Rogers 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(iii) Revenue from the sale of wireless and cable equipment is recorded when the equipment is delivered and

accepted by the independent dealer or customer. Equipment subsidies provided to new and existing subscribers

are recorded as a reduction of equipment revenues upon activation of the service;

(iv) Installation fees and activation fees charged to subscribers do not meet the criteria as a separate unit of

accounting. As a result, these fees are recorded as part of equipment revenue or, in the case of Cable and

Telecom, are deferred and amortized over the related service period, as appropriate. The related service period

for Cable is determined to be approximately four years while that of Telecom ranges from 26 to 33 months,

based on subscriber disconnects, transfers of service and moves. Incremental direct installation costs related

to re-connects are deferred to the extent of deferred installation fees and amortized over the same period as

these related installation fees. New connect installation costs are capitalized to PP&E and amortized over the

useful life of the related assets;

(v) Advertising revenue is recorded in the period the advertising airs on the Company’s radio or television stations

and the period in which advertising is featured in the Company’s media publications;

(vi) Monthly subscription revenues received by television stations for subscriptions from cable and satellite providers

are recorded in the month in which they are earned;

(vii) The Blue Jays’ revenue, which is composed primarily of home game admission and concession revenue, is

recognized as the related games are played during the baseball season. Revenue from radio and television

agreements is recorded at the time the related games are aired. The Blue Jays also receive revenue from the

Major League Baseball (“MLB”) Revenue Sharing Agreement which distributes funds to and from member

clubs, based on each club’s revenues. This revenue is recognized in the season in which it is earned, when the

amount is estimable and collectibility is reasonably assured; and

(viii) Multi-product discounts are incurred as Cable, Wireless, Media and Telecom products and services are provided,

and are charged directly to the revenue for the products and services to which they relate.

Unearned revenue includes subscriber deposits, installation fees and amounts received from subscribers related to ser-

vices and subscriptions to be provided in future periods.

(o ) SU B SC R I BE R A C QUI S IT I ON COS T S:

Except as described in note 2(n)(iv), the Company expenses the costs related to the acquisition of new subscribers upon

activation and costs related to the retention of existing subscribers are expensed as incurred.

(p ) ST O CK - B AS E D C OMP E NS A TI O N A N D O TH E R S T OC K -B A SED PA Y ME N T S:

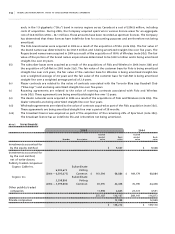

Effective January 1, 2004, Canadian GAAP requires the Company to calculate the fair value of stock-based compensation

awarded to employees and to expense the fair value over the vesting period of the stock options. In accordance with the

transition rules, the Company adopted the standard retroactively to January 1, 2002 without restating prior periods. The

Company determined the fair value of stock options granted to employees since January 1, 2002 using the Black-Scholes

option pricing model and recorded an adjustment to opening retained earnings in the amount of $7.0 million, repre-

senting the expense for the 2003 and 2002 fiscal years, with a corresponding increase in contributed surplus.

The Company accounts for all stock-based payments to non-employees and employee awards that are direct

awards of stock, call for settlement in cash or other assets, or are stock appreciation rights that call for settlement by the

issuance of equity instruments using the fair value-based method. The estimated fair value is amortized to expense over

the vesting period.

Stock-based awards that are settled in cash or may be settled in cash at the option of employees or directors,

including restricted stock units, are recorded as liabilities. The measurement of the liability and compensation cost for

these awards is based on the intrinsic value of the awards. Compensation cost for the awards is recorded in operating

income over the vesting period of the award. Changes in the Company’s payment obligation prior to the settlement

date are recorded in operating income over the vesting period. The payment amount is established for these awards on

the date of exercise of the award by the employee.

The Company also has an employee share accumulation plan. Under the terms of the plan, participating

employees with the Company can contribute a specified percentage of their regular earnings through regular pay-

roll deductions. The designated administrator of the plan then purchases, on a monthly basis, Class B Non-Voting