Rogers 2005 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

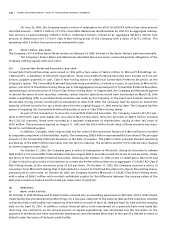

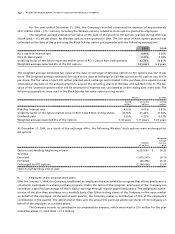

A transition adjustment arising on the change from mark-to-market accounting to hedge accounting was

calculated as at July 1, 2004, resulting in a deferred transitional gain of $80.0 million. This transitional gain is being amortized

to income over the shorter of the remaining life of the debt and the term of the exchange agreements.

Amortization of the net transitional gain for the year ended December 31, 2005 was $10.8 million (2004 –

$3.2 million).

On March 15, 2005, a cross-currency swap of US$50.0 million notional amount matured. Cable incurred a net

cash outlay of $10.5 million upon settlement of this swap.

Cable repaid its US$291.5 million 10.0% Senior Secured Second Priority Notes at maturity on March 15, 2005.

Including the $58.1 million net cash outlay on the settlement of the cross-currency interest rate swap of US$283.4 million

notional amount, Cable paid a total of $409.8 million.

On November 30, 2004, the Company entered into an additional aggregate US$1,700.0 million notional principal

amount of cross-currency interest rate exchange agreements that meet the requirements of hedge accounting as hedges

against foreign exchange fluctuations under AcG-13.

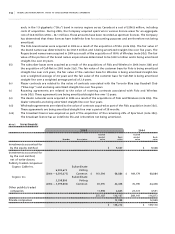

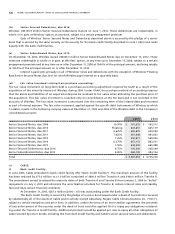

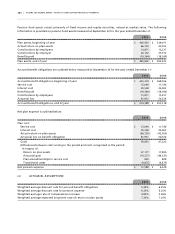

Note 13. Shareholders’ equity:

2005 2004

Capital stock:

Common shares:

56,233,894 Class A Voting shares (2004 – 56,235,394) $ 72,311 $ 72,313

257,702,341 Class B Non-Voting shares (2004 – 218,979,074) 418,695 355,793

Total capital stock 491,006 428,106

Convertible Preferred Securities (notes 2(s)(i) and 13(b)) – 188,000

Contributed surplus 3,638,157 2,288,669

Deficit

(601,548) (519,441)

3,036,609 1,957,228

$ 3,527,615 $ 2,385,334

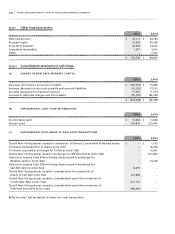

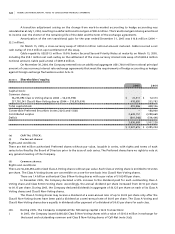

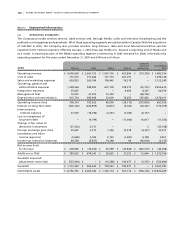

(a ) C AP I T AL ST O CK :

(i ) Pr e fe r re d sh a re s :

Rights and conditions:

There are 400 million authorized Preferred shares without par value, issuable in series, with rights and terms of each

series to be fixed by the Board of Directors prior to the issue of such series. The Preferred shares have no rights to vote at

any general meeting of the Company.

(i i ) Co m m on sh a re s :

Rights and conditions:

There are 56,240,494 authorized Class A Voting shares without par value. Each Class A Voting share is entitled to 50 votes

per share. The Class A Voting shares are convertible on a one-for-one basis into Class B Non-Voting shares.

There are 1.4 billion authorized Class B Non-Voting shares with a par value of $1.62478 per share.

In December 2005, the Company declared a 50% increase to the dividend paid for each outstanding Class A

Voting share and Class B Non-Voting share. Accordingly, the annual dividend per share increased from $0.10 per share

to $0.15 per share. During 2005, the Company declared dividends in aggregate of $0.125 per share on each of its Class A

Voting shares and Class B Non-Voting shares.

The Class A Voting shares may receive a dividend at a semi-annual rate of up to $0.05 per share only after the

Class B Non-Voting shares have been paid a dividend at a semi-annual rate of $0.05 per share. The Class A Voting and

Class B Non-Voting shares share equally in dividends after payment of a dividend of $0.05 per share for each class.

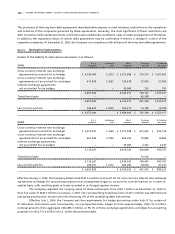

(i i i ) D u ri n g 2 00 5 , t h e C om p a ny co m pl e t ed th e f o l lo w in g c a p it a l s to c k t r an s act i on s :

I. In 2005, the Company issued 8,464,426 Class B Non-Voting shares with a value of $316.0 million in exchange for

the issued and outstanding common and Class B Non-Voting shares of Call-Net (note 3(a));