Reebok 2010 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

132 Group Management Report – Financial Review Group Business Performance Economic and Sector Development

North American sporting goods industry

driven by volume and average price

increases

In the USA, we estimate that sporting

goods sales increased at a mid-single-

digit rate in 2010, driven by increases in

average selling prices and volumes. Lean

inventory levels in the first half of 2010

helped retailers minimise promotion and

discounting activities, thus driving up

average prices for the industry. Improving

momentum was also supported by

increasing levels of consumer spending

with both the back-to-school and holiday

season recording strong results in the

second half. Footwear sales are projected

to have increased at a high-single-digit

rate in 2010, driven in particular by

growth in the toning, running, basketball

and outdoor categories. Increasing

demand for functional apparel helped to

offset declines in licensed apparel. The

equipment market in the region remained

subdued, with the golf market seeing

further declines in 2010.

Asian sporting goods industry expands

Asia’s sporting goods industry grew

at a high-single-digit rate in 2010,

primarily driven by the region’s emerging

economies. In China, rising levels of

domestic demand and increasing wages

as well as continued retail expansion

resulted in a growth rate of around 20%

for the industry. In Japan, however, in line

with the overall weakness in consumer

spending, the sporting goods industry

declined in 2010. While the toning

category provided some positive impetus

on footwear, in general, both footwear

and apparel sales at retail remained

highly promotional in Japan.

Positive momentum in Latin American

sporting goods market continues

In 2010, the Latin American sporting

goods industry recorded a strong

performance with a double-digit growth

rate. The substantial economic growth

in the region in 2010 coupled with the

positive effects of the FIFA World Cup

resulted in relatively high consumer

spending on sporting goods, particularly

in the football category.

adidas Group and competitors

outperform economic environment

adidas Group revenues and profitability

as well as those of many competitors

and retailers increased in 2010. In

most regions, sales of our Group and

other major sporting goods companies

increased more significantly than GDP

and overall consumer spending.

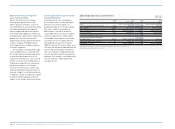

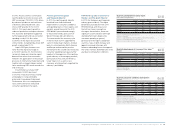

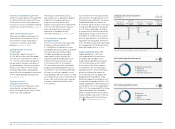

Exchange rate development 1 )

€ 1 equals

Average

rate 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Average

rate 2010

USD 1.3932 1.3479 1.2271 1.3648 1.3362 1.3279

GBP 0.8912 0.8898 0.8175 0.8600 0.8608 0.8584

JPY 130.23 125.93 108.79 113.68 108.65 116.56

RUB 44.144 39.695 38.282 41.692 40.820 40.303

CNY 9.5148 9.2006 8.3269 9.1457 8.8493 8.9885

1) Spot rates at quarter-end.

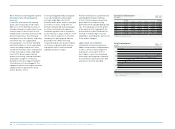

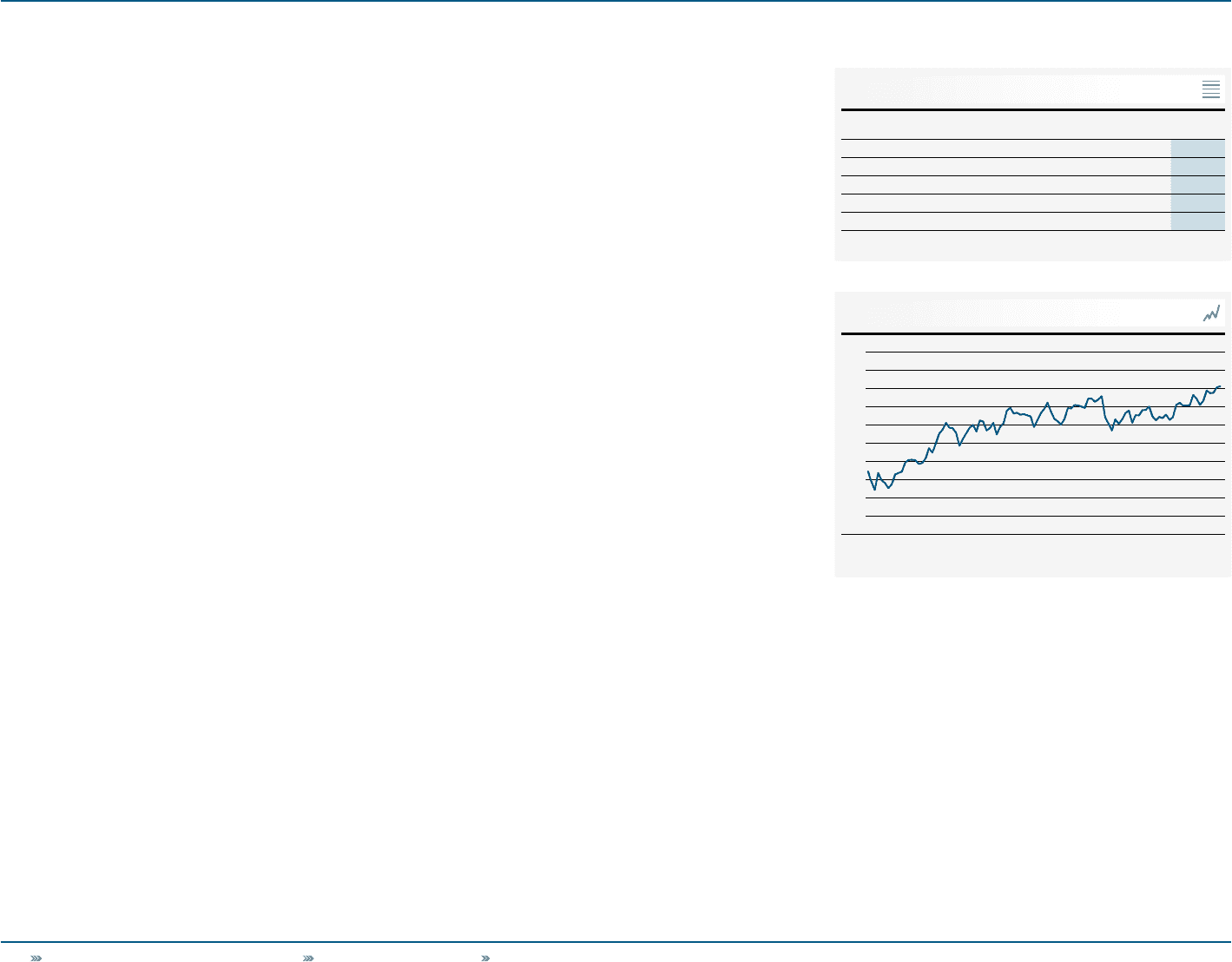

05

Oil price development 1 )

in US $

Jan. 1, 2009 Dec. 31, 2010

100

80

60

40

20

1) West Texas Intermediate Cushing crude oil.

Source: Bloomberg.

06