Rogers 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

U.S. GAAP Differences

We prepare our financial statements in accordance with Canadian GAAP. U.S. GAAP differs from Canadian GAAP in certain

respects. The areas of principal differences and their impact on our Audited Consolidated Financial Statements are

described in Note 23 to the Audited Consolidated Financial Statements. The significant differences in accounting relate to:

• Gain On Sale and Issuance of Subsidiary Shares to Non-Controlling Interest

• Gain on Sale of Cable Systems

• Pre-operating Costs

• Equity Instruments

• Capitalized Interest

• Unrealized Holding Gains and Losses on Investments

• Acquisition of Cable Atlantic

• Financial Instruments

• Stock-based Compensation

• Minimum Pension Liability

• Income Taxes

• Installation Revenues and Costs

• Loss on Repayment of Long-Term Debt

• Acquisition of Wireless

• Blue Jays

Recent United States accounting pronouncements are also discussed in Note 23 to the Audited Consolidated Financial

Statements.

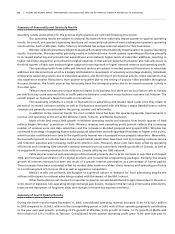

Intercompany and Related Party Transactions

RC I AR R AN G EM E N TS WI T H I T S S UB S ID I A RI E S

RCI has entered into a number of agreements with its subsidiaries, including Wireless, Cable, Telecom, and Media. These

agreements govern the management, commercial and cost-sharing arrangements that RCI have with its subsidiaries. RCI

monitors intercompany and related party agreements to ensure they remain beneficial to the Company. RCI continually

evaluates the expansion of existing arrangements and the entry into new agreements.

RCI’s agreements with its subsidiaries have historically focused on areas of operation in which joint or combined

services provide efficiencies of scale or other synergies. For example, RCI manages the call centre operations of Wireless,

Cable and effective September 1, 2005, Telecom, with the goal of improving productivity, increasing service levels and

reducing costs.

More recently, RCI’s arrangements are increasingly focused on sales and marketing activities. In addition, RCI

continues to look for other operations and activities that can be shared or jointly operated with other companies within

the Rogers group. Any new arrangements will be entered into only if the companies believe such arrangements are in

each company’s best interest. The definitive terms and conditions of the agreements relating to these arrangements are

subject to the approval of the Audit Committee of the Board of Directors of each company.

MA N A GE M EN T S E R VI C ES AG R E EM E NT

Each of Wireless, Cable and Media has entered into a management services agreement with RCI under which RCI agrees to

provide supplemental executive, administrative, financial, strategic planning, information technology and various other

services to each subsidiary. Those services relate to, among other things, assistance with tax advice, Canadian regulatory

matters, financial advice (including the preparation of business plans and financial projections and the evaluation of

PP&E expenditure proposals), treasury services, service on the subsidiary’s Boards of Directors and on committees of the

Boards of Directors, advice and assistance in relationships with employee groups, internal audits, investor relations,

purchasing and legal services. In return for these services, each of the subsidiaries has agreed to pay RCI certain fees,

which, in the case of Cable and Media, is an amount equal to 2% of their respective consolidated revenue for each fiscal