Rogers 2005 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

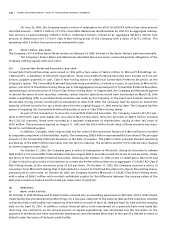

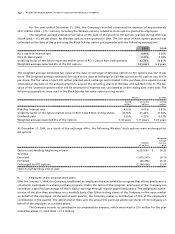

118 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

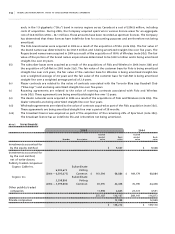

On June 30, 2005, the Company issued a notice of redemption for all of its US$224.8 million face value amount

(accreted amount – US$221.5 million) of 5.75% convertible debentures due November 26, 2005 for an aggregate redemp-

tion amount of approximately US$223.0 million. Debenture holders converted an aggregate US$224.5 million face

amount of debentures into 7,715,417 Class B Non-Voting shares of the Company with a value of $271.2 million. The

remaining US$0.3 million face amount was redeemed in cash.

(i i ) Se n i or No t es , du e 2 0 06:

The Company’s $75.0 million Senior Notes mature on February 14, 2006. Interest on the Senior Notes is paid semi-annually.

The Company’s Senior Notes and debentures described above are senior unsecured general obligations of the

Company ranking equally with each other.

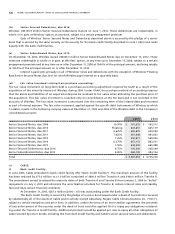

(i i i ) C o nv e rt i bl e Pr e fe r re d Se c ur i ti e s , d ue 20 0 9 :

Convertible Preferred Securities were issued in 1999 with a face value of $600.0 million to Microsoft R-Holdings, Inc.

(“Microsoft”), a subsidiary of Microsoft Corporation. These Convertible Preferred Securities bore interest at 51⁄2% per

annum, payable quarterly in cash, Class B Non-Voting shares or additional Convertible Preferred Securities, at the

Company’s option. The Convertible Preferred Securities were convertible, in whole or in part, at any time, at Microsoft’s

option, into 28.5714 Class B Non-Voting shares per $1,000 aggregate principal amount of Convertible Preferred Securities,

representing a conversion price of $35 per Class B Non-Voting share. In August 2004, the Company and Microsoft agreed

to amend the terms of such securities, whereby certain transfer restrictions would have terminated on March 28, 2006

unless a qualifying offer to purchase these securities was made by the Company. In the event such transfer restrictions

terminated, during a three-month period subsequent to March 28, 2006, the Company had the option to extend the

maturity of these securities for up to three years from the original August 11, 2009 maturity date. The Company had the

option of repaying the Convertible Preferred Securities in cash or Class B Non-Voting shares.

As part of the transaction to issue the Convertible Preferred Securities, the Company issued 5,333,333 war-

rants to Microsoft, each exercisable into one Class B Non-Voting share. Since the proceeds of $600.0 million included

the 5,333,333 warrants, these were recorded as a separate component of shareholders’ equity at their fair value of

$24.0 million. These warrants expired on August 11, 2002 and the $24.0 million book value of these warrants was trans-

ferred to contributed surplus.

In addition, Canadian GAAP requires that the fair value of the conversion feature of $188.0 million be recorded

as a separate component of shareholders’ equity. The remaining $388.0 million represented the fair value of the principal

amount of the Convertible Preferred Securities at the date of issuance. The $388.0 million principal element was being

accreted up to the $600.0 million face value over the term to maturity. The accretion and the 51⁄2% interest were charged

to interest expense (note 2(s)(i)).

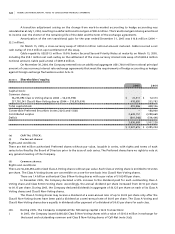

On October 11, 2005, the Company gave a notice of redemption to Microsoft, stating its intention to redeem

$600 million 51⁄2% Convertible Preferred Securities due August 2009 in accordance with the terms of such securities. Under

the terms of the Convertible Preferred Securities, following the October 11, 2005 notice of redemption, Microsoft had

27 days in which to give notice of its intention to convert the Preferred Securities into an aggregate 17,142,857 RCI Class B

Non-Voting shares, at the conversion price of $35 per share. On October 17, 2005, the Company received a notice of

conversion from Microsoft stating that it had elected to convert its Preferred Securities into Class B Non-Voting shares,

and pursuant to such notice, on October 24, 2005, the Company issued to Microsoft 17,142,857 Class B Non-Voting shares

with a value of $696.5 million and recorded contributed surplus for the difference between the carrying values of the

debt plus conversion feature and the total par value (note 13(a)(iii)(iv)).

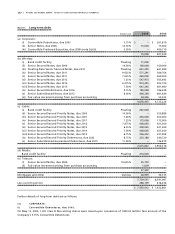

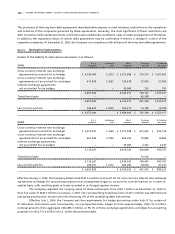

(b ) WI R EL E S S:

(i ) Ba n k c re d it f ac i li t y:

On October 8, 2004 Wireless and its bank lenders entered into an amending agreement to Wireless’ $700.0 million bank

credit facility that provided among other things, for a two year extension to the maturity date and the reduction schedule

so that the bank credit facility now reduces by $140.0 million on each of April 30, 2008 and April 30, 2009 with the maturity

date on the April 30, 2010. In addition, certain financial ratios to be maintained on a quarterly basis were made less

restrictive, the restriction on the annual amount of capital expenditures was eliminated and the restriction on the

payment of dividends and other shareholder distributions was eliminated other than in the case of a default or event of

default under the terms of the bank credit facility.