Rogers 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

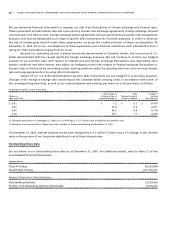

in the 2004 Annual MD&A. As at March 31, 2005, 91.8% of our U.S. dollar-denominated debt was hedged on an economic

basis and 80.1% was hedged on an accounting basis.

There was no change in our U.S. dollar-denominated debt nor in our cross-currency interest rate exchange

agreements during the three months ended June 30, 2005. As a result, as at June 30, 2005, 91.8% of our U.S. dollar-

denominated debt remained hedged on an economic basis and 80.1% remained hedged on an accounting basis.

During the three months ended September 30, 2005, as described above, RCI converted almost all of its

U.S. dollar-denominated unhedged 5.75% Convertible Debentures. In addition, as a result of the acquisition of Telecom

and taking into account the redemption of the majority of its 10.625% Senior Secured Notes due 2008, approximately

US$22.0 million of these unhedged Notes remained outstanding at the end of the period. As a result of these events, the

amount of our U.S. dollar-denominated debt hedged on an economic basis increased from 91.8% to 95.5% and on an

accounting basis increased from 80.1% to 83.3%.

During the three months ended December 31, 2005, as a result of the redemption of Cable’s US$113.7 million

11% Senior Subordinated Guaranteed Debentures, total U.S. dollar-denominated debt decreased to US$4,916.9 million;

consequently the amount of debt hedged with respect to foreign exchange via cross-currency interest rate exchange

agreements increased to 97.7% from 95.5% at September 30, 2005, on an economic basis and increased to 85.2% from

83.3% at September 30, 2005 on an accounting basis, since the aggregate notional principal amount of cross-currency

interest rate exchange agreements did not change.

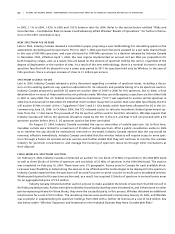

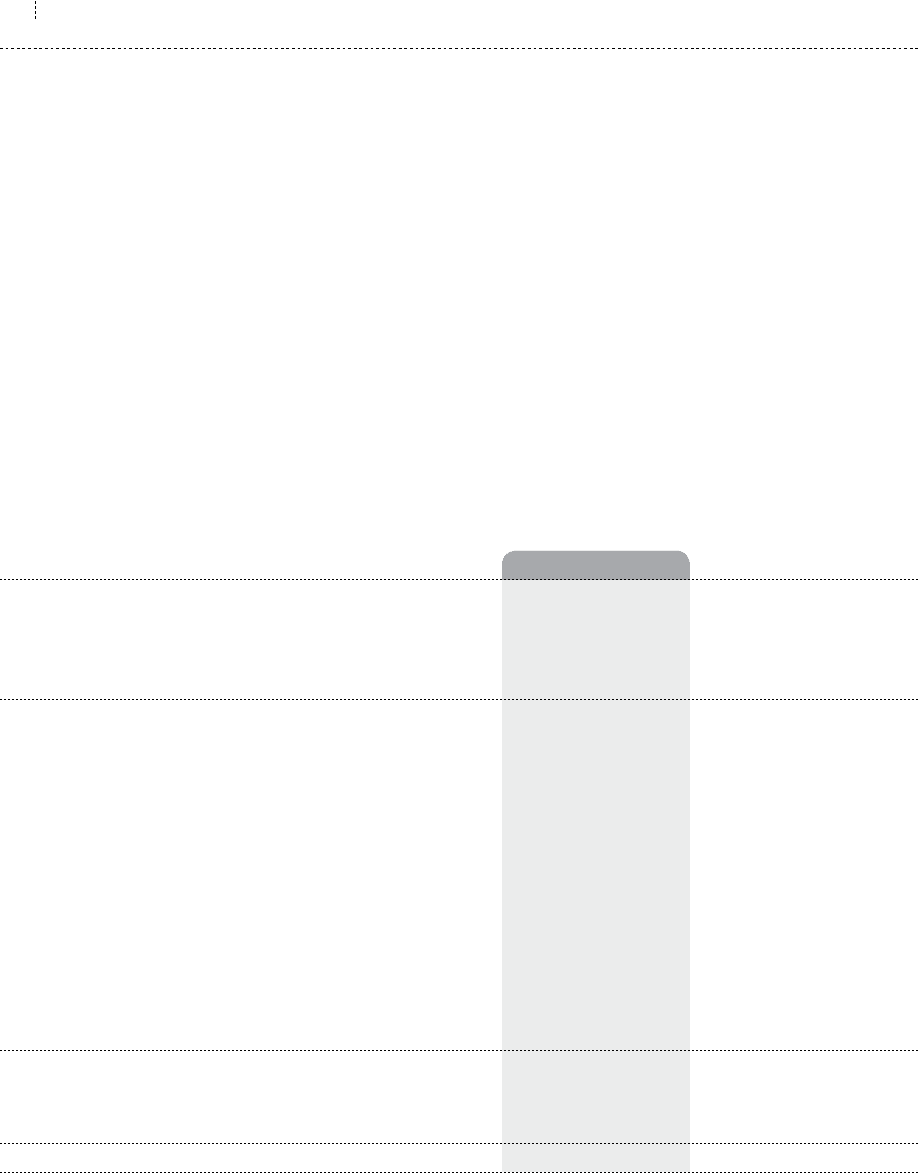

As a result of the financing activity during the year, including changes in cross-currency interest rate exchange

agreements, RCI’s consolidated hedged position, on an economic basis, changed during the year as noted below.

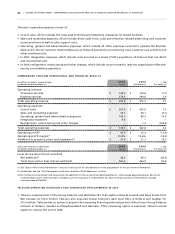

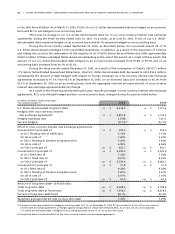

(In millions of dollars, except percentages)

Years ended December 31, 2 0 0 5 2 0 0 4

U.S. dollar-denominated long-term debt US $ 4,916.9 US $ 5,517.6

Hedged with cross-currency interest

rate exchange agreements US $ 4,801.8 US $ 5,135.3

Hedged exchange rate 1.3148 1.3211

Percent hedged 97.7%(1) 93.1%

Effect of cross-currency interest rate exchange agreements:

Converted US $ principal of US $ 550.0 US $ 550.0

at US $ floating rate of LIBOR plus 3.13% 3.13%

for all-in rate of 7.62% 5.53%

to Cdn $ floating at bankers acceptance plus 3.42% 3.42%

for all-in rate of 6.90% 6.06%

on Cdn $ principal of Cdn $ 652.7 Cdn $ 652.7

Converted US $ principal of US $ 4,200.0 US $ 4,533.4

at US $ fixed rate of 7.34% 7.54%

to Cdn $ fixed rate of 8.07% 8.35%

on Cdn $ principal of Cdn $ 5,593.4 Cdn $ 6,064.2

Converted US $ principal of US $ 51.8 US $ 51.8

at US $ fixed rate of 9.38% 9.38%

to Cdn $ floating at bankers acceptance plus 2.67% 2.67%

for all-in rate of 6.07% 5.30%

on Cdn $ principal of Cdn $ 67.4 Cdn $ 67.4

Amount of long-term debt(2) at fixed rates:

Total long-term debt Cdn $ 8,409.6 Cdn $ 9,198.6

Total long-term debt at fixed rates Cdn $ 7,076.5 Cdn $ 8,478.5

Percent of long-term debt fixed 84.1% 92.2%

Weighted average interest rate on long-term debt 7.76% 7.93%

(1) Pursuant to the requirements for hedge accounting under AcG-13, on December 31, 2005, RCI accounted for 87.3% of its cross-currency

interest rate exchange agreements as hedges against designated U.S. dollar-denominated debt. As a result, 85.2% of consolidated

U.S. dollar-denominated debt is hedged for accounting purposes versus 97.7% on an economic basis.

(2) Long-term debt includes the effect of the cross-currency interest rate exchange agreements.