Rogers 2005 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(i x ) S e ni o r S e cu r ed Deb e nt u re s , d u e 2 01 6 :

Wireless’ US$154.9 million Senior Secured Debentures mature on June 1, 2016. These debentures are redeemable, in

whole or in part, at Wireless’ option, at any time, subject to a certain prepayment premium.

Each of Wireless’ Senior Secured Notes and Debentures described above is secured by the pledge of a senior

bond that is secured by the same security as the security for the bank credit facility described in note 11(b)(i) and ranks

equally with the bank credit facility.

(x ) S en i o r S ub o rd i n at e d N ot e s , d ue 20 1 2 :

On November 30, 2004, Wireless issued US$400.0 million Senior Subordinated Notes due on December 15, 2012. These

notes are redeemable in whole or in part, at Wireless’ option, at any time up to December 15, 2008, subject to a certain

prepayment premium and at any time on or after December 15, 2008 at 104.0% of the principal amount, declining ratably

to 100.0% of the principal amount on or after December 15, 2010.

Interest is paid semi-annually on all of Wireless’ notes and debentures with the exception of Wireless’ Floating

Rate Senior Secured Notes due 2010 for which Wireless pays interest on a quarterly basis.

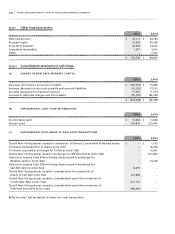

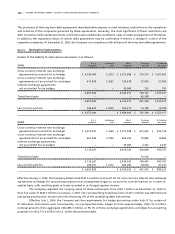

(x i ) F a ir val u e i nc r eme n t a ri s ing fr o m p urc h as e a c c ou n ti n g:

The fair value increment on long-term debt is a purchase accounting adjustment required by GAAP as a result of the

acquisition of the minority interest of Wireless during 2004. Under GAAP, the purchase method of accounting requires

that the assets and liabilities of an acquired enterprise be revalued to fair value when allocating the purchase price of

the acquisition. This fair value increment is recorded only on consolidation at the RCI level and is not recorded in the

accounts of Wireless. The fair value increment is amortized over the remaining term of the related debt and recorded

as part of interest expense. The fair value increment, applied against the specific debt instruments of Wireless to which

it relates, results in the following carrying values at December 31, 2005 and 2004 of the Wireless debt in the Company’s

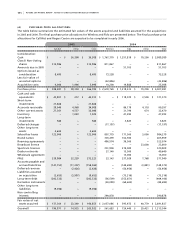

consolidated accounts:

2005 2004

Senior Secured Notes, due 2006 10.50% $ 161,632 $ 165,572

Senior Secured Notes, due 2010 Floating 643,857 665,119

Senior Secured Notes, due 2011 9.625% 605,875 630,090

Senior Secured Notes, due 2011 7.625% 461,648 461,925

Senior Secured Notes, due 2012 7.25% 550,871 569,006

Senior Secured Notes, due 2014 6.375% 857,172 883,551

Senior Secured Notes, due 2015 7.50% 644,409 665,488

Senior Secured Debentures, due 2016 9.75% 193,290 200,349

Senior Subordinated Notes, due 2012 8.00% 468,709 484,126

Total $ 4,587,463 $ 4,725,226

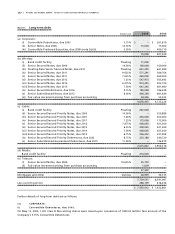

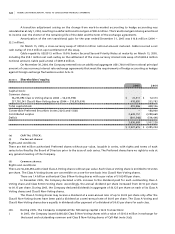

(c ) C A BLE :

(i ) Ba n k c re d it f ac i li t y:

In June 2005, Cable amended its bank credit facility (the “Bank Credit Facility”). The maximum amount of the facility

has been reduced by $75.0 million to $1.0 billion comprised of $600.0 million Tranche A and $400.0 million Tranche B.

The amendment served to extend the maturity dates of both Tranche A and Tranche B from January 2, 2009 to “bullet”

repayments on July 2, 2010 and eliminate the amortization schedule for Tranche B; reduce interest rates and standby

fees and relax certain financial covenants.

At December 31, 2005, $267.0 million (2004 – nil) was outstanding under the Bank Credit Facility.

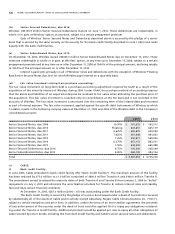

The Bank Credit Facility is secured by the pledge of a senior bond issued under a deed of trust which is secured

by substantially all of the assets of Cable and its wholly owned subsidiary, Rogers Cable Communications Inc. (“RCCI”),

subject to certain exceptions and prior liens. In addition, under the terms of an inter-creditor agreement, the proceeds

of any enforcement of the security under the deed of trust would be applied first to repay any obligations outstand-

ing under the Tranche A Credit Facility. Additional proceeds would be applied pro rata to repay all other obligations of

Cable secured by senior bonds, including the Tranche B Credit Facility and Cable’s senior secured notes and debentures.