Rogers 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

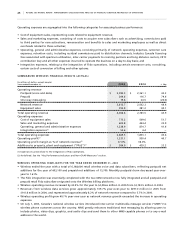

29 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Network-related additions to PP&E in the year ended 2005 primarily reflect capacity expansion of the GSM/

GPRS network and transmission. The remaining network-related additions to PP&E relate primarily to technical upgrade

projects, including new cell sites, operational support systems and the addition of new services. Other additions to PP&E

reflect information technology initiatives and other facilities and equipment.

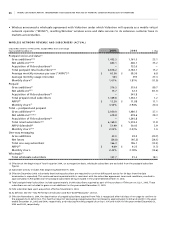

On February 9, 2006, Wireless announced that it intends to begin deploying a 3G network based upon the

UMTS/HSDPA (Universal Mobile Telephone System/High-Speed Downlink Packet Access) standard which Wireless expects

will provide it with data speeds that are superior to those offered by other 3G wireless technologies and enable it to

add incremental voice and data capacity at significantly lower costs. UMTS/HSDPA is the next generation technology

evolution for the global standard GSM platform which provides broadband wireless data speeds that will enable new

and faster data products such as video conferencing and mobile television as well as simultaneous voice and data usage.

Wireless estimates that the deployment of this network across most of the major Canadian cities will require total

spending of approximately $390 million over the course of 2006 and 2007, including approximately $70 million of

capacity spending that would have otherwise been invested in GSM. Because UMTS/HSDPA technology is fully back-

wards compatible with GSM, subscribers with UMTS/HSDPA enabled devices will be able to receive voice and data services

everywhere that Wireless offers wireless service across Canada, as well as when roaming in the more than 175 other

countries around the world where GSM service is available and where Wireless has roaming agreements in place.

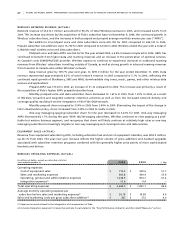

UP D A TE ON FI D O I N TE G RA T I ON

The integration of Fido was substantially completed during 2005. Wireless successfully completed the integration of the

Fido GSM network across the country, and completed the migration of the Fido postpaid and prepaid subscriber bases

onto the Wireless billing systems. The integration of other back-office systems was substantially completed during 2005.

Prior to completion of the acquisition, Wireless developed a plan to restructure and integrate the operations

of Fido. As a result of the restructuring and integration, $129.0 million was originally accrued as a liability assumed on

acquisition in the allocation of the purchase price as at December 31, 2004. As at December 31, 2004, no payments had

been made related to this liability. This liability included severance and other employee-related costs, as well as costs

to consolidate facilities, systems and operations, close cell sites and terminate leases and other contracts. During 2005,

Wireless finalized its plan and revised the estimated restructuring and integration costs. As restructuring and integration

activities progressed and Wireless was able to assess such matters as the extent of its network coverage, management

was able to finalize those cell site and facility leases to be terminated and negotiate lease termination costs with the

landlord where applicable. The negotiations related to the termination of other contracts were completed during 2005

as well. Additionally, as the dismantling of cell sites progressed, Wireless was able to estimate the costs involved in

dismantling sites with greater accuracy. With the continued restructuring and integration of Fido’s operational and

administrative functions, Wireless was able to determine those employees who would be retained and those whose

employment would be severed in order to avoid the duplication of functions within the integrated enterprise.

During the year, adjustments were made to the purchase price allocation from that recorded on a preliminary

basis at December 31, 2004 to reflect finalization of fair value of net assets acquired. These adjustments resulted in a

net decrease of $29.7 million in the estimated fair values of net assets acquired. In addition, the estimated liabilities for

Fido restructuring costs accrued as part of the purchase price allocation have decreased by a total of $55.7 million from

$129.0 million recorded at December 31, 2004 to $73.3 million due to revisions to the restructuring and integration plan

discussed above. The adjustments to these liabilities assumed on acquisition and the payments made in the year ended

December 31, 2005 are as follows:

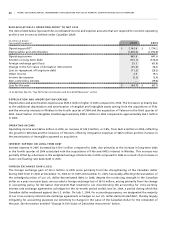

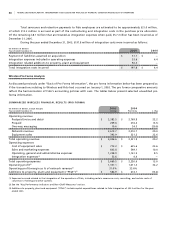

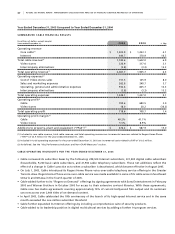

As at As at

December 31, Revised December 31,

(In millions of dollars) 2004 Adjustments Liabilities Payments 2005

Network decommissioning and

restoration costs $ 52.8 $ (18.5) $ 34.3 $ (18.5) $ 15.8

Lease and other contract

termination costs 48.3 (21.6) 26.7 (23.0) 3.7

Involuntary severance 27.9 (15.6) 12.3 (10.2) 2.1

Liabilities assumed on acquisition $ 129.0 $ (55.7) $ 73.3 $ (51.7) $ 21.6