Rogers 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

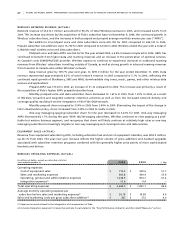

19 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

and Media $12.4 million of the operating profit increase. Consolidated operating profit as a percentage of operating

revenue (“operating profit margin”) decreased to 28.6% in 2005 from 30.9% in 2004. On a consolidated basis, we recorded

a net loss of $44.7 million for the year ended December 31, 2005, as compared to a net loss of $67.1 million in 2004.

Refer to the respective individual segment discussions for details of the revenue, operating expenses, operating

profit and additions to PP&E of Wireless, Cable, Telecom, and Media.

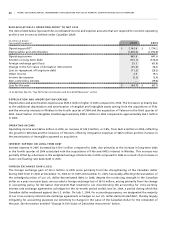

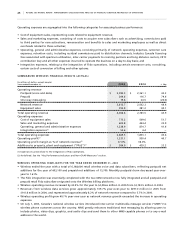

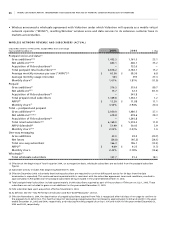

2005 Performance Against Targets

The following table sets forth the guidance ranges for selected full-year financial and operating metrics that we pro-

vided for 2005, as revised during the year, versus the actual results we achieved for the year. As indicated in the table,

we either met or exceeded our operating and financial targets in all categories.

2 0 0 5 2 0 0 5

(In millions of dollars, except subscribers) Guidance(1) Actual

Revenue

Wireless (network revenue) $ 3,560 to $ 3,600 $ 3,613

Cable 2,060 to 2,075 2,068

Media (excluding Sports Entertainment) 925 to 950 937

Sports Entertainment 150 to 160 160

Operating Profit(2)

Wireless(3) $ 1,350 to $ 1,390 $ 1,391

Cable(4) 710 to 725 719

Media (excluding Sports Entertainment) 130 to 140 139

Sports Entertainment (18) to (22) (11)

Capital Expenditures

Wireless(5) $ 475 to $ 500 $ 492

Cable 590 to 690 676

Net subscriber additions (000s)

Wireless voice and data 600,000 to 650,000 619,000

Basic cable Flat to down 1% from 2004 9,200

Internet subscribers 165,000 to 195,000 209,000

Digital subscribers 175,000 to 275,000 238,000

Fido integration costs

Non-recurring cash integration costs $ 185 to $ 215 $ 198

(1) As reaffirmed or revised October 25, 2005. Does not include July 1, 2005 acquisition of Telecom.

(2) Before management fees paid to RCI.

(3) Excluding costs related to Fido integration.

(4) Includes $19.2 million of losses associated with cable telephony launch.

(5) Excludes expenditures related to Fido integration.