Rogers 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

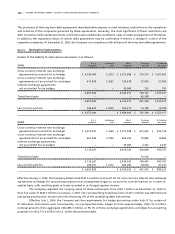

125 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

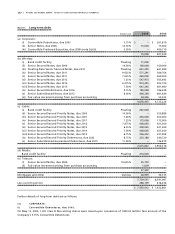

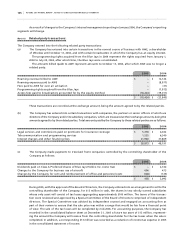

II. During 2005, the Company issued 7,716,448 Class B Non-Voting shares with a value of $271.2 million upon the

conversion of convertible debt (note 11(a));

III. On July 25, 2005, 1,500 Class A Voting shares were converted to 1,500 Class B Non-Voting shares;

IV. On conversion of the Convertible Preferred Securities on October 24, 2005, the Company issued 17,142,857 Class B

Non-Voting shares with a value of $696.5 million and recorded contributed surplus of $668.6 million for the

difference between the carrying values of the debt of $508.5 million plus conversion feature of $188.0 million

and the total par value of the Class B Non-Voting shares of $27.9 million (note 11(a)(iii) and note 13(b)); and

V. During 2005, 5,398,036 Class B Non-Voting shares were issued to employees upon exercise of options for consid-

eration of $106.1 million.

As a result of the above transactions, $1,326.8 million of the issued amounts related to Class B Non-Voting

shares were recorded in contributed surplus. In addition, $22.7 million was recorded in contributed surplus related to

stock-based compensation, including the adjustment of $20.5 million to the fair value of the RWCI unvested options and

the $8.5 million related to the options issued in exchange for Call-Net options (notes 3 and 13(c)).

(i v ) D u ri n g 2 0 04 , t h e C o mp a ny com p le t ed t he fo l lo w i ng ca p it a l s t oc k t r a ns a ct i on s :

I. On December 31, 2004, 28,072,856 Class B Non-Voting shares with a value of $811.9 million were issued in

exchange for Class B Restricted Voting shares of Wireless (note 3(b));

II. On April 15, 2004, the Company filed a final shelf prospectus in all of the provinces in Canada and in the U.S.

under which it will be able to offer up to aggregate of US$750 million of Class B Non-Voting shares, preferred

shares, debt securities, warrants, share purchase contracts or units, or any combination thereof, for a period of

25 months;

III. On June 16, 2004, 9,541,985 Class B Non-Voting shares were issued under the shelf prospectus for net cash

proceeds of $238.9 million;

IV. 4,019,485 Class B Non-Voting shares were issued to employees upon the exercise of stock options for cash of

$62.3 million;

V. 103,102 Series E Convertible Preferred shares with a value of $1.8 million were converted to 103,102 Class B Non-

Voting shares, and 1,386 Series E Convertible Preferred shares were cancelled upon their expiry in April 2004;

VI. On December 31, 2004, the Company redeemed for cancellation its Series XXVII Preferred shares held by a

subsidiary company;

VII. On December 1, 2004, the Series XXX Preferred shares held by a subsidiary company were cancelled as a result

of the windup of the subsidiary company; and

VIII. On December 31, 2004, the Company redeemed for cancellation its Series XXXI Preferred shares held by a

subsidiary company.

As a result of the above transactions, $1,046.8 million of the issued amounts related to Class B Non-Voting

shares was recorded in contributed surplus. In addition, $72.0 million was recorded in contributed surplus related to

stock-based compensation (note 13(c)).

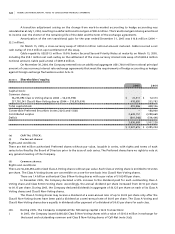

IX. The Articles of Continuance of the Company under the Company Act (British Columbia) impose restrictions on

the transfer, voting and issue of the Class A Voting and Class B Non-Voting shares in order to ensure that the

Company remains qualified to hold or obtain licences required to carry on certain of its business undertakings

in Canada.

The Company is authorized to refuse to register transfers of any shares of the Company to any person who is

not a Canadian in order to ensure that the Company remains qualified to hold the licences referred to above.

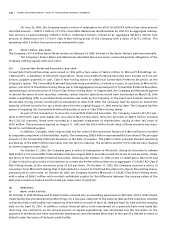

(b ) CO N VE R T IB L E P REF E RR E D S ECU R IT I ES AND WA R RA N TS:

As part of the issuance of the Convertible Preferred Securities (note 11(a)(iii)), the Company issued 5,333,333 warrants to

Microsoft, each exercisable into one Class B Non-Voting share. These warrants were recorded as a separate component

of shareholders’ equity at their fair value of $24.0 million. Upon expiration of these warrants on August 11, 2002,

$24.0 million was transferred to contributed surplus.