Rogers 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Total severance and retention payments to Fido employees are estimated to be approximately $21.0 million,

of which $12.3 million is accrued as part of the restructuring and integration costs in the purchase price allocation.

Of the remaining $8.7 million that are treated as integration expenses when paid, $5.7 million has been incurred as of

December 31, 2005.

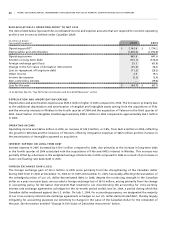

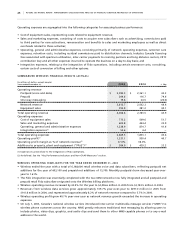

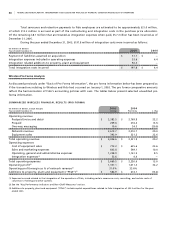

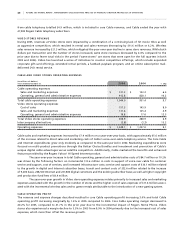

During the year ended December 31, 2005, $197.8 million of integration costs were incurred as follows:

(In millions of dollars)

Years Ended December 31, 2005 2004

Payment of liabilities assumed on acquisition $ 51.7 $ –

Integration expenses included in operating expenses 53.6 4.4

Integration related additions to property, plant and equipment 92.5 –

Total integration costs incurred $ 197.8 $ 4.4

Wireless Pro Forma Analysis

As discussed previously under “Basis of Pro Forma Information”, the pro forma information below has been prepared as

if the transactions relating to Wireless and Fido had occurred on January 1, 2003. The pro forma comparative amounts

reflect the harmonization of Fido’s accounting policies with ours. The tables below present selected unaudited pro

forma information.

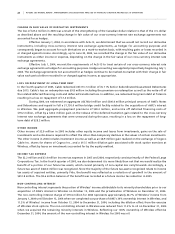

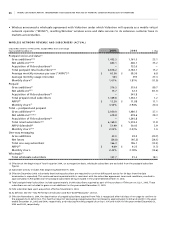

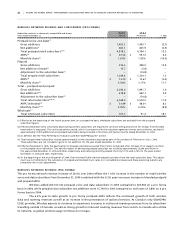

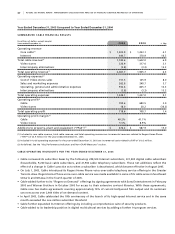

SU M M AR I ZE D W I R EL E SS FI N A NC I AL RE S U LT S ( P RO F OR M A)

(In millions of dollars, except margin) 20 0 5 2 0 0 4

Years ended December 31, Actual Pro Forma % Chg

Operating revenue

Postpaid (voice and data) $ 3,383.5 $ 2,769.8 22.2

Prepaid 209.6 216.4 (3.1)

One-way messaging 19.6 24.5 (20.0)

Network revenue 3,612.7 3,010.7 20.0

Equipment sales 393.9 321.2 22.6

Total operating revenue $ 4,006.6 $ 3,331.9 20.2

Operating expenses

Cost of equipment sales $ 773.2 $ 625.6 23.6

Sales and marketing expenses 603.8 549.1 10.0

Operating, general and administrative expenses 1,238.9 1,141.5 8.5

Integration expenses(1) 53.6 4.4 –

Total operating expenses $ 2,669.5 $ 2,320.6 15.0

Operating profit(2) 1,337.1 1,011.3 32.2

Operating profit margin as % of network revenue(2) 37.0% 33.6%

Additions to property, plant and equipment (“PP&E”)(3) $ 584.9 $ 674.1 (13.2)

(1) Expenses incurred related to the integration of the operations of Fido, including certain severance costs, consulting, and certain costs of

conversion of billing and other systems.

(2) See the “Key Performance Indicators and Non-GAAP Measures” section.

(3) Additions to property, plant and equipment (“PP&E”) include capital expenditures related to Fido integration of $92.5 million for the year

ended 2005.