Reebok 2010 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

176 Group Management Report – Financial Review Subsequent Events and Outlook

adidas Group currency-neutral sales to

increase at a mid- to high-single-digit

rate in 2011

We expect adidas Group sales to increase

at a mid- to high-single-digit rate on

a currency-neutral basis in 2011. The

positive sales development will be

driven by rising consumer confidence

as the global economy continues to

improve. The positive impacts of our

high exposure to fast-growing emerging

markets, the further expansion of Retail

as well as continued momentum at the

Reebok brand will more than offset the

non-recurrence of sales related to the

2010 FIFA World Cup. As a result, we

expect the adidas Group to outperform

global economic growth in 2011.

Currency-neutral Wholesale

revenues expected to increase

at a mid-single-digit rate

We project currency-neutral Wholesale

segment revenues to increase at a

mid-single-digit rate compared to the

prior year. Order backlog development

as well as positive retailer and trade

show feedback support our growth

expectations for 2011. Currency-neutral

adidas Sport Performance sales are

forecasted to increase at a low- to

mid-single-digit rate due to growth in

key categories such as running and

training. adidas Sport Style revenues are

projected to increase at a high-single-

to low-double-digit rate on a currency-

neutral basis as a result of the expanded

distribution scope and continued

momentum in our product lines, in

particular adidas NEO. Currency-neutral

Reebok sales are expected to increase

due to growth in the women’s fitness

and men’s training category as well as

increases in the Classics business.

Retail sales to increase at a low-double-

digit rate on a currency-neutral basis

adidas Group currency-neutral Retail

segment sales are projected to grow at a

low-double-digit rate in 2011. Expansion

of the Group’s own-retail store base and

comparable store sales are expected to

contribute at a similar rate to the revenue

growth. The Group expects a net increase

of its store base by around 100 adidas

and Reebok stores in 2011. We forecast to

open around 200 new stores, depending

on the availability of desired locations.

New stores will primarily be located in

emerging markets in Eastern Europe.

Approximately 100 stores will be closed

over the course of the year. Around 220

stores will be remodelled. Comparable

store sales are expected to increase at

a mid-single-digit rate compared to the

prior year. As a result of the forecasted

improvements in the consumer

environment in 2011, concept stores are

expected to perform slightly better than

factory outlets.

Currency-neutral sales of Other

Businesses to increase at a mid-

single-digit rate

In 2011, revenues of Other Businesses

are expected to increase at a mid-single-

digit rate on a currency-neutral basis.

TaylorMade-adidas Golf currency-neutral

sales are projected to grow at a low- to

mid-single-digit rate compared to the

prior year. Product launches in core

categories such as metalwoods, irons

and putters should support growth in

this segment against a slow recovery

in the global golf market. Revenues at

Rockport are forecasted to increase

at a high-single- to low-double-digit

rate as a result of improvements in the

brand’s product portfolio and own-retail

expansion. Sales at Reebok-CCM Hockey

are expected to grow at a low-single-digit

rate in 2011, mainly due to new product

introductions.

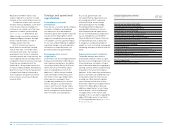

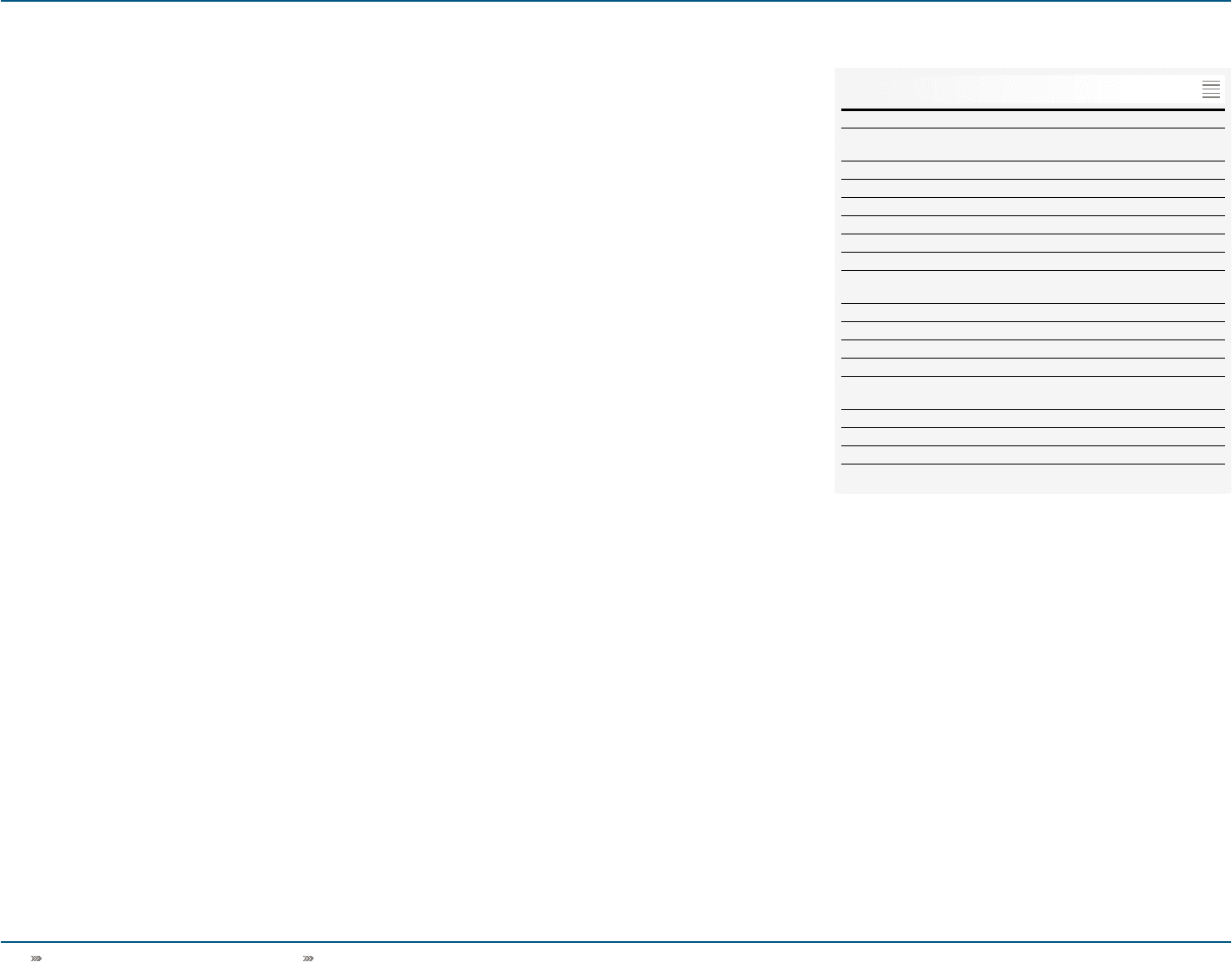

adidas Group 2011 Outlook

Currency-neutral sales

development (in %):

adidas Group mid- to high-single-digit increase

Wholesale mid-single-digit increase

Retail low-double-digit increase

Comparable store sales mid-single-digit increase

Other Businesses mid-single-digit increase

TaylorMade-adidas Golf low- to mid-single-digit increase

Rockport high-single- to low-double-digit

increase

Reebok-CCM Hockey low-single-digit increase

Gross margin 47.5% to 48.0%

Operating margin 7.5% to 8.0%

Earnings per share € 2.98 to € 3.12

Average operating working

capital as a percentage of sales increase

Capital expenditure 1 ) € 350 million to € 400 million

Store base net increase by around 100 stores

Net borrowings decline

1) Excluding acquisitions and finance leases.

01