Rogers 2005 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

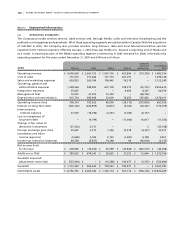

135 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

As a result of changes to the Company’s internal management reporting in January 2006, the Company’s reporting

segments will change.

Note 18. Related party transactions:

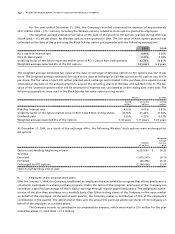

The Company entered into the following related party transactions:

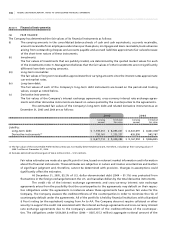

(a) The Company has entered into certain transactions in the normal course of business with AWE, a shareholder

of Wireless until October 13, 2004, and with certain broadcasters in which the Company has an equity interest.

The programming rights acquired from the Blue Jays in 2004 represent the rights acquired from January 1,

2004 to July 30, 2004, after which time, the Blue Jays were consolidated.

The amounts billed (paid) to AWE represent amounts to October 13, 2004, after which AWE was no longer a

related party.

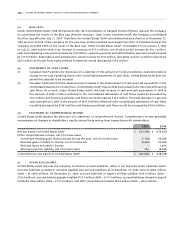

2005 2004

Roaming revenue billed to AWE $ – $ 12,146

Roaming expenses paid to AWE – (8,977)

Fees paid to AWE for over air activation – (31)

Programming rights acquired from the Blue Jays – (7,972)

Access fees paid to broadcasters accounted for by the equity method (18,424) (19,011)

$ (18,424) $ (23,845)

These transactions are recorded at the exchange amount, being the amount agreed to by the related parties.

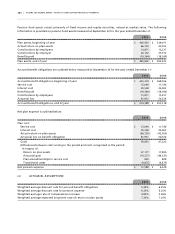

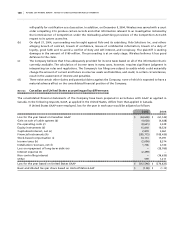

(b) The Company has entered into certain transactions with companies, the partners or senior officers of which are

directors of the Company and/or its subsidiary companies, which are measured at their exchange amounts, being the

amounts agreed to by the related parties. Total amounts paid by the Company to these related parties are as follows:

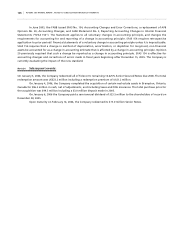

2005 2004

Legal services and commissions paid on premiums for insurance coverage $ 5,358 $ 4,042

Telecommunication and programming services 1,555 6,340

Interest charges and other financing fees 21,960 37,809

$ 28,873 $ 48,191

(c) The Company made payments to (received from) companies controlled by the controlling shareholder of the

Company as follows:

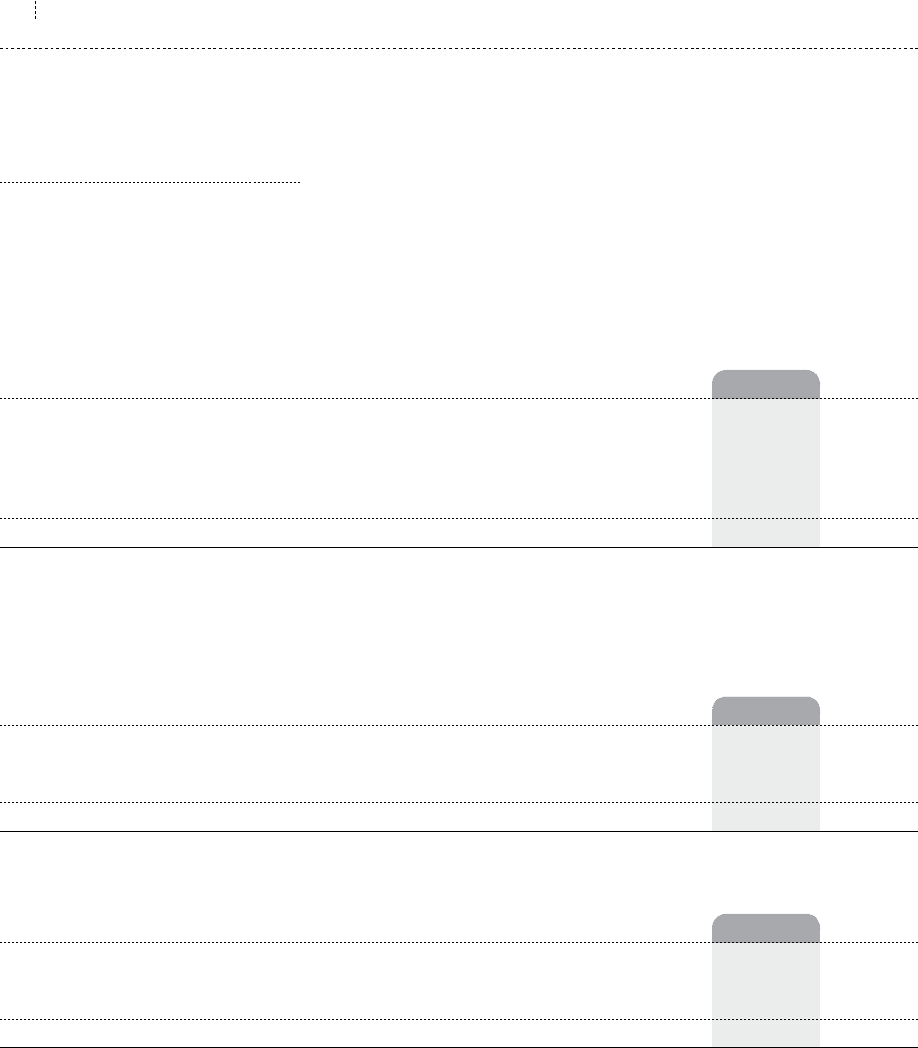

2005 2004

Dividends paid on Class A Preferred shares of Blue Jays Holdco Inc. (note 7(a)) $ – $ 2,744

Charges to the Company for business use of aircraft 606 473

Charges by the Company for rent and reimbursement of office and personnel costs (148) (125)

$ 458 $ 3,092

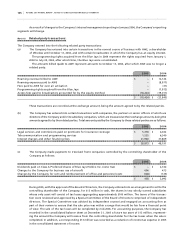

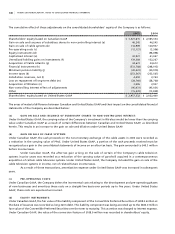

During 2005, with the approval of the Board of Directors, the Company entered into an arrangement to sell to the

controlling shareholder of the Company, for $13 million in cash, the shares in two wholly owned subsidiaries

whose only asset will consist of tax losses aggregating approximately $100 million. The terms of the transac-

tion were reviewed and approved by a Special Committee of the Board of Directors comprised of independent

directors. The Special Committee was advised by independent counsel and engaged an accounting firm as

part of their review to ensure that the sale price was within a range that would be fair from a financial point

of view. The sale of the tax losses will be completed by mid-2006. For accounting purposes, the Company has

recorded in the consolidated balance sheet at December 31, 2005 a future tax asset of $13 million, represent-

ing the amount the Company will receive from the controlling shareholder for the tax losses when the sale is

completed. In addition, a corresponding $13 million was recorded as a reduction of income tax expense in 2005

in the consolidated statement of income.