Rogers 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

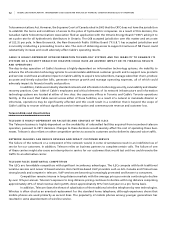

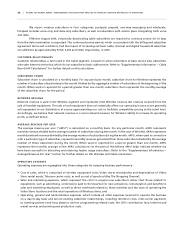

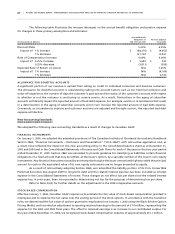

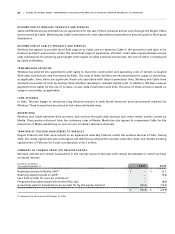

The following table illustrates the increase (decrease) on the accrual benefit obligation and pension expense

for changes in these primary assumptions and estimates:

Accrued Benefit

Obligation at Pension Expense

(In thousands of dollars) End of Fiscal 2005 Fiscal 2005

Discount Rate 5.25% 6.25%

Impact of: 1% increase $ (88,376) $ (9,853)

1% decrease 121,730 13,831

Rate of Compensation Increase 4.00% 4.00%

Impact of: 0.25% increase $ 5,682 $ 935

0.25% decrease (5,811) (950)

Expected Rate of Return on Assets N/A 7.25%

Impact of: 1% increase N/A (4,100)

1% decrease N/A 4,100

AL L O WA N CE FO R DO U BT F UL A CC O UN T S

A significant portion of our revenue is earned from selling on credit to individual consumers and business customers.

The allowance for doubtful accounts is calculated by taking into account factors such as our historical collection and

write-off experience, the number of days the customer is past due and the status of the customer’s account with respect

to whether or not the customer is continuing to receive service. As a result, fluctuations in the aging of subscriber

accounts will directly impact the reported amount of bad debt expense. For example, events or circumstances that result

in a deterioration in the aging of subscriber accounts will in turn increase the reported amount of bad debt expense.

Conversely, as circumstances improve and customer accounts are adjusted and brought current, the reported bad debt

expense will decline.

New Accounting Standards

We adopted the following new accounting standards as a result of changes to Canadian GAAP:

FI N A NC I AL IN S T RU M EN T S

On January 1, 2005, we adopted the amended provisions of The Canadian Institute of Chartered Accountants Handbook

Section 3860, “Financial Instruments – Disclosure and Presentation” (“CICA 3860”) with retroactive application and, as

a result, have reflected the impact of this new accounting policy in the consolidated balance sheet as at December 31,

2005 and 2004 and in the Consolidated Statements of Income and Cash Flows for each of the years in the two-year period

ended December 31, 2005. Section 3860 was amended to provide guidance for classifying as liabilities certain financial

obligations of a fixed amount that may be settled, at the issuer’s option, by a variable number of the issuer’s own equity

instruments. Any financial instruments issued by an enterprise that give the issuer unrestricted rights to settle the principal

amount for cash or the equivalent value of its own equity instruments are no longer presented as equity.

As a result of retroactively adopting Section 3860, we reclassified the liability portion of its 5½% Convertible

Preferred Securities due August 2009 to long-term debt and the related interest expense has been included as interest

expense in the Consolidated Statements of Income. These changes do not affect loss per share since the related interest

expense has, in prior years, been incorporated in determining net loss for the purposes of determining loss per share.

Refer to Note 2(s)(i) for further details on the adjustments to the 2004 comparative amounts.

ST O C K- B AS E D C O MP E NS A TI O N

Effective January 1, 2004, Canadian GAAP requires us to estimate the fair value of stock-based compensation granted to

employees and to expense the fair value over the vesting period of the stock options. In accordance with the transition

rules, we determined the fair value of options granted to employees since January 1, 2002 using the Black-Scholes Option

Pricing Model, and recorded an adjustment to opening retained earnings in the amount of $7.0 million, representing the

expense for the 2002 and 2003 fiscal years. The offset to retained earnings is an increase in our contributed surplus. For

the year ended December 31, 2004, we recognized stock-based compensation expense of approximately $15.1 million.