Rogers 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

IM P A IR M EN T O F IN D EF I NI T E -L I VE D I N T AN G IB L E A S SE T S A ND L ON G -L I VED AS S ET S

Indefinite-lived intangible assets, including goodwill and spectrum/broadcast licences, as well as long-lived assets including

PP&E and other intangible assets, are assessed for impairment on at least an annual basis or more often if events or

circumstances warrant. These impairment tests involve the use of both discounted and undiscounted cash flow analyses

to assess the fair value of both indefinite-lived and long-lived assets and the recoverability of the carrying value of these

assets. These analyses involve estimates of future cash flows, estimated periods of use and applicable discount rates. If

the fair values of these assets as determined above are less than the related carrying values, impairment losses would be

recognized, as applicable.

CA P I TA L IZ A TI O N O F D I RE C T L A BO U R A N D O VE R HEA D

As discussed above, direct labour and certain overhead costs are capitalized to PP&E by applying specified capitalization

rates. Estimates of historical costs are used to determine these capitalization rates. We assess these capitalization rates to

ensure their continued applicability, and any changes to these rates, which may be significant, are included prospectively

in the periods in which these assessments are completed. Although interest costs are permitted to be capitalized during

construction, it is our policy not to capitalize interest.

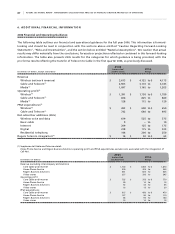

IN C O ME TA X E S T IM A TE S

We use judgment in the estimation of income taxes and future income tax assets and liabilities. In the preparation of

its financial statements, we are required to estimate income taxes in each of the jurisdictions in which we operate. This

involves estimating actual current tax exposure, together with assessing temporary differences that result from differing

treatments in items for accounting purposes versus tax purposes, and in estimating the recoverability of the benefits

arising from tax loss carryforwards. We are required to assess whether it is more likely than not that future income tax

assets will be realized prior to the expiration of the related tax loss carryforwards. Judgment is required to determine

if a valuation allowance is needed against either all or a portion of our future tax assets. Various considerations are

reflected in this judgment including future profitability of the related company, tax planning strategies that are being

implemented or could be implemented to recognize the benefits of these tax assets, as well as the expiration of the tax

loss carryforwards. Judgments and estimates made to assess the tax treatment of items and the need for a valuation

allowance impact the future tax balances as well as net income through the current and future tax provisions. As at

December 31, 2005 and as detailed in Note 14 to the Consolidated Financial Statements, we have tax loss carryforwards of

approximately $3,860.9 million expiring at various times through 2016. Our net future income tax asset, prior to valuation

allowances, totals approximately $1,078.2 million at December 31, 2005 (2004 – $696.8 million). A full valuation allow-

ance had been provided against our net future income tax assets in 2004. However, in 2005, we reduced the valuation

allowance to reflect that it is more likely than not that certain income tax assets will be realized resulting in the recognition

of a net future tax asset of $460.4 million. Approximately $451.8 million of the income tax assets recognized in 2005

relate to assets arising on acquisitions. Accordingly, the benefit related to these assets has been reflected as a reduction

of goodwill.

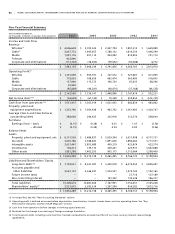

PE N S IO N P L AN S

When accounting for defined benefit pension plans, assumptions are made in determining the valuation of benefit

obligations and the future performance of plan assets. Delayed recognition of differences between actual results and

expected or estimated results is a guiding principle of pension accounting. This principle results in recognition of changes

in benefit obligations and plan performance over the working lives of the employees who benefit under the plan.

The primary assumptions and estimates include the discount rate, the expected return on plan assets and the rate of

compensation increase. Changes to these primary assumptions and estimates would impact pension expense and the

deferred pension asset.