Rogers 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

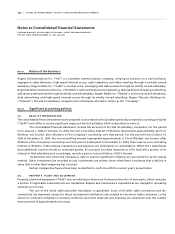

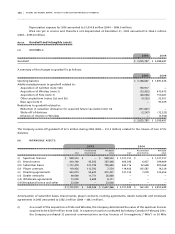

104 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(k ) A CQ U I RE D P R OG R A M R IG H TS :

Acquired program rights are carried at the lower of cost less accumulated amortization, and net realizable value.

Acquired program rights and the related liabilities are recorded when the licence period begins and the program is

available for use. The cost of acquired program rights is amortized over the expected performance period of the related

programs. Net realizable value of acquired program rights is assessed using the industry standard daypart methodology.

(l ) IN C OM E T A XES :

Future income tax assets and liabilities are recognized for the future income tax consequences attributable to differences

between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Future

income tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply to

taxable income in the years in which those temporary differences are expected to be recovered or settled. A valuation

allowance is recorded against any future income tax asset if it is not more likely than not that the asset will be realized.

Income tax expense is the sum of the Company’s provision for current income taxes and the difference between opening

and ending balances of future income tax assets and liabilities.

(m ) DER I VA T IV E IN S TR U ME N TS:

The Company uses derivative financial instruments to manage risks from fluctuations in exchange rates and interest

rates. These instruments include cross-currency interest rate exchange agreements, interest rate exchange agreements,

foreign exchange forward contracts and, from time-to-time, foreign exchange option agreements. All such instruments

are only used for risk management purposes.

Effective January 1, 2004, the Company adopted Accounting Guideline 13, “Hedging Relationships” (“AcG-13”),

which established new criteria for hedge accounting for all hedging relationships in effect. Effective January 1, 2004, the

Company re-assessed all relationships to determine whether the criteria for hedge accounting were met, and applied the

new guidance on a prospective basis. The Company formally documents the relationship between derivative instruments

and the hedged items, as well as its risk management objective and strategy for undertaking various hedge transactions.

At the instrument’s inception, the Company also formally assesses whether the derivatives are highly effective at reducing

or modifying currency risk related to the future anticipated interest and principal cash outflows associated with the

hedged item. Effectiveness requires a high correlation of changes in fair values or cash flows between the hedged item

and the hedging item. On a quarterly basis, the Company confirms that the derivative instruments continue to be highly

effective at reducing or modifying interest rate or foreign exchange risk associated with the hedged items. Derivative

instruments that meet these criteria are carried at their intrinsic value.

For those instruments that do not meet the above criteria, variations in their fair value are marked-to-market

on a current basis, with the resulting gains or losses recorded in or charged against income.

See note 12 for a discussion of the impact of the adoption of this standard in 2004.

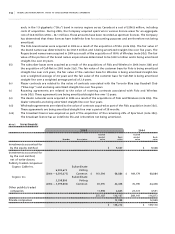

(n ) RE V EN U E R E CO G NIT I ON :

The Company offers certain products and services as part of multiple deliverable arrangements. The Company divides

multiple deliverable arrangements into separate units of accounting. Components of multiple deliverable arrangements

are separately accounted for provided the delivered elements have stand-alone value to the customers and the fair value

of any undelivered elements can be objectively and reliably determined. Consideration for these units is then measured

and allocated amongst the accounting units based upon their fair values and then the Company’s relevant revenue

recognition policies are applied to them. The Company recognizes revenue once persuasive evidence of an arrange-

ment exists, delivery has occurred or services have been rendered, fees are fixed and determinable and collectibility

is reasonably assured.

The Company’s principal sources of revenue and recognition of these revenues for financial statement

purposes are as follows:

(i) Monthly subscriber fees in connection with wireless and wireline services, cable, telephony, Internet services,

rental of equipment, network services, and media subscriptions are recorded as revenue on a pro rata basis

over the month as the service is provided;

(ii) Revenue from wireless airtime, roaming, long distance and optional services, pay-per-view and video-on-

demand services, video rentals, and other sales of products are recorded as revenue as the services or products

are delivered;