Rogers 2005 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

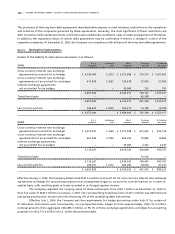

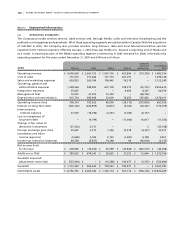

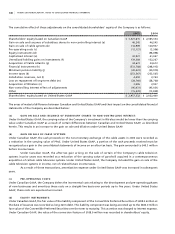

Pension fund assets consist primarily of fixed income and equity securities, valued at market value. The following

information is provided on pension fund assets measured at September 30 for the year ended December 31:

2005 2004

Plan assets, beginning of year $ 402,433 $ 339,071

Actual return on plan assets 66,730 43,053

Contributions by employees 13,871 13,237

Contributions by employer 20,152 25,572

Benefits paid (19,364) (18,500)

Plan assets, end of year $ 483,822 $ 402,433

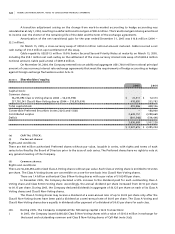

Accrued benefit obligations are outlined below measured at September 30 for the year ended December 31:

2005 2004

Accrued benefit obligations, beginning of year $ 453,318 $ 368,306

Service cost 15,094 11,746

Interest cost 29,538 24,003

Benefits paid (19,364) (18,500)

Contributions by employees 13,871 13,237

Actuarial loss 81,931 54,526

Accrued benefit obligations, end of year $ 574,388 $ 453,318

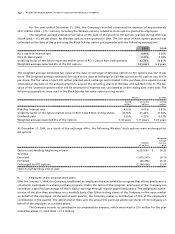

Net plan expense is outlined below:

2005 2004

Plan cost:

Service cost $ 15,094 $ 11,746

Interest cost 29,538 24,003

Actual return on plan assets (66,730) (43,053)

Actuarial loss on benefit obligation 81,931 54,526

Costs 59,833 47,222

Differences between costs arising in the period and costs recognized in the period

in respect of:

Return on plan assets 37,177 17,900

Actuarial gain (74,377) (49,537)

Plan amendments/prior service cost 830 829

Transitional asset (9,875) (9,875)

Net pension expense $ 13,588 $ 6,539

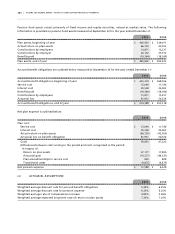

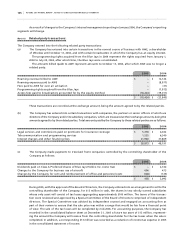

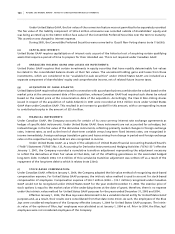

(a ) A CT U A RI A L A SS U M PT I ON S :

2005 2004

Weighted average discount rate for accrued benefit obligations 5.25% 6.25%

Weighted average discount rate for pension expense 6.25% 6.25%

Weighted average rate of compensation increase 4.00% 4.00%

Weighted average expected long-term rate of return on plan assets 7.25% 7.25%