Rogers 2005 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

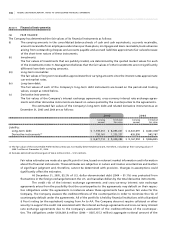

137 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

cross-currency interest rate exchange agreements are secured by substantially all of the assets of the respective

subsidiary companies to which they relate and generally rank equally with the other secured indebtedness of

such subsidiary companies.

(vi) Other long-term liabilities:

The carrying amounts of other long-term liabilities approximate fair values as the interest rates approximate

current rates.

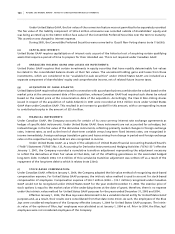

(b ) OT H ER D IS C LO S URE S :

The Company does not have any significant concentrations of credit risk related to any financial asset.

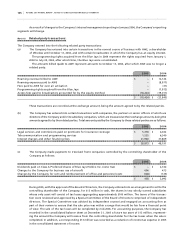

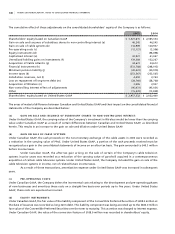

Note 20. Commitments:

(a) On September 16, 2005, the Company announced a joint venture with Bell Canada to build and manage a

nationwide fixed wireless broadband network. The companies will jointly and equally fund the initial network

deployment costs estimated at $200 million over a three-year period. The Company will also contribute its

broadband wireless spectrum in the 2.3 GHz, 2.5 GHz and 3.5 GHz frequency ranges, subject to approvals from

Industry Canada.

(b) RCI enters into agreements with suppliers to provide services and products that include minimum spend

commitments. The Company has agreements with certain telephone companies that guarantee the long-term

supply of network facilities and agreements relating to the operations and maintenance of the network.

(c) In the ordinary course of business and in addition to the amounts recorded on the consolidated balance sheets

and disclosed elsewhere in the notes, the Company has entered into agreements to acquire broadcasting rights

to programs and films over the next three years at a total cost of approximately $57.7 million. In addition, the

Company has commitments to pay access fees over the next year totalling approximately $18.4 million.

(d) On February 7, 2005, the Company was awarded a share of the broadcast rights to the 2010 Olympic Winter

Games and the 2012 Olympic Summer Games at a cost of US$30.6 million.

(e) The Company has a 33.33% interest in each of Tech TV Canada and Biography Channel Canada, which are equity-

accounted investments. The Company has committed to fund its share of the losses and PP&E expenditures

in these new channels to a maximum of $8.8 million, through equity financing and shareholder loans. As at

December 31, 2005, the Company has funded a total of $5.9 million.

(f) Pursuant to CRTC regulation, the Company is required to make contributions to the Canadian Television Fund

(“CTF”), which is a cable industry fund designed to foster the production of Canadian television programming.

Contributions to the CTF are based on a formula, including gross broadcast revenues and the number of

subscribers. The Company may elect to spend a portion of the above amount for local television programming

and may also elect to contribute a portion to another CRTC-approved independent production fund. The

Company estimates that its total contribution for 2006 will amount to approximately $34.1 million.

(g) In addition to the items listed above, the future minimum lease payments under operating leases for the rental

of premises, distribution facilities, equipment and microwave towers and commitments for player contracts

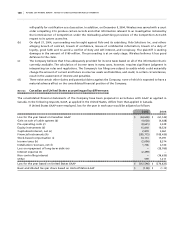

and other contracts at December 31, 2005 are as follows:

Year ending December 31:

2006 $ 214,123

2007 187,992

2008

143,284

2009 126,154

2010

90,012

2011 and thereafter 80,191

$ 841,756

Rent expense for 2005 amounted to $194.3 million (2004 – $134.2 million).