Rogers 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

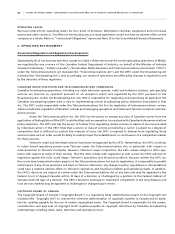

Cable faces emerging competition from utilities, such as hydroelectric companies, as these companies look

to utilize their infrastructure to provide Internet and other services, such as VoIP, that may directly compete with our

current and future service offerings. In addition, there are wireless technologies, such as WiFi and WiMax, that could

potentially be deployed on a regional basis to provide wireless broadband Internet access to customers.

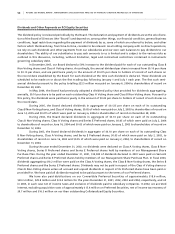

Rogers Video competes with other DVD, videocassette and video game sales and rental store chains, such as

Blockbuster Inc. and Wal-Mart Stores Inc., as well as individually owned and operated outlets and more recently online-

based subscription rental services. Competition is principally based on location, price and availability of titles.

TE L E CO M C O MP E T IT I ON

Telecom competes with the incumbent telephone companies in Canada, including Bell, TELUS, and MTS Allstream.

Telecom also competes with competitive suppliers of local, long distance, private line and data services using traditional

circuit-switched and newer VoIP technologies.

One of the biggest forces for potential change in the telecommunications industry is the threat of substitution

of the traditional wireline telephone by new technologies. Wireless is often cited as an eventual replacement for the

standard home telephone, although experience shows that mobile phones are used primarily as second lines. The popu-

larity of mobile phones among younger generations has resulted in some abandonment of wireline service, but these

preferences are not likely to challenge the prominence of the traditional wireline phone for many years, if at all. A more

recently cited threat to the standard wireline home telephone is telephone service over the Internet, commonly referred

to as VoIP.

In the business market, there is a continuing shift from ATM and frame relay (two common data networks) to IP

delivered through VPN services. This transition results in lower costs for both users and carriers. Telecom is well positioned

to benefit from this trend with one of the most advanced IP networking solutions available.

ME D I A C OM P ET I T IO N

Broadcasting’s radio stations compete with the other stations in their respective market areas as well as with other

media, such as newspapers, magazines, television, outdoor advertising, direct mail marketing and the Internet.

Competition within the radio broadcasting industry occurs primarily in individual market areas, amongst

individual market stations. On a national level, Media’s Broadcasting division competes generally with other larger radio

operators such as Corus Entertainment Inc., Standard Radio Inc. and CHUM Limited, each of which owns and operates

radio station clusters in markets across Canada. Additionally, over the past several years the CRTC has granted additional

licences in various markets for the development of new radio stations which in turn provide additional competition

to the established stations in the respective markets. Two new licenced satellite subscription-based radio services now

provide competition to Broadcasting’s radio stations.

OMNI.1, OMNI.2, OMNI.10 and OMNI TV (Manitoba) compete principally for viewers and advertisers with

television stations that broadcast in their local markets. These include Canadian television stations as well as U.S. border

stations, specialty channels and increasingly with other distant Canadian signals and U.S. border stations given the time-

shifting capacity available to digital subscribers.

Rogers Sportsnet competes for viewers and advertisers principally with The Sports Network (“TSN”), Headline

Sports and sports programs carried by other Canadian and U.S. television stations and networks.

On a product level, The Shopping Channel competes with various retail stores, catalog retailers, Internet retailers

and direct mail retailers. On a broadcasting level, The Shopping Channel competes with other television channels for

viewer attention and loyalty, and particularly with infomercials selling products on television.

The Canadian magazine industry is highly-competitive, competing for both readers and advertisers. This com-

petition comes from other Canadian magazines and from foreign, mostly U.S., titles that sell in significant quantities

in Canada. In the past, the competition from foreign titles has been restricted to competition for readers as there

have been restrictions on foreigners operating in the Canadian magazine advertising market. These restrictions were

significantly reduced as a result of the enactment in 1999 of the Foreign Publishers Advertising Services Act (Canada) and

amendments to the Canadian Tax Act. Increasing competition from U.S. magazines for advertising revenues is expected

in the coming years.