Rogers 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 ROGERS 2005 ANNUAL REPORT . LETTER TO SHAREHOLDERS

in our Wireless, Cable and Media businesses and the acquisition of

Rogers Telecom during 2005. We are also delivering on our com-

mitment to deleverage our balance sheet, as we generated strong

operating profit growth, converted two outstanding preferred debt

securities into equity, and utilized equity as a currency in our acquisi-

tion of Rogers Telecom.

We continued to grow our subscriber levels at very respectable

rates, attracting new customers to our services, while at the same

time generally reducing the rate of churn of existing customers

through cross-selling additional products and improved customer

service and retention programs. We grew the number of Wireless

subscribers by 11.8% adding more than 649,800 net subscribers

and significantly reducing postpaid churn to 1.61%, while aver-

age revenue per postpaid subscriber increased by 6.8%. At Cable,

both Internet and digital cable net subscriber additions were up

versus the prior year as we added 208,500 and 237,800 subscrib-

ers, respectively, while holding our basic cable subscriber base

steady. We also launched our voice-over-cable telephony service for

consumers, adding almost 50,000 subscribers by year end. In addition,

we acquired approximately 525,000 consumer and business local

wireline telephony lines during the year with our acquisition of

Rogers Telecom.

At Media, the launch of three new FM radio stations in the Maritimes

and the acquisition of TV broadcasting licences in British Columbia

and Manitoba during 2005 added to Rogers’ clout in Canada’s media

industry. And in the wake of Canada’s successful bid to host the 2010

Olympic Winter Games, Rogers Media, together with CTV/BGM, won

the exclusive high-profile broadcast rights for the games.

ANTI C I PATIN G T HE F UT URE

As technologies rapidly advance and converge, there are tremendous

opportunities for Rogers to deliver increasingly innovative products

that add significant convenience and value to our customers’ lives.

Equally important are the opportunities to continue leveraging many

of the platforms and distribution channels of our Wireless, Cable and

Telecom businesses to drive further efficiencies and better returns.

In recent years, we have made much progress in centralizing cer-

tain infrastructure operations, including information technologies,

call centres, and finance under a shared services model. In 2005 we

took another significant step by combining our Wireless, Cable and

Telecom units under a single operating management structure. This

structure is designed to facilitate continued strong and profitable

growth while sharpening our integrated approach to many of Rogers’

markets, channels and functions.

We also continued to increase the breadth and depth of our

management team. During the year we were fortunate to attract

several experienced executives into the company to spearhead our

telecom operations, as well as our company-wide human resources,

corporate marketing, finance and purchasing functions.

By nearly any measure, it’s clear that 2005 was a year of great results

for Rogers, and was a period in which we began to reap the benefits

of several strategic initiatives we embarked upon in recent years to

further expand the scale and scope of our business.

2005 was a time of integration and execution, of organizing for the

future, and of establishing important capabilities and presence in the

telephony market. It was also a year during which we strongly secured

our position as Canada’s largest wireless provider with leading posi-

tions in cable, media and telecom.

It was a demanding year as we integrated recent acquisitions, built

and reorganized, but we kept our eye on the ball, continuing to exe-

cute the day-to-day operations of our businesses. I am very proud

and grateful for the hard work and commitment of the nearly 25,000

dedicated employees across Rogers.

INTE G R ATING TH E PL AT FORM

A very important accomplishment of 2005 was in substantially com-

pleting the considerable task of integrating Microcell’s network, sub-

scriber base and billing platforms, which we acquired late in 2004.

Indeed, we made better progress than anticipated and are positioned

to meet or exceed the operating cost savings of $100 million per year

starting in 2006 that we targeted, in addition to significant savings in

our future capital expenditures. Not only was the integration trans-

parent to customers, we improved the customer experience by signifi-

cantly enhancing the signal strength for all of our wireless customers

and dramatically expanding the coverage area for Fido subscribers.

With the Microcell integration essentially complete, we are now

solidly the largest wireless provider in Canada, both in terms of cus-

tomers and network coverage, and we cover the market with two

powerful but separate brands – Rogers Wireless and Fido. We are

now also at the forefront with the richest wireless spectrum holdings

of any North American carrier. This enviable spectrum position allows

us to add network capacity more efficiently and is also ample from

which to deploy next generation wireless technologies like HSDPA,

which we will begin rolling out in 2006.

During 2005, we expanded the scope of our integration efforts to

include Call-Net Enterprises, which we acquired on July 1, 2005, and

which has now been rebranded Rogers Telecom. Through the Rogers

Home Phone division, Rogers Telecom focuses on the consumer market,

while Rogers Business Solutions brings to bear Rogers’ communica-

tions capabilities for the business market. This initiative will continue

through 2006 but it is well underway and is progressing as planned.

EXEC U T ING T O D EL IV ER RESU L TS

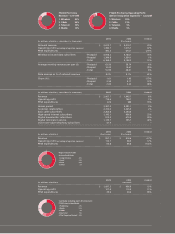

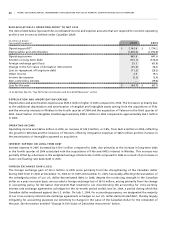

Consistent with our commitment to shareholders, Rogers delivered

strong consolidated financial results in 2005. A 13.7% increase in

revenues to $7.9 billion and a 21.4% increase in operating profit

before integration expenses to $2.3 billion reflected solid pro forma

revenue and pro forma operating expense year-over-year growth

Fellow Shareholders, Customers, Employees and Partners,