Rogers 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

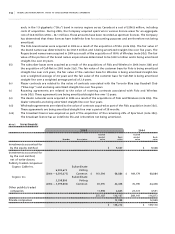

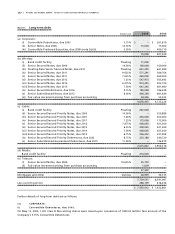

122 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

At December 31, 2005, Media had $274.0 million (2004 – nil) outstanding under its bank credit facility. Borrowings

under this facility are available to Media for general corporate purposes. Media’s bank credit facility is available on a

fully revolving basis until maturity on September 30, 2010 and there are no scheduled reductions prior to maturity.

The interest rates charged on this credit facility range from the bank prime rate or U.S. base rate plus nil

to 2.0% per annum and the bankers’ acceptance rate or LIBOR plus 1.0% to 3.0% per annum. The bank credit facil-

ity requires, among other things, that Media satisfy certain financial covenants, including the maintenance of certain

financial ratios.

The bank credit facility is secured by floating charge debentures over most of the assets of Media and three

of its subsidiaries, Rogers Broadcasting Limited (“RBL”), Rogers Publishing Limited (“RPL”) and Rogers Sportsnet Inc.

(“Sportsnet”), subject to certain exceptions. Each of RBL, RPL and Sportsnet has guaranteed Media’s present and future

liabilities and obligations under the credit facility.

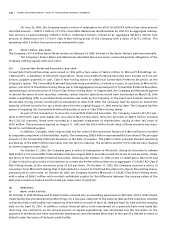

(e ) T EL E C OM :

During 2005, Telecom redeemed $237.9 million (US$200.9 million) aggregate principal amount of its 10.625% Senior

Secured Notes due 2008. Premiums and related expenses aggregated $17.5 million and a loss of $1.5 million, net of the

adjustment to the fair value of debt on acquisition of $16.0 million, was recorded. As a result, $25.7 million (approximately

US$22.0 million) aggregate principal amount of these Notes remain outstanding as at December 31, 2005 (note 24).

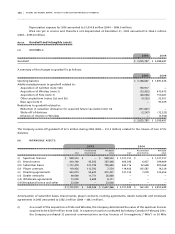

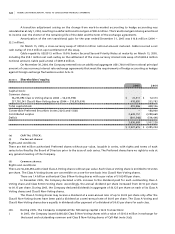

(f ) DE B T R E PA Y ME N TS :

(i) During 2005, the Company redeemed an aggregate US$606.1 million principal amount of Senior

Secured Second Priority Notes, Senior Secured Notes and Senior Subordinated Guaranteed Debentures by cash and

converted US$224.8 million face value amount of Convertible Debentures by issuing 7,716,448 Class B Non-Voting shares

and paying US$0.3 million in cash. The Company also converted the $600.0 million face value of its Convertible Preferred

Securities and issued 17,142,857 of Class B Non-Voting shares in return. The Company paid aggregate prepayment

premiums and other expenses of US$20.8 million, wrote off deferred financing costs of $3.0 million and wrote off

$16.0 million of the fair value increment related to Telecom’s Senior Secured Notes that arose on the acquisition of

Telecom. As a result, the Company recorded a loss on the repayment of debt of $11.2 million.

(ii) During 2004, the Company redeemed an aggregate US$708.4 million and C$300.0 million principal

amount of Senior Notes and Debentures and repaid $1,750.0 million related to the bridge credit facility established in

connection with the Company’s acquisition of Wireless. The Company paid aggregate prepayment premiums of

$49.2 million, and wrote off deferred financing costs of $19.2 million, offset by a $40.2 million gain on the release of the

deferred transition gain related to the cross-currency interest rate exchange agreements that were unwound during the

year, resulting in a loss on the repayment of debt of $28.2 million.

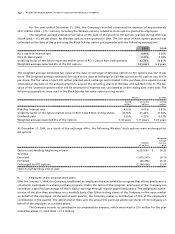

(g ) WE I GH T E D A VE R AGE IN T ER E ST R AT E :

The Company’s effective weighted average interest rate on all long-term debt, as at December 31, 2005, including the

effect of all of the derivative instruments, was 7.76% (2004 – 7.98%).

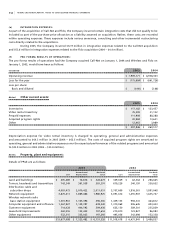

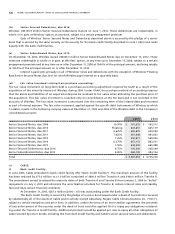

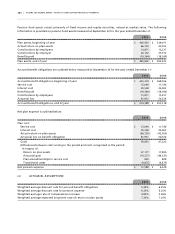

(h ) PR I NC I P AL RE P AYM E NT S :

As at December 31, 2005, principal repayments due within each of the next five years and in total thereafter on all long-

term debt are as follows:

2006 $ 286,139

2007 451,218

2008

865

2009 760

2010

1,253,904

Thereafter 5,700,720