Reebok 2010 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

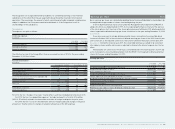

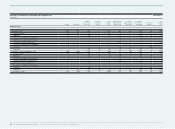

222 Consolidated Financial Statements Notes Notes – Additional Information

Equity compensation benefits 38

Management Share Option Plan (MSOP) of adidas AG Management Share Option Plan (MSOP) of adidas AG

Under the Management Share Option Plan (MSOP) adopted by the shareholders of adidas AG on

May 20, 1999, and amended by resolution of the Annual General Meeting on May 8, 2002, and on

May 13, 2004, the Executive Board was authorised to issue non-transferable stock options for up

to 1,373,350 no-par-value bearer shares to members of the Executive Board of adidas AG as well

as to managing directors/senior vice presidents of its related companies and to other executives

of adidas AG and its related companies until August 27, 2004. The granting of stock options took

place in tranches not exceeding 25% of the total volume for each fiscal year.

A two-year vesting period and a term of approximately seven years upon their respective issue

applied for the stock options.

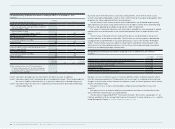

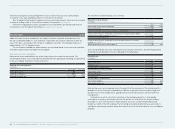

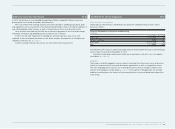

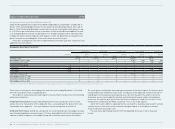

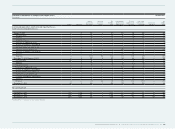

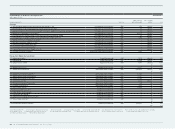

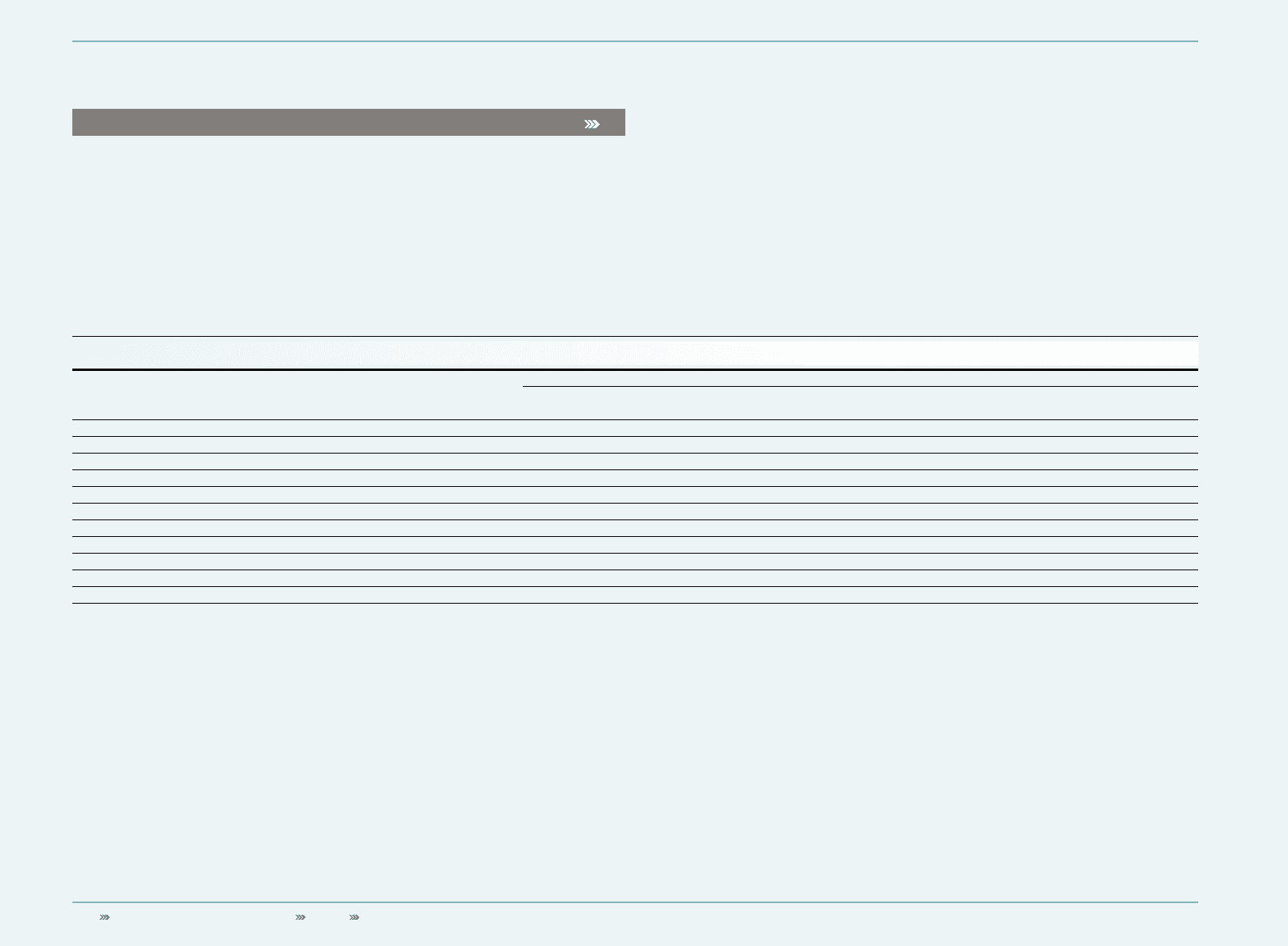

Management Share Option Plan (MSOP)

Tranche I (1999) Tranche II (2000) Tranche III (2001) Tranche IV (2002) Tranche V (2003)

Share price

in € Number Exercise

price in € Number Exercise

price in € Number Exercise

price in € Number Exercise

price in € Number Exercise

price in €

Originally issued 266,550 335,100 342,850 340,850 88,000

Outstanding as at Jan. 1, 2009 0 — 0 — 0 — 11,200 6.40 4,600 4.00

Forfeited during the period 0 — 0 — 0 — 300 0.00 500 82.60

Exercised during the period

May 2009 1 ) 0.00 0 — 0 — 0 — 0 — 0 —

Aug. 2009 1 ) 136.48 0 — 0 — 0 — 0 — 4,100 82.60

Nov. 2009 1 ) 0.00 0 — 0 — 0 — 0 — 0 —

Expired during the period 0 — 0 — 0 — 10,900 0.00 0 —

Outstanding as at Dec. 31, 2009 0 — 0 — 0 — 0 — 0 —

Exercisable as at Dec. 31, 2009 0 — 0 — 0 — 0 — 0 —

Outstanding as at Jan. 1, 2010 0 — 0 — 0 — 0 — 0 —

1) Due to the share split effective May 2006, one option grants the right to purchase four shares. Accordingly, the share price information refers to four shares each.

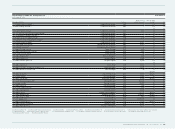

There were no stock options outstanding at the end of the years ending December 31, 2010 and

2009. No stock options were issued during 2010.

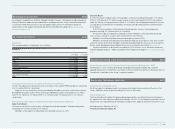

Stock options could only be exercised subject to the attainment of at least one of the following

performance objectives:

(1) Absolute Performance: During the period between the issuance and exercise of the stock

options, the stock market price for the adidas AG share – calculated upon the basis of the “total

shareholder return approach” – has increased by an annual average rate of at least 8%.

(2) Relative Performance: During the same period, the stock market price for the adidas AG share

must have developed by an annual average of 1% more favourably than the stock market prices of

a basket of global competitors of the adidas Group and in absolute terms may not have fallen.

The stock options could only be exercised against payment of the exercise price. The exercise price

corresponded to the arithmetical mean of the closing price of the adidas AG share over the last 20

trading days of the respective exercise period, less a discount, based on the extent to which the

share price at exercise exceeded the absolute and relative performance hurdles outlined above.

In any case, the exercise price was at least the lowest issue price as stated in § 9 section 1 of the

German Stock Corporation Act (AktG), currently € 1.00 (i.e. € 4.00 per option).

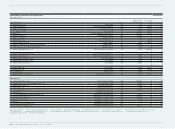

Option terms and conditions stipulated that the stock options could have been used for existing

common shares in lieu of new shares from the contingent capital, or in the place of common

shares the discount was paid in cash.

The new shares participated in profits from the beginning of the year in which they were

issued.