Reebok 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review Risk and Opportunity Report 167

Other activities to mitigate credit risks

include retention of title clauses as well

as, on a selective basis, credit insur-

ances, accounts receivable sales without

recourse and bank guarantees.

Objective evidence that financial

assets are impaired includes, for

instance, significant difficulty of the

issuer or debtor, indications of the

potential bankruptcy of the borrower and

the disappearance of an active market

for a financial asset because of financial

difficulties. The Group utilises allowance

accounts for impairments that represent

our estimate of incurred credit losses

with respect to accounts receivable.

Allowance accounts are used as long

as the Group is satisfied that recovery

of the amount due is possible. Once this

is no longer the case, the amounts are

considered irrecoverable and are directly

written off against the financial asset.

The allowance consists of two

components:

(1) an allowance established for all

receivables dependent on the ageing

structure of receivables past due date

and

(2) a specific allowance that relates

to individually assessed risk for each

specific customer – irrespective of

ageing.

At the end of 2010, no Group

customer accounted for more than 10%

of accounts receivable. We therefore

believe that the potential financial impact

of our credit risks from customers,

particularly smaller retailers, is

moderate and we rate the likelihood of

occurrence as possible see Economic and

Sector Development, p. 130.

The adidas Group Treasury depart-

ment arranges currency and interest

rate hedges, and invests cash, with

major banks of a high credit standing

throughout the world. adidas Group

companies are authorised to work with

banks rated BBB+ or higher.

Only in exceptional cases are

subsidiaries authorised to work with

banks rated lower than BBB+. To limit

risk in these cases, restrictions are

clearly stipulated, such as maximum

cash deposit levels. In addition, the credit

default swap premiums of our partner

banks are monitored on a weekly basis.

In the event that the defined threshold is

exceeded, credit balances are shifted to

banks compliant with the limit. During

2010, the credit default swap premiums

for many banks further declined

from their highs in the aftermath of

the financial turmoil in 2008. This

development indicates a slight decrease

of the associated risks.

Although financial market conditions

improved in 2010, we continue to

believe that the potential financial

impact of credit risks from these assets

is moderate and the likelihood of

occurrence is possible. Nevertheless,

we believe our risk concentration is

limited due to the broad distribution

of our investment business with more

than 24 banks. At December 31, 2010,

no bank accounted for more than 8% of

our investment business and the average

concentration, including subsidiaries’

short-term deposits in local banks, was

1%. This leads to a maximum exposure

of € 105 million in the event of default of

any single bank.

Furthermore, we held derivatives with a

positive fair market value in the amount

of € 86 million. The maximum exposure

to any single bank resulting from these

assets amounted to € 8 million and the

average concentration was 1%.

Financing and liquidity risks

Liquidity risks arise from not having

the necessary resources available to

meet maturing liabilities with regard to

timing, volume and currency structure.

In addition, the adidas Group faces the

risk of having to accept unfavourable

financing terms due to liquidity

restraints. Our Group’s Treasury

department uses an efficient cash

management system to manage liquidity

risk. At December 31, 2010, Group

cash and cash equivalents amounted

to € 1.16 billion (2009: € 775 million).

Moreover, our Group maintains

€ 2.17 billion bilateral short-term credit

lines and a € 1.86 billion committed

medium-term syndicated loan facility

with international banks, which does not

include a market disruption clause. The

€ 4.03 billion in credit lines are designed

to ensure sufficient liquidity at all times

see Treasury, p. 146.

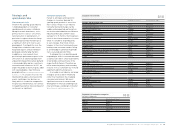

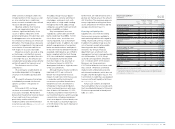

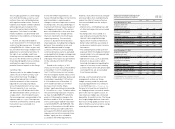

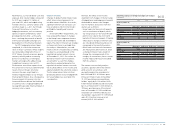

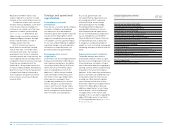

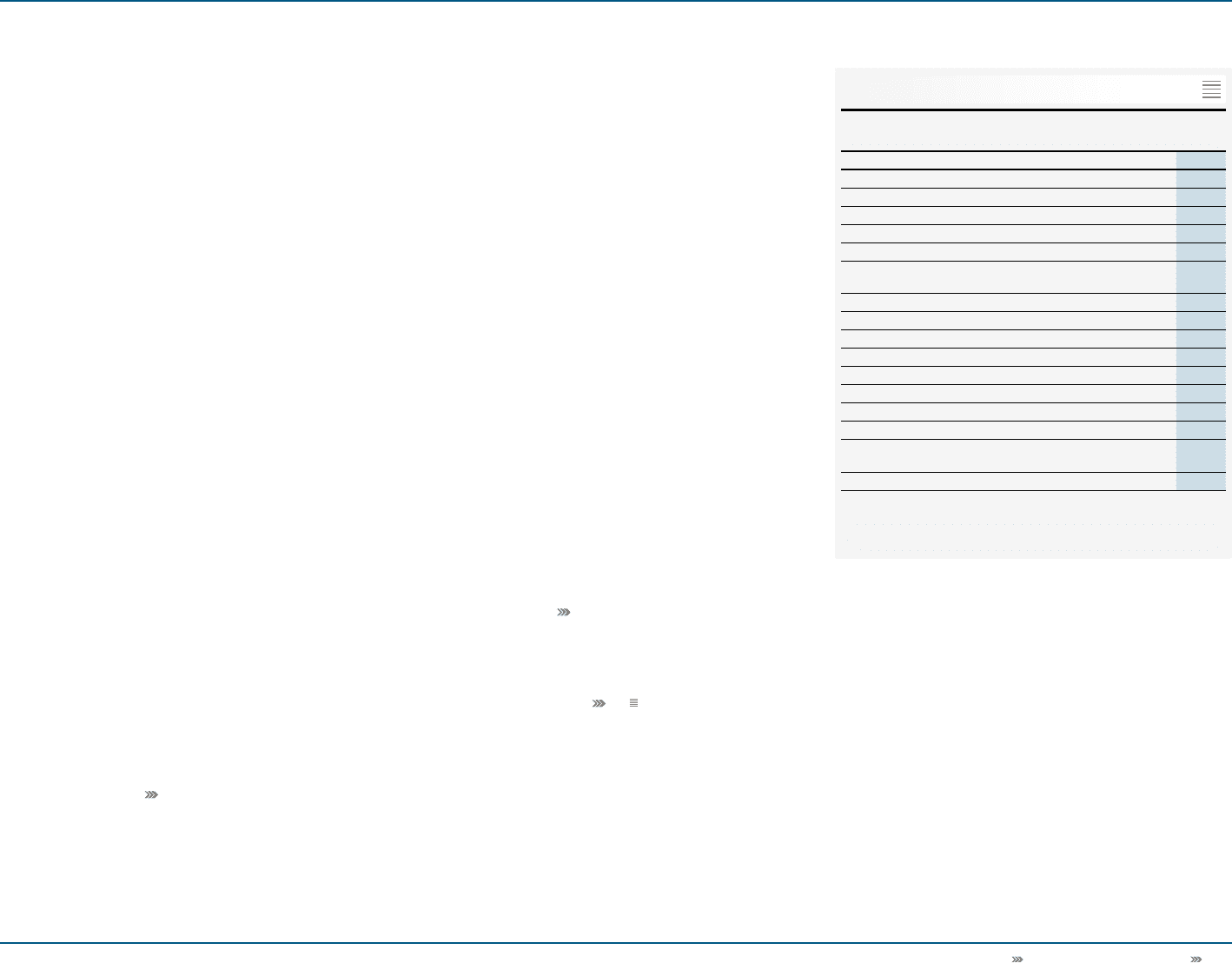

Future cash outflows arising from

financial liabilities that are recognised

in

the Consolidated Statement of Financial

Position are presented in the adjacent

table

see 04.

Future cash outflows 1 )

€ in millions

Up to 1

year

Between

1 and 3

years

Between

3 and 5

years

After

5 years Total

As at December 31, 2010

Bank borrowings 2 ) 95 — — — 95

Private placements 3 ) 320 482 237 118 1,157

Eurobond 3 ) 24 48 514 — 586

Accounts payable 1,694 — — — 1,694

Other financial liabilities 27 2 1 — 30

Derivative financial

liabilities 96 12 0 0 108

Total 2,256 544 752 118 3,670

As at December 31, 2009

Bank borrowings 2 ) 103 — — — 103

Private placements 3 ) 245 537 370 201 1,353

Eurobond 3 ) 24 48 538 — 610

Accounts payable 1,166 — — — 1,166

Other financial liabilities 21 0 1 1 23

Derivative financial

liabilities 81 23 1 1 106

Total 1,640 609 909 203 3,361

1) Rounding differences may arise in totals.

2) Classified as long-term (between 1 and 3 years) in the consolidated financial

statements, as they are covered by the committed mid-term syndicated loan.

3) Including interest payments.

04