Rogers 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

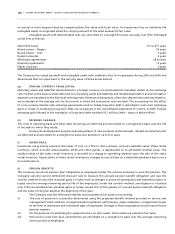

(i i ) Ot h e r:

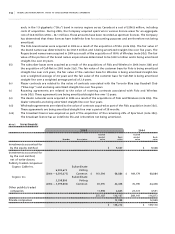

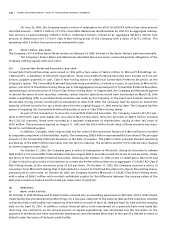

On January 31, 2005, the Company completed the acquisition of Rogers Centre, a multi-purpose stadium located in

Toronto, Canada for a purchase price of approximately $26.6 million, including acquisition costs, plus $4.8 million of

assumed liabilities. The purchase price has been allocated on a preliminary basis to working capital and property, plant

and equipment pending finalizing the valuation of its tangible and intangible assets. The operations of Rogers Centre

were consolidated with those of the Company as of January 31, 2005.

Two other acquisitions occurred during 2005 for cash consideration of approximately $11.7 million.

(b ) 20 0 4 A C QU I SI T ION S :

The Company completed the following acquisitions during 2004 which were accounted for by the purchase method:

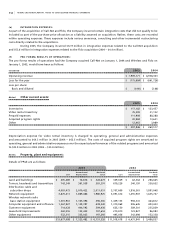

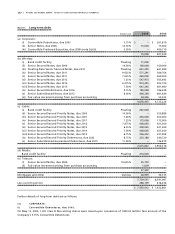

(i ) Wi r el e ss min o ri t y i nte r es t s:

On October 13, 2004, the Company acquired the 34% interest of Wireless owned by JVII General Partnership, a part-

nership wholly owned by AT&T Wireless Services, Inc. (“AWE”), for cash consideration totalling $1,767.4 million. With

this transaction, the Company increased its ownership in Wireless from 55.3% to 89.3%. Wireless is a subsidiary of the

Company whose results were already consolidated with those of the Company prior to this transaction.

On November 11, 2004, the Company announced that it would launch an exchange offer for any and all of the

remaining outstanding shares of Wireless owned by the public, with consideration being 1.75 Class B Non-Voting shares

of the Company for each share of Wireless. For accounting purposes, the value of the consideration was calculated

as the average price of the Class B Non-Voting shares of the Company over a period of two days before and after

the November 11, 2004 announcement date of the exchange offer. At December 31, 2004, the Company completed

the acquisition of all of the publicly-held shares of Wireless in exchange for 28,072,856 Class B Non-Voting shares of the

Company valued at $811.9 million. This represented an acquisition of an approximate 11.2% interest in Wireless. As a

result, at December 31, 2004, the Company owned 100% of Wireless.

On December 31, 2004, the Company issued stock options to purchase Class B Non-Voting shares of the Company

in exchange for both vested and non-vested stock options to purchase shares of Wireless, using the same conversion ratio

of 1.75. The fair value of the vested options issued totalled approximately $29.3 million, and was included as part of the

purchase price. The fair value of the unvested options issued of approximately $43.9 million will be amortized to expense

over the vesting period. The fair values of the Company’s options were calculated using the Black-Scholes model.

Including direct incremental acquisition costs of approximately $10.2 million, the aggregate purchase price for

the acquisition of the Wireless shares and options totalled $2,618.8 million.

Goodwill related to the step acquisitions of Wireless has been assigned to the Wireless reporting segment.

(i i ) Mi c r oc e ll Te l e co m mu n ica t io n s I nc. :

On November 9, 2004, the Company acquired the outstanding equity securities of Microcell Telecommunications Inc.

(“Fido”) for cash consideration. The results of Fido were consolidated effective November 9, 2004. Fido is a provider

of wireless telecommunications services in Canada. With this acquisition, the Company now operates the only Global

System for Mobile communications (“GSM”) network in Canada.

Including direct incremental acquisition costs of approximately $14.9 million, the purchase price totalled

$1,318.4 million, including $51.7 million paid for warrants in 2005.

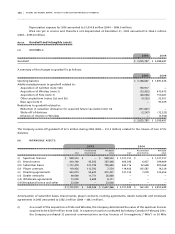

Prior to completion of the acquisition, the Company developed a plan to restructure and integrate the opera-

tions of Fido. As a result of the restructuring and integration, $129.0 million was originally accrued as a liability assumed

on acquisition in the allocation of the purchase price as at December 31, 2004. As at December 31, 2004, no payments had

been made related to this liability. This liability included severance and other employee-related costs, as well as costs

to consolidate facilities, systems and operations, close cell sites and terminate leases and other contracts. During 2005,

management finalized its plan and revised the estimated restructuring and integration costs. As restructuring activities

progressed and the Company was able to assess such matters as the extent of its network coverage, management was

able to finalize those cell site and facility leases to be terminated and negotiate lease termination costs with the landlord

where applicable. The negotiations related to the termination of other contracts were completed during 2005 as

well. Additionally, as the dismantling of cell sites progressed, the Company was able to estimate the costs involved in

dismantling sites with greater accuracy. With the continued integration of Fido’s operational and administrative functions,