Rogers 2005 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

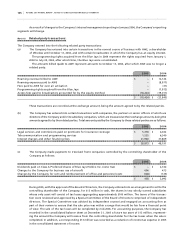

that the realization of future income tax assets does not meet the more likely than not realization criterion, a valuation

allowance is recorded against the future tax assets.

In making an assessment of whether future income tax assets are more likely than not to be realized,

management regularly prepares information regarding the expected use of such assets by reference to its internal income

forecasts. Based on management’s estimates of the expected realization of future income tax assets, during 2005 the

Company reduced the valuation allowance to reflect that it is more likely than not that certain future income tax assets

will be realized. Approximately $451.8 million of the future income tax assets recognized in 2005 relate to future income

tax assets arising on the acquisitions of Fido and Sportsnet (note 6(a)). Accordingly, the benefit related to these assets has

been reflected as a reduction of goodwill. Any reduction in the valuation allowance related to the remaining unbenefited

Fido future income tax assets, aggregating $61.4 million at December 31, 2005, will be recorded as a reduction

to purchased goodwill.

As a result of the acquisition of Call-Net, the Company acquired tax assets of approximately $389.9 million

against which a valuation allowance has been recorded. Any reduction in the valuation allowance related to the Call-Net

future income tax assets will first reduce acquired goodwill, then acquired intangible assets and income tax expense.

The valuation allowance at December 31, 2005 includes $516.7 million of income tax assets primarily relating to

non-capital loss carryforwards and $101.1 million of income tax assets relating to losses on capital account.

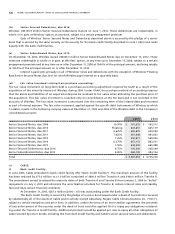

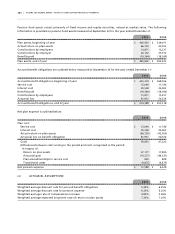

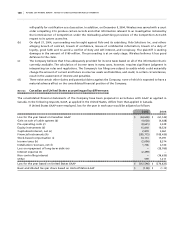

Total income tax expense (reduction) varies from the amounts that would be computed by applying the statu-

tory income tax rate to income before income taxes for the following reasons:

2005 2004

Statutory income tax rate 36.1% 35.3%

Income tax expense (reduction) on income before income taxes

and non-controlling interest $ (15,344) $ 5,607

Increase (decrease) in income taxes resulting from:

Change in the valuation allowance for future income tax assets 10,880 (13,440)

Adjustments to future income tax assets and liabilities for changes

in substantively enacted rates (23,293) (920)

Non-taxable portion of capital gains (1,750) (2,391)

Non-deductible foreign exchange on debt and other items 2,167 2,491

Non-deductible portion of accreted interest on Convertible Preferred Securities – 7,387

Recovery of prior years’ income taxes – (6,660)

Non-deductible (non-taxable) amounts from investments accounted for

by the equity method (1,140) 3,715

Stock-based compensation 13,862 5,432

Other items 6,907 (7,995)

Large corporations tax 9,866 10,221

Income tax expense $ 2,155 $ 3,447

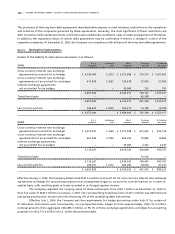

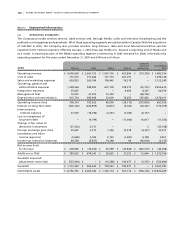

As at December 31, 2005, the Company has the following non-capital income tax losses available to reduce future years’

income for income tax purposes:

Income tax losses expiring in the year ending December 31:

2006 $ 479,833

2007 659,371

2008 1,116,873

2009

305,033

2010 197,163

2011

–

2012 –

2013 2,794

2014 706,473

2015

364,616

2016 28,791

$ 3,860,947