Rogers 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

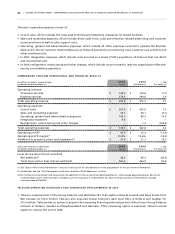

Telecom’s operating expenses consist of:

• Cost of sales, which includes the costs paid to third-party telephone companies for leased facilities;

• Sales and marketing expenses, which include direct sales force, sales and retention related advertising and customer

communications as well as sales support costs;

• Operating, general and administrative expenses, which include all other expenses incurred to operate the business

daily and to service customer relationships such as network operations, provisioning costs, customer care activities and

other overhead costs;

• In 2005, integration expenses, which include costs incurred as a result of RCI’s acquisition of Telecom that are direct

and incremental; and

• In 2004, realignment, restructuring and other charges, which include costs incurred to improve organization effective-

ness by consolidating operations.

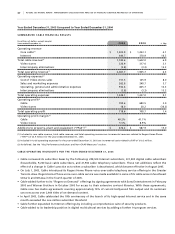

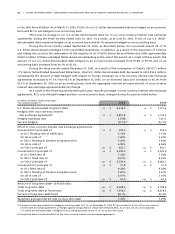

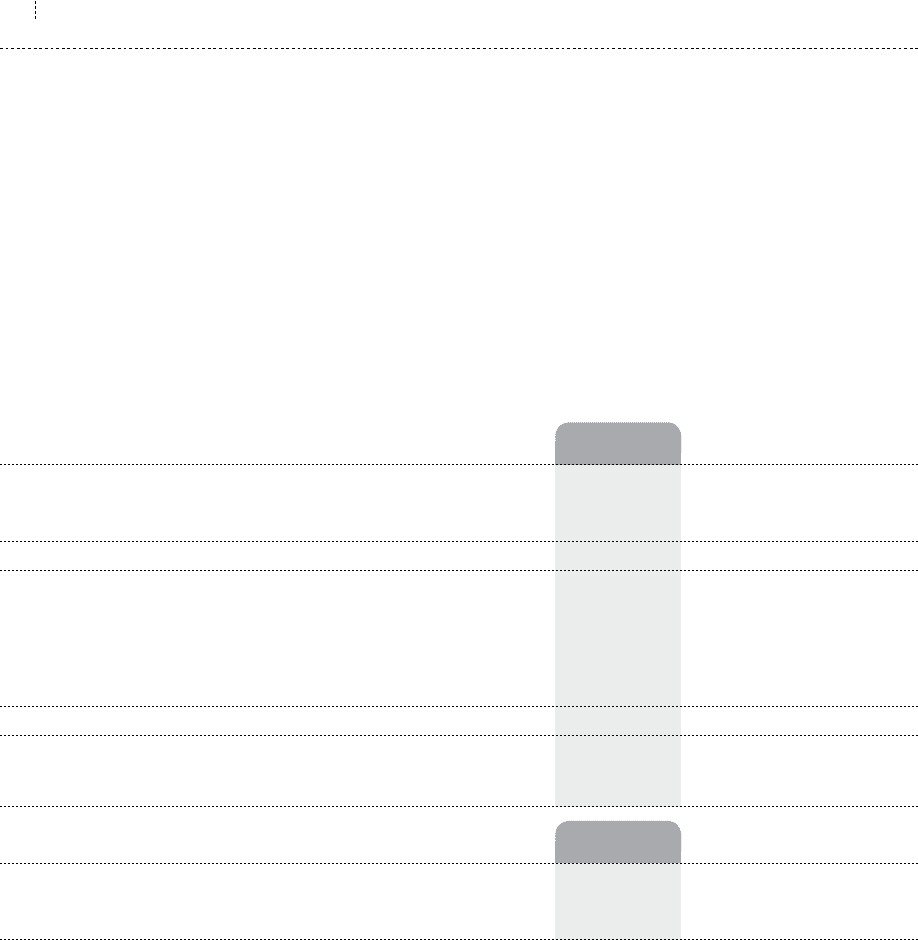

SU M M AR I ZE D T E L EC O M O PE R A TI O NA L A N D F I NA N CIA L R E SU L TS

(In millions of dollars, except margin) 20 0 5 2 0 0 4 % Chg

Six Months Ended December 31, Actual Pro Forma (1) Pro Forma (1)

Operating revenue

Consumer services $ 149.0 $ 150.6 (1.1)

Business services 274.9 264.6 3.9

Total operating revenue $ 423.9 $ 415.2 2.1

Operating expenses

Cost of sales $ 207.8 $ 205.0 1.3

Sales and marketing expenses 56.3 58.1 (3.1)

Operating, general and administrative expenses 109.3 98.5 10.9

Integration expenses 4.6 – –

Realignment, restructuring and other charges – 1.2 (100.0)

Total operating expenses $ 378.0 $ 362.8 4.2

Operating profit(2) $ 45.9 $ 52.4 (12.4)

Operating profit margin(2) 10.8% 12.6% (14.2)

Additions to property, plant and equipment(2) $ 37.4 $ 31.7 18.0

(Subscriber statistics in thousands) 2 0 0 5 2 0 0 4 % Chg

Six Months Ended December 31, Actual Pro Forma (1) Pro Forma (1)

Local service lines (Circuit switched)

Net additions(3) 46.0 66.2 (30.5)

Total local service lines (Circuit switched) 561.4 464.9 20.8

(1) See “Basis of Pro Forma Information” section for discussion of considerations in the preparation of this pro forma information.

(2) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section.

(3) Pro forma circuit-switched local service line net additions for the six months ended December 31, 2004 exclude approximately 61,900 circuit-

switched local service lines that were included upon the acquisition on November 20, 2004 of certain portions of the Eastern Canada

customer base of Bell/360.

TE L E CO M O P ER A T IN G H I GH L I GH T S A ND S IG N IF I CAN T D E VE L OPM E NT S I N 20 0 5

• Telecom acquired most of the Group Telecom and 360 Network’s CLEC assets in New Brunswick and Nova Scotia from

Bell Canada for $12.6 million. Telecom also acquired Group Telecom’s dark local fibre in Ontario and Québec for

$12.0 million. Telecom has an option to acquire the remaining lit and operational portion of the former Group Telecom

network in Ontario, Quebec and Newfoundland and Labrador. If the remaining option is exercised, Telecom would

expect to close by the end of 2006.