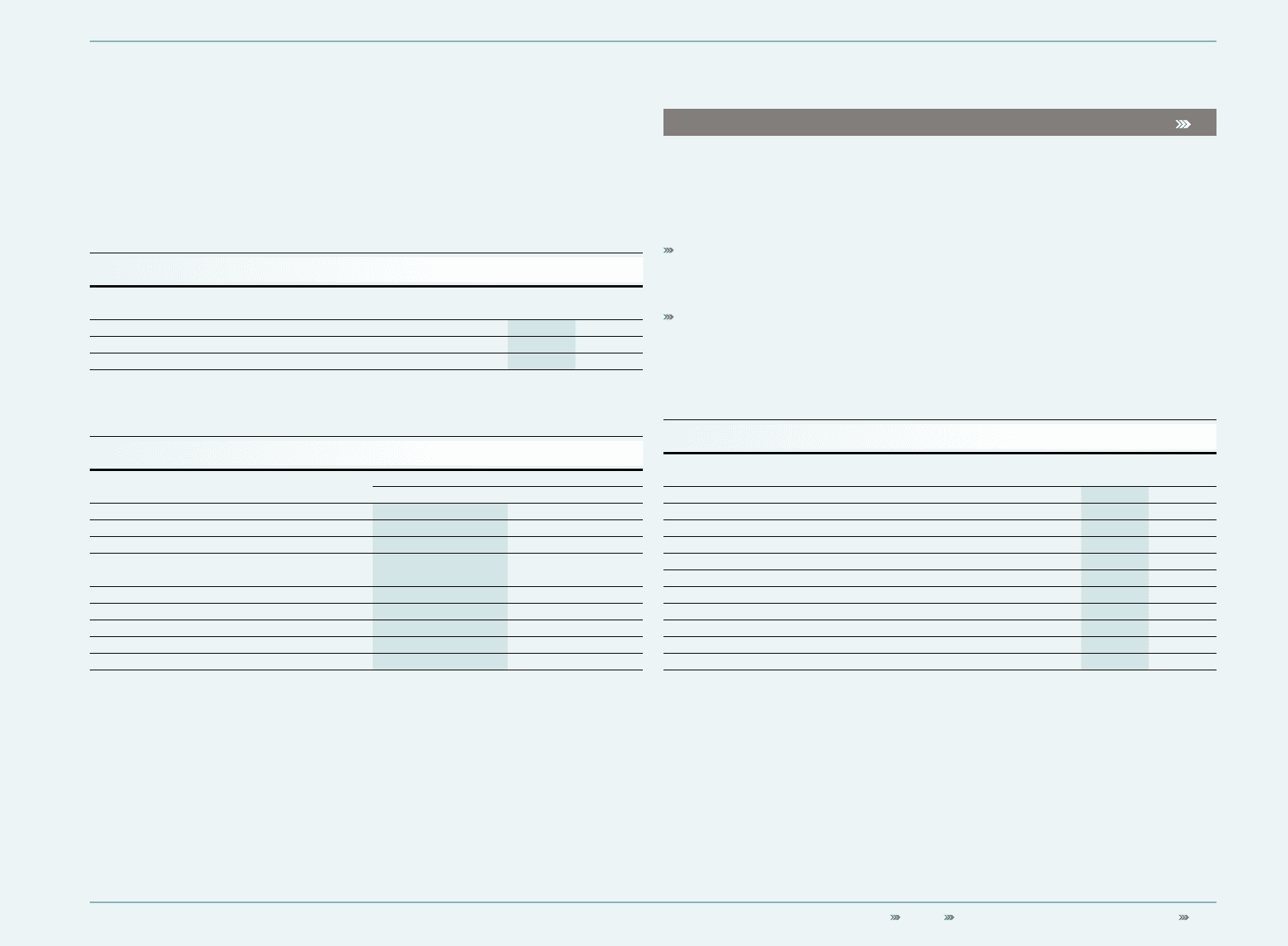

Tax expenses Tax expenses

Tax expenses are split as follows:

Income tax expenses

€ in millions

Year ending

Dec. 31, 2010 Year ending

Dec. 31, 2009

Current tax expenses 314 156

Deferred tax (income) (76) (43)

Income tax expenses 238 113

The effective tax rate of the Group differs from an assumed tax rate of 30% for the year ending

December 31, 2010 as follows:

Tax rate reconciliation

€ in millions

Year ending Dec. 31, 2010 Year ending Dec. 31, 2009

€ in millions in % € in millions in %

Expected income tax expenses 242 30.0 108 30.0

Tax rate differentials (89) (11.0) (94) (26.1)

Non-deductible expenses 43 5.3 (36) (10.1)

Losses for which benefits were not recognisable and

changes in valuation allowances 8 1.0 119 33.2

Changes in tax rates (11) (1.4) 4 1.1

Other, net 1 0.1 1 0.3

194 24.0 102 28.3

Withholding tax expenses 44 5.5 11 3.1

Income tax expenses 238 29.5 113 31.5

For 2010, the line “changes in tax rates” mainly reflects a UK tax rate deduction effective in 2011.

For 2010, the line “non-deductible expenses” includes tax benefits of in total € 14 million

(2009: € 57 million) related to the favourable resolution of foreign tax disputes for prior years.

For 2009, the line “losses for which benefits were not recognisable and changes in valuation

allowances” mainly relates to changes in valuation allowances of the US tax group.

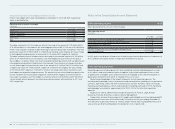

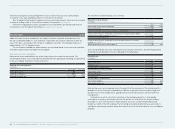

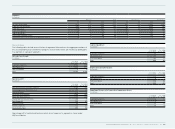

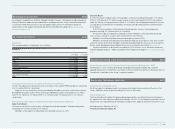

Earnings per share 34

Basic earnings per share are calculated by dividing the net income attributable to shareholders by

the weighted average number of shares outstanding during the year.

In 2009, dilutive potential shares arose under the Management Share Option Plan (MSOP) of

adidas AG, which was implemented in 1999. As the required performance criteria for the exercise

of the stock options of all tranches of the share option plan were fulfilled in 2009, dilutive potential

shares impacted the diluted earnings per share calculation for the year ending December 31, 2009

see Note 38.

It was also necessary to include dilutive potential shares arising from the convertible bond

issuance in October 2003 in the calculation of diluted earnings per share of the 2009 financial year

until conversion as the required conversion criteria were fulfilled at the balance sheet date 2009

see Note 17. During the financial year 2009, the convertible bond was assumed to be converted

into ordinary shares and the net income is adjusted to eliminate the interest expense less the tax

effect.

Following the full conversion of the Group’s convertible bond in the fourth quarter of 2009 and

as no share options are outstanding anymore from the MSOP, the Group had no dilutive potential

shares for the year ending December 31, 2010.

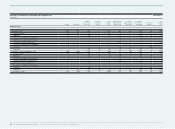

Earnings per share

Year ending

Dec. 31, 2010 Year ending

Dec. 31, 2009

Net income attributable to shareholders (€ in millions) 567 245

Weighted average number of shares 209,216,186 196,220,166

Basic earnings per share (in €) 2.71 1.25

Net income attributable to shareholders (€ in millions) 567 245

Interest expense on convertible bond, net of taxes (€ in millions) — 10

Net income used to determine diluted earnings per share (€ in millions) 567 255

Weighted average number of shares 209,216,186 196,220,166

Weighted share options — 34,369

Weighted assumed conversion convertible bond — 12,983,564

Weighted average number of shares for diluted earnings per share 209,216,186 209,238,099

Diluted earnings per share (in €) 2.71 1.22