Reebok 2010 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review Business Performance by Segment Other Businesses Performance 157

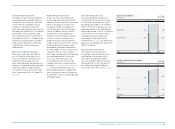

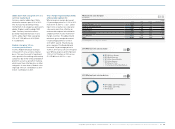

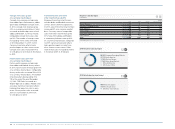

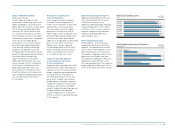

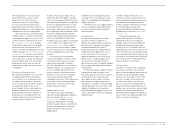

2010 Other Businesses net sales by region

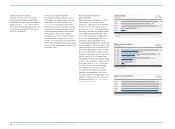

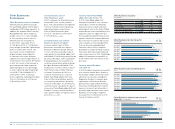

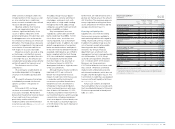

2010 Other Businesses sales by brand

21

22

52% North America

26% Other Asian Markets

17% Western Europe

2% European Emerging Markets

2% Greater China

1% Latin America

64% TaylorMade-adidas Golf

18% Rockport

14% Reebok-CCM Hockey

4% Other Centrally Managed Brands

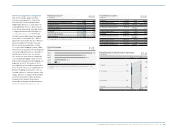

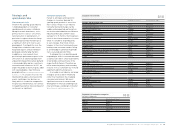

Other Businesses net sales by region

€ in millions

2010 2009 Change Change

currency-neutral

Western Europe 235 224 5% 1%

European Emerging Markets 35 30 17% 8%

North America 735 685 7% 0%

Greater China 29 24 18% 12%

Other Asian Markets 372 319 17% 3%

Latin America 14 12 16% 10%

Total 1 ) 1,420 1,293 10% 2%

1) Rounding differences may arise in totals.

20

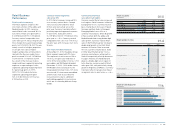

Reebok-CCM Hockey sales up 3%

on a currency-neutral basis

Currency-neutral Reebok-CCM Hockey

sales grew 3% in 2010. This development

was driven by increases in hardware

supported by new product introductions

such as the Reebok 11K and CCM

U+ Crazy Light skates. Regionally,

Reebok-CCM Hockey sales grew at a

mid-single-digit rate in Scandinavia

and at a low-single-digit rate in North

America. Currency translation effects

positively impacted sales in euro terms.

Reebok-CCM Hockey revenues increased

13% to € 200 million in 2010 from

€ 177 million in 2009.

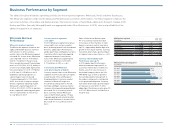

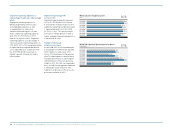

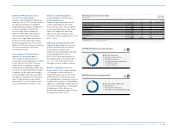

Gross margin of Other Businesses

improves 4.2 percentage points

Gross margin of Other Businesses

increased 4.2 percentage points to 43.5%

in 2010 from 39.3% in 2009. This was

mainly due to a strong gross margin

improvement at TaylorMade-adidas Golf

as a result of improving product margins.

In addition, the Rockport gross margin

increased significantly versus the prior

year due to a lower portion of clearance

sales. In absolute terms, gross profit

increased 21% to € 618 million in 2010

versus € 509 million in 2009 see 16.

Segmental operating expenses

as a percentage of sales increase

0.1 percentage points

Segmental operating expenses rose

11% to € 249 million in 2010 from

€ 225 million in 2009. This was driven

in particular by Rockport’s own-retail

expansion. Segmental operating

expenses as a percentage of sales

increased 0.1 percentage points to 17.6%

(2009: 17.4%).

Segmental operating profit up 30%

Segmental operating profit increased

30% to € 369 million in 2010 versus

€ 283 million in the prior year.

Segmental operating margin improved

4.1 percentage points to 26.0%

(2009: 21.9%), driven by increases at

TaylorMade-adidas Golf and Rockport

see 16. The improvements were

mainly due to gross margin increases.

Number of employees decreases

At year-end 2010, the Group employed

1,676 people in Other Businesses,

representing a decrease of 4% versus

1,750 employees in the previous year.

This development is primarily a result of

reorganisation initiatives at TaylorMade-

adidas Golf and Reebok-CCM Hockey. On

a full-time equivalent basis, the number

of employees in Other Businesses

decreased 5% and amounted to 1,599 at

the end of 2010 (2009: 1,676).