Reebok 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Our Group Global Operations 109

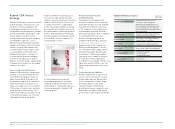

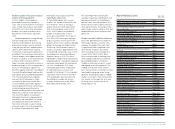

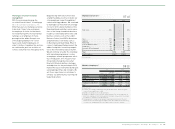

Apparel production by region 1 )

1) Figures include adidas, Reebok and adidas Golf.

Hardware production by region 1 )

1) Figures include adidas, Reebok and adidas Golf.

06

08

82% Asia

12% Europe

6% Americas

98% Asia

2% Europe

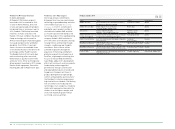

Apparel production 1 )

in million units

1) Figures include adidas, Reebok and adidas Golf.

Hardware production 1 )

in million units

1) Figures include adidas, Reebok and adidas Golf.

07

09

2007

2008

2009

2010

2007

2008

2009

2010

252

284

239

301

39

42

34

48

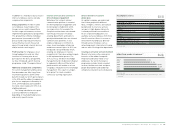

China’s share of footwear

production decreases

97% of our total 2010 footwear volume

for adidas, Reebok and adidas Golf was

produced in Asia (2009: 97%). Production

in Europe and the Americas combined

accounted for 3% of the sourcing

volume (2009: 3%) see 04. China

represents our largest sourcing country

with approximately 39% of the total

volume, followed by Vietnam with 31%

and Indonesia with 22%. As part of our

strategy to increase the regional diversity

of our supplier base to meet the ongoing

needs of our business, the overall

representation of China in our sourcing

mix declined 2 percentage points. At

the same time, the footwear volumes

sourced from Cambodia almost tripled

in 2010 from a low comparison base. In

2010, our footwear suppliers produced

approximately 219 million pairs of shoes

(2009: approx. 171 million pairs) see

05. The year-over-year increase was

driven by the strong sales growth in 2010

and a low comparison base in 2009 due to

inventory clean-up activities. Our largest

footwear factory produced approximately

9% of the footwear sourcing volume

(2009: 11%). Rockport purchased

approximately 8 million pairs of footwear

in 2010, which represents an increase of

27% versus the prior year. Products were

primarily sourced from factories in China

(67%), Vietnam (25%), Indonesia (5%) and

India (3%). The largest factory accounted

for 37% of the total sourcing volume of

the Rockport brand.

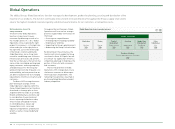

Volume of apparel production increases

In 2010, we sourced 82% of the total

apparel volume for adidas, Reebok

and adidas Golf from Asia (2009: 83%).

Europe remained the second-largest

apparel sourcing region, representing

12% of the volume (2009: 11%). The

Americas accounted for 6% of the volume

(2009: 6%) see 06. China was the

largest source country, representing

36% of the produced volume, followed

by Thailand with 13% and Indonesia with

13%. In total, our suppliers produced

approximately 301 million units of

apparel in 2010 (2009: approx. 239 million

units) see 07. The largest apparel

factory produced approximately 9%

of this apparel volume in 2010 (2009:

11%). In addition, Reebok-CCM Hockey

sourced around 2 million units of apparel

in 2010 (2009: approx. 2 million units).

The majority of this volume was also

produced in Asia, while small portions

were sourced from the Americas

(particularly Canada) and Europe.

The Sports Licensed Division sourced

approximately 23 million units of apparel

and 15 million units of headwear (2009:

20 million and 14 million, respectively).

The majority of purchased apparel

products was sourced as unfinished

goods from Latin America (85%) and Asia

(15%), and was subsequently finished in

our own screen-printing facilities in the

USA. The majority of headwear sourced

was finished products manufactured

predominately in Asia (97%) and the

USA (3%).

67% of adidas and Reebok branded

hardware produced in China

In 2010, the bulk (i.e. 98%) of adidas and

Reebok branded hardware products, such

as balls and bags, was also produced in

Asia (2009: 98%). China remained our

largest source country, accounting for

67% of the sourced volume, followed

by Vietnam with 20% and Pakistan with

11%. The remaining 2% was sourced via

European countries see 08. The total

2010 hardware sourcing volume was

approximately 48 million units (2009:

approximately 34 million units), with the

largest factory accounting for 21% of

production see 09.

TaylorMade and Reebok-CCM Hockey

sourced 98% and 72% of their hardware

volumes from Asia, respectively (2009:

92% and 78%). In addition, both brands

sourced a portion of hardware products

in the Americas. At TaylorMade, the

majority of golf club components were

manufactured by suppliers in China and

assembled by TaylorMade in the USA,

China and Japan.