Rogers 2005 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

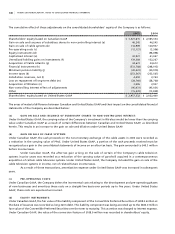

In June 2005, the FASB issued SFAS No. 154, Accounting Changes and Error Corrections, a replacement of APB

Opinion No. 20, Accounting Changes, and FASB Statement No. 3, Reporting Accounting Changes in Interim Financial

Statements (“SFAS 154”). The Statement applies to all voluntary changes in accounting principle, and changes the

requirements for accounting for and reporting of a change in accounting principle. SFAS 154 requires retrospective

application to prior periods’ financial statements of a voluntary change in accounting principle unless it is impracticable.

SFAS 154 requires that a change in method of depreciation, amortization, or depletion for long-lived, non-financial

assets be accounted for as a change in accounting estimate that is affected by a change in accounting principle. Opinion

20 previously required that such a change be reported as a change in accounting principle. SFAS 154 is effective for

accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005. The Company is

currently evaluating the impact of the new standard.

Note 24. Subsequent events:

On January 3, 2006, the Company redeemed all of Telecom’s remaining 10.625% Senior Secured Notes due 2008. The total

redemption amount was US$23.2 million including a redemption premium of US$1.2 million.

On January 4, 2006, the Company completed the acquisition of certain real estate assets in Brampton, Ontario,

Canada for $96.3 million in cash, net of adjustments, and including taxes and title insurance. The total purchase price for

the acquisition was $99.3 million including a $3.0 million deposit made in 2005.

On January 6, 2006 the Company paid a semi-annual dividend of $23.5 million to the shareholders of record on

December 28, 2005.

Upon maturity on February 14, 2006, the Company redeemed its $75.0 million Senior Notes.