Rogers 2005 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

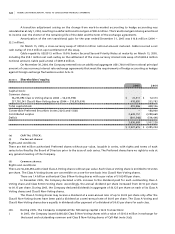

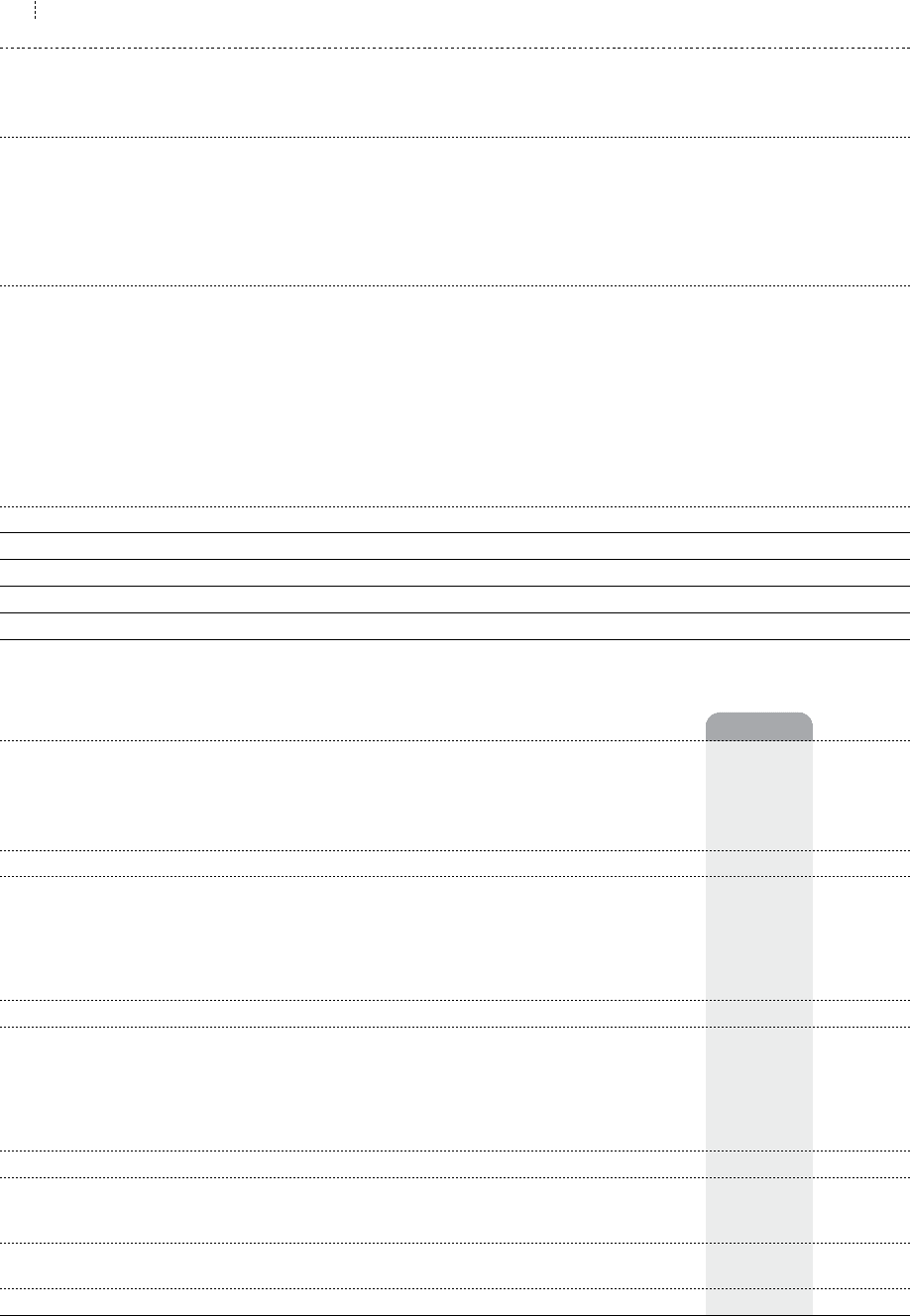

134 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

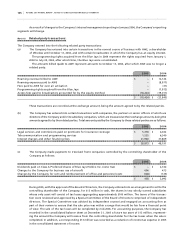

Corporate

items and Consolidated

2004 Wireless Cable Media eliminations Total

Operating revenue $ 2,783,525 $ 1,945,655 $ 956,962 $ (77,893) $ 5,608,249

Cost of sales 509,540 145,936 142,381 – 797,857

Sales and marketing expenses 444,379 248,754 190,489 – 883,622

Operating, general and administrative expenses 874,800 842,306 508,720 (37,612) 2,188,214

Integration expenses 4,415 – – – 4,415

Management fees 11,675 38,913 13,661 (64,249) –

Depreciation and amortization 497,674 486,038 67,342 41,497 1,092,551

Operating income (loss) 441,042 183,708 34,369 (17,529) 641,590

Interest on long-term debt (219,366) (247,365) (14,043) (95,224) (575,998)

Intercompany:

Interest expense (7,196) (552) (42,225) 49,973 –

Dividends – – 42,915 (42,915) –

Loss on repayment of long-term debt (2,313) (18,013) – (7,884) (28,210)

Change in fair value of derivative instruments (7,796) 34,570 – – 26,774

Foreign exchange gain (loss) (46,714) (41,089) (154) 20,402 (67,555)

Investment and other income (expense) 7,939 (872) (19,522) 31,740 19,285

Income tax reduction (expense) (6,487) (1,196) (2,606) 6,842 (3,447)

Non-controlling interest – – – (79,581) (79,581)

Net income (loss) for the year $ 159,109 $ (90,809) $ (1,266) $ (134,176) $ (67,142)

Additions to PP&E $ 439,157 $ 587,906 $ 20,322 $ 7,553 $ 1,054,938

Goodwill acquired/adjustments (note 6(a)) $ 1,360,746 $ – $ 148,530 $ (12,225) $ 1,497,051

Goodwill $ 1,739,465 $ 926,445 $ 720,229 $ 2,548 $ 3,388,687

Identifiable assets $ 5,054,803 $ 3,861,925 $ 1,224,559 $ 3,131,451 $ 13,272,738

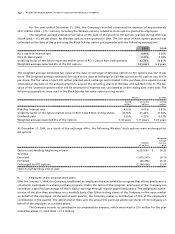

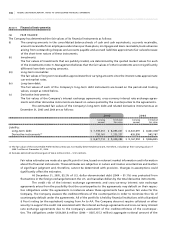

(b ) PR O DU C T R E VE N UE:

Revenue from external customers is comprised of the following:

2005 2004

Wireless:

Post-paid (voice and data) $ 3,383,444 $ 2,361,128

Prepaid 209,588 116,658

One-way messaging 19,628 24,480

Equipment sales 393,998 281,259

4,006,658 2,783,525

Cable:

Cable 1,298,956 1,253,053

Internet 440,664 378,912

Rogers Home Phone 4,938 –

Video store operations 326,926 316,954

Intercompany eliminations (3,751) (3,264)

2,067,733 1,945,655

Media:

Advertising 503,948 470,768

Circulation and subscription 137,247 126,852

Retail 251,792 230,865

Other 55,496 71,278

Blue Jays 148,693 57,199

1,097,176 956,962

Telecom:

Consumer 149,010 –

Business 274,880 –

423,890 –

Corporate items and intercompany eliminations (113,303) (77,893)

$ 7,482,154 $ 5,608,249