Rogers 2005 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

142 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Under United States GAAP, unvested options that were issued as consideration for the acquisition of

the remaining shares of RWCI on December 31, 2004 were revalued at this date with the resulting intrinsic value of

$38.3 million recorded as unearned compensation cost. Unearned compensation cost is recognized as compensation

expense over the remaining vesting period. During 2005, under United States GAAP, $20.7 million of compensation

expense was recorded related to these options.

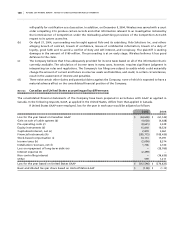

(j ) MI N IM U M P ENS I ON LI A BIL I TY :

Under United States GAAP, the Company is required to record an additional minimum pension liability for one of its plans

to reflect the excess of the accumulated benefit obligation over the fair value of the plan assets. Other comprehensive

income has been increased by $0.4 million (2004 – charged with $8.5 million), which is net of income taxes of $0.2 million

(2004 – $4.6 million). No such adjustments are required under Canadian GAAP.

(k ) I NC O M E T AX E S:

Included in the caption “Income taxes” is the tax effect of various adjustments where appropriate. Under Canadian

GAAP, future income tax assets and liabilities are remeasured for substantively enacted rate changes, whereas under

United States GAAP, future income tax assets and liabilities are only remeasured for enacted tax rates.

(l ) IN S TA L LA T ION RE V EN U ES A ND CO S TS:

For Canadian GAAP purposes, cable installation revenues for both new connects and re-connects are deferred and

amortized over the customer relationship period. For United States GAAP purposes, installation revenues are immediately

recognized in income to the extent of direct selling costs, with any excess deferred and amortized over the customer

relationship period.

(m ) LOS S O N R E PAY M EN T O F LO N G- T ER M DE B T:

On March 26, 2004, the Company repaid long-term debt resulting in a loss on early repayment of long-term debt of

$2.3 million. This loss included, among other items, a $40.2 million gain on the realization of the deferred transitional

gain related to cross currency interest rate exchange agreements which were unwound in connection with the repayment

of long-term debt. Under United States GAAP, the Company records cross currency interest rate exchange agreements at

fair value. Therefore, under United States GAAP, the deferred transition gain realized under Canadian GAAP would be

reduced by $28.8 million, representing the $40.2 million gain net of realization of a gain of $11.4 million, related to the

deferred transition adjustment that arose on the adoption of SFAS 133 (note 23(h)).

(n ) AC Q UI S I TI O N O F W I RE L ES S IN T ER E ST :

At December 31, 2004, the Company acquired the outstanding shares of Wireless not owned by the Company and

exchanged the outstanding stock options of Wireless for stock options in the Company (note 3(b)). United States

GAAP requires that the intrinsic value of the unvested options issued be determined as of the consummation date of

the transaction and be recorded as deferred compensation. Canadian GAAP requires that the fair value of unvested

options be recorded as deferred compensation. Under United States GAAP, this results in an increase in goodwill in the

consolidated accounts of the Company of $5.6 million, with a corresponding adjustment to contributed surplus.

Under Canadian GAAP, as part of the purchase price equation, the derivative instruments of Wireless were

recorded at their fair value at the date of acquisition (note 3(b)). The fair value increment is amortized to interest expense

over the remaining terms of the derivative instruments. Under United States GAAP, the derivative instruments are

recorded at fair value. Therefore, under United States GAAP, the fair value increment related to derivative instruments

is reduced by $20.1 million with an offsetting decrease to goodwill. As a consequence, the amortization of the fair value

increment is not required under United States GAAP.