Rogers 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

and the liabilities assumed on acquisition. Among other things, the determination of these fair values involved the use of

discounted cash flow analyses, estimated future margins, estimated future subscribers, estimated future royalty rates,

the use of information available in the financial markets and estimates as to costs to close duplicate facilities and buy out

certain contracts. Should actual rates, cash flows, costs and other items differ from our estimates, this may necessitate

revisions to the purchase price allocation or the carrying value of the related assets and liabilities acquired, including

revisions that may impact net income in future periods.

CA R R IE R C H AR G E P A YA B LE R ES E RV E S

Carrier charges are incurred for the transmission of voice and data over other carriers’ networks. These costs consist of

both fixed payments and variable amounts based on actual usage and negotiated or regulated contract rates. Telecom

records carrier charges as incurred. Accordingly, at each balance sheet date, Telecom records its best estimate of the

carrier charge incurred but not billed based on internal usage reports and, for disputed amounts, a reserve based on an

analysis of the probability of paying the disputed amount.

US E F UL LI V ES O F P P& E

We depreciate the cost of PP&E over their respective estimated useful lives. These estimates of useful lives involve

considerable judgment. In determining the estimates of these useful lives, we take into account industry trends and

company-specific factors, including changing technologies and expectations for the in-service period of these assets.

On an annual basis, we reassess our existing estimates of useful lives to ensure they match the anticipated life of the

technology from a revenue-producing perspective. If technological change happens more quickly or in a different way

than anticipated, we might have to reduce the estimated life of PP&E, which could result in a higher depreciation

expense in future periods.

AM O R TI Z AT I ON O F I NT A NG I B LE AS S ET S

We amortize the cost of finite-lived intangible assets over their estimated useful lives. These estimates of useful lives

involve considerable judgment. During 2004 and 2005, the acquisitions of Fido, Call-Net, the Rogers Centre and the

minority interests in Wireless and Sportsnet together with the consolidation of the Blue Jays, resulted in significant

increases to our intangible asset balances. Judgment is also involved in determining that spectrum and broadcast licences

have indefinite lives, and therefore not amortized.

The determination of the estimated useful lives of brand names involves historical experience, marketing

considerations and the nature of the industries in which we operates. The useful lives of subscriber bases are based

on the historical churn rates of the underlying subscribers and judgments as to the applicability of these rates going

forward. The useful lives of roaming agreements are based on estimates of the useful lives of the related network

equipment. The useful lives of wholesale agreements and dealer networks are based on the underlying contractual lives.

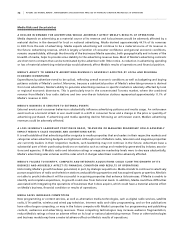

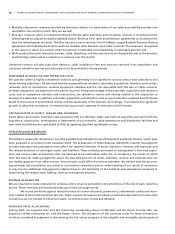

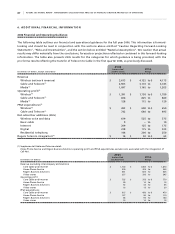

The determination of the estimated useful lives of intangible assets impacts amortization expense in the current period

as well as future periods. The impact on net income on a full-year basis of changing the useful lives of the finite-lived

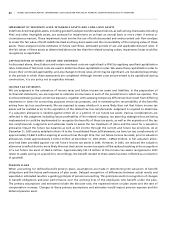

assets by one year is shown in the chart below.

Increase in Decrease in

Net Income Net Income

Amortization if Life Increased if Life Decreased

(In millions of dollars) Period by 1 year by 1 year

Brand names

Rogers 20.0 years $ 0.7 $ (0.8)

Fido 5.0 years $ 3.4 $ (5.1)

Subscriber Base

Rogers 4.6 years $ 30.4 $ (53.7)

Fido 2.3 years $ 23.5 $ (61.0)

Telecom 2.4 years $ 15.3 $ (37.9)

Roaming Agreements 12.0 years $ 3.4 $ (4.0)

Dealer network

Rogers 4.0 years $ 1.4 $ (2.3)

Fido 4.0 years $ 0.7 $ (1.1)

Wholesale agreements 3.2 years $ 1.0 $ (1.9)