Rogers 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

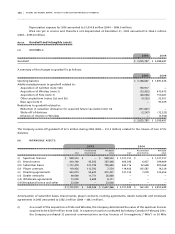

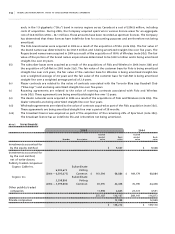

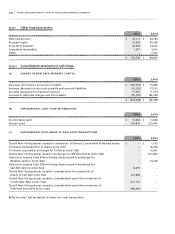

117 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

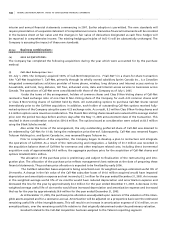

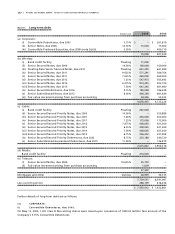

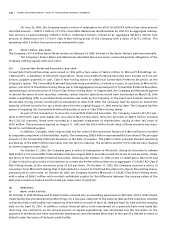

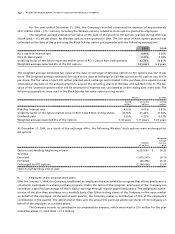

Note 11. Long-term debt:

Interest rate 2005 2004

(a) Corporate:

(i) Convertible Debentures, due 2005 5.75% $ – $ 261,810

(ii) Senior Notes, due 2006 10.50% 75,000 75,000

(iii) Convertible Preferred Securities, due 2009 (note 2(s)(i)) 5.50% – 490,710

75,000 827,520

(b) Wireless:

(i) Bank credit facility Floating 71,000 –

(ii) Senior Secured Notes, due 2006 10.50% 160,000 160,000

(iii) Floating Rate Senior Secured Notes, due 2010 Floating 641,245 661,980

(iv) Senior Secured Notes, due 2011 9.625% 571,291 589,764

(v) Senior Secured Notes, due 2011 7.625% 460,000 460,000

(vi) Senior Secured Notes, due 2012 7.25% 547,973 565,692

(vii) Senior Secured Notes, due 2014 6.375% 874,425 902,700

(viii) Senior Secured Notes, due 2015 7.50% 641,245 661,980

(ix) Senior Secured Debentures, due 2016 9.75% 180,598 186,438

(x) Senior Subordinated Notes, due 2012 8.00% 466,360 481,440

(xi) Fair value increment arising from purchase accounting 44,326 55,232

4,658,463 4,725,226

(c) Cable:

(i) Bank credit facility Floating 267,000 –

(ii) Senior Secured Second Priority Notes, due 2005 10.00% – 350,889

(iii) Senior Secured Second Priority Notes, due 2007 7.60% 450,000 450,000

(iv) Senior Secured Second Priority Notes, due 2011 7.25% 175,000 175,000

(v) Senior Secured Second Priority Notes, due 2012 7.875% 408,065 421,260

(vi) Senior Secured Second Priority Notes, due 2013 6.25% 408,065 421,260

(vii) Senior Secured Second Priority Notes, due 2014 5.50% 408,065 421,260

(viii) Senior Secured Second Priority Notes, due 2015 6.75% 326,452 337,008

(ix) Senior Secured Second Priority Debentures, due 2032 8.75% 233,180 240,720

(x) Senior Subordinated Guaranteed Debentures, due 2015 11.00% – 136,819

2,675,827 2,954,216

(d) Media:

Bank credit facility Floating 274,000 –

(e) Telecom:

(i) Senior Secured Notes, due 2008 10.625% 25,703 –

(ii) Fair value increment arising from purchase accounting 1,619 –

27,322 –

Mortgages and other Various 28,939 34,135

7,739,551 8,541,097

Less current portion 286,139 618,236

$ 7,453,412 $ 7,922,861

Further details of long-term debt are as follows:

(a ) C OR P O RA T E:

(i ) Co n ve r ti b le D eb e nt u res , d u e 2 005 :

On May 13, 2005, 1,031 Class B Non-Voting shares were issued upon conversion of US$0.03 million face amount of the

Company’s 5.75% Convertible Debentures.