Rogers 2005 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 21. Guarantees:

The Company has entered into agreements that contain features which meet the definition of a guarantee under GAAP.

A description of the major types of such agreements is provided below:

(a ) B US I N ES S S A LE A ND BU S IN E S S C OM B IN A T IO N A G RE E M EN T S:

As part of transactions involving business dispositions, sales of assets or other business combinations, the Company may

be required to pay counterparties for costs and losses incurred as a result of breaches of representations and warranties,

intellectual property right infringement, loss or damages to property, environmental liabilities, changes in laws and

regulations (including tax legislation), litigation against the counterparties, contingent liabilities of a disposed business

or reassessments of previous tax filings of the corporation that carries on the business.

The Company is unable to make a reasonable estimate of the maximum potential amount it could be required

to pay counterparties. The amount also depends on the outcome of future events and conditions, which cannot be

predicted. No amount has been accrued in the consolidated balance sheets relating to this type of indemnification or

guarantee at December 31, 2005 or 2004. Historically, the Company has not made any significant payments under these

indemnifications or guarantees.

(b ) SA L ES O F S ER V ICE S :

As part of transactions involving sales of services, the Company may be required to pay counterparties for costs and

losses incurred as a result of breaches of representations and warranties, changes in laws and regulations (including tax

legislation) or litigation against the counterparties.

The Company is unable to make a reasonable estimate of the maximum potential amount it could be

required to pay counterparties. No amount has been accrued in the consolidated balance sheets relating to this type of

indemnification or guarantee at December 31, 2005 or 2004. Historically, the Company has not made any significant

payments under these indemnifications or guarantees.

(c ) P U RCH A SE S A N D D E VE L OP M E NT OF AS S E TS :

As part of transactions involving purchases and development of assets, the Company may be required to pay counterparties

for costs and losses incurred as a result of breaches of representations and warranties, loss or damages to property,

changes in laws and regulations (including tax legislation) or litigation against the counterparties.

The Company is unable to make a reasonable estimate of the maximum potential amount the Company could

be required to pay counterparties. The amount also depends on the outcome of future events and conditions, which can-

not be predicted. No amount has been accrued in the consolidated balance sheets relating to this type of indemnification

or guarantee at December 31, 2005 or 2004. Historically, the Company has not made any significant payments under

these indemnifications or guarantees.

(d ) IN D EM N I FI C AT I ONS :

The Company indemnifies its directors, officers and employees against claims reasonably incurred and resulting from the

performance of their services to the Company, and maintains liability insurance for its directors and officers as well as

those of its subsidiaries.

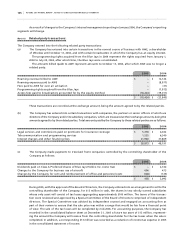

Note 22. Contingent liabilities:

(a) On August 9, 2004, a proceeding under the Class Actions Act (Saskatchewan) was brought against Wireless

and other providers of wireless communications services in Canada. The proceeding involves allegations by

Wireless customers of breach of contract, misrepresentation and false advertising with respect to the system

access fee charged by Wireless to some of its customers. The plaintiffs seek unquantified damages from the

defendant wireless communications service providers. Wireless believes it has good defences to the allegations.

The proceeding has not been certified as a class action and it is too early to determine whether the proceeding