Rogers 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

$513.5 million, with 36.6% growth at Wireless, 1.7% growth at Cable, a 29.2% decline at Media and the inclusion of

$22.9 million at Telecom. The fourth quarter results in 2005 also reflected integration expenses of $25.3 million at

Wireless, $2.3 million at Telecom and $5.3 million at Corporate.

Consolidated operating income for the three months ended December 31, 2005, totalled $112.9 million, an

increase of 2.2% compared to the corresponding period of 2004 due to the growth in Wireless and the inclusion of

Telecom, offset by total integration expenses of $32.9 million and the additional amortization of intangible assets which

arose on the acquisition of Call-Net in the third quarter of 2005 and the acquisitions of Fido and the minority interests

in Wireless in the fourth quarter of 2004. Amortization of intangibles totalled approximately $99.0 million in the three

months ended December 31, 2005 compared to approximately $49.4 million in the corresponding period in 2004.

We recorded a net loss of $66.7 million for the three months ended December 31, 2005, or basic loss per share

of $0.22 (diluted – $0.22), compared to a net loss of $29.1 million or basic loss per share of $0.12 (diluted – $0.12) in the

corresponding period of 2004. While we experienced growth in operating profit, a deferred income tax recovery, and

lower interest expense during the three months ended December 31, 2005 relative to the corresponding period in 2004,

the increased net loss was due to integration expenses, the amortization of intangibles assumed on acquisition and the

fact that the prior year’s quarter reflects foreign exchange gains and other income totalling $47.0 million.

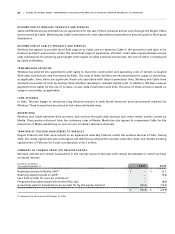

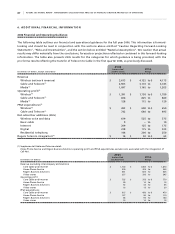

S U P P L E M E N T A R Y I N F O R M A T I O N

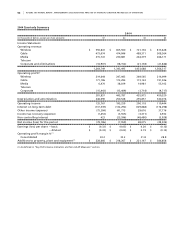

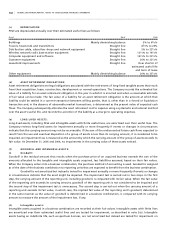

2005 Quarterly Summary

2005

(In thousands of dollars, except per share amounts) Q1 Q2 Q3 Q4

Income Statement

Operating revenue

Wireless $ 875,371 $ 963,888 $ 1,068,888 $ 1,098,511

Cable 505,256 500,079 513,072 549,326

Media 219,280 293,402 284,520 299,974

Telecom – – 212,604 211,286

Corporate and eliminations (17,492) (24,858) (32,017) (38,936)

1,582,415 1,732,511 2,047,067 2,120,161

Operating profit(1)

Wireless 298,376 364,760 381,488 292,425

Cable 180,669 171,562 172,046 194,326

Media 11,320 44,195 33,293 39,038

Telecom – – 23,055 22,885

Corporate (15,141) (15,063) (20,510) (35,155)

475,224 565,454 589,372 513,519

Depreciation and amortization 341,633 358,746 376,984 400,648

Operating income 133,591 206,708 212,388 112,871

Interest on long-term debt (184,767) (180,325) (178,792) (166,195)

Other income (expense) 8,663 (3,441) 17,894 (21,098)

Income tax recovery (expense) (3,514) (3,748) (2,603) 7,710

Non-controlling interest – – – –

Net income (loss) for the period (46,027) 19,194 48,887 (66,712)

Earnings (loss) per share – basic $ (0.17) $ 0.07 $ 0.17 $ (0.22)

– diluted $ (0.17) $ 0.07 $ 0.16 $ (0.22)

Operating profit margin %(1)

Consolidated 30.0 32.6 28.8 24.2

Additions to property, plant and equipment(1) $ 260,419 $ 344,738 $ 318,656 $ 429,983

(1) As defined in “Key Performance Indicators and Non-GAAP Measures” section.