Rogers 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

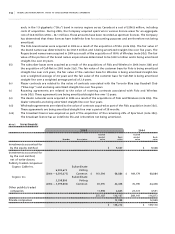

113 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

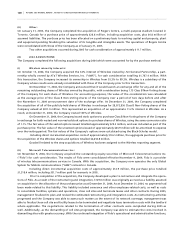

Depreciation expense for 2005 amounted to $1,074.8 million (2004 – $984.0 million).

PP&E not yet in service and therefore not depreciated at December 31, 2005 amounted to $364.5 million

(2004 – $305.8 million).

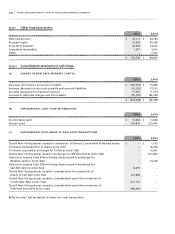

Note 6. Goodwill and intangible assets:

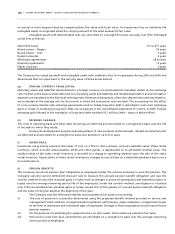

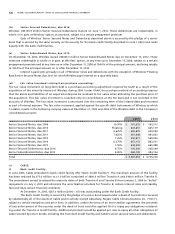

(a ) G OO D W IL L :

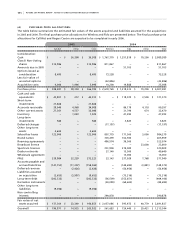

2005 2004

Goodwill $ 3,035,787 $ 3,388,687

A summary of the changes to goodwill is as follows:

2005 2004

Opening balance $ 3,388,687 $ 1,891,636

Additions/adjustments to goodwill related to:

Acquisition of Call-Net (note 3(d)) 190,977 –

Acquisition of Wireless (note 3) (53,932) 615,615

Acquisition of Fido (note 3) (26,046) 750,487

Other acquisitions (notes 3(a) and (b)) (9,525) 53,021

Blue Jays (note 7) – 95,509

Reductions to goodwill related to:

Reduction in valuation allowance for acquired future tax assets (note 14) (451,827) –

Write-off of divisions (2,547) (12,225)

Dilution of interest in Wireless – (5,356)

$ 3,035,787 $ 3,388,687

The Company wrote-off goodwill of $2.5 million during 2005 (2004 – $12.2 million) related to the closure of two of its

divisions.

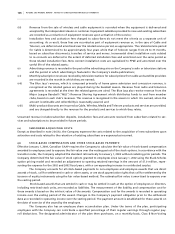

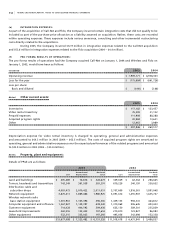

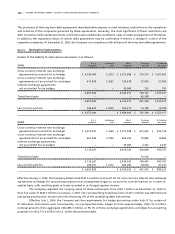

(b ) IN T AN G I BL E A S SET S :

2005 2004

Accumulated Net book Accumulated Net book

Cost amortization value Cost amortization value

(i) Spectrum licences $ 928,553 $ – $ 928,553 $ 1,017,157 $ – $ 1,017,157

(ii) Brand names 410,740 43,292 367,448 406,396 6,927 399,469

(iii)

Subscriber bases 1,112,479 321,799 790,680 942,716 42,648 900,068

(iv) Player contracts 119,926 112,392 7,534 119,926 105,587 14,339

(v) Roaming agreements 523,074 50,623 472,451 531,734 7,078 524,656

(vi) Dealer networks 40,640 11,751 28,889 – – –

(vii) Wholesale agreements 13,000 4,689 8,311 – – –

(viii) Broadcast licence and other 23,600 – 23,600 – – –

$ 3,172,012 $ 544,546 $ 2,627,466 $ 3,017,929 $ 162,240 $ 2,855,689

Amortization of subscriber bases, brand names, player contracts, roaming agreements, dealer networks and wholesale

agreements in 2005 amounted to $382.3 million (2004 – $64.3 million).

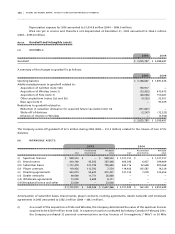

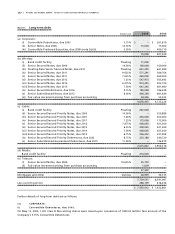

(i) As a result of the acquisitions of Fido and Wireless, the Company determined the value of the spectrum licences

acquired to be $520.9 million (note 3(d)). In a spectrum auction conducted by Industry Canada in February 2001,

the Company purchased 23 personal communications services licences of 10 megahertz (“MHz”) or 20 MHz